Inventory optimization has always been a challenge while designing and planning a supply chain. A variety of barriers can impact an effective inventory strategy, such as working in functional silos and demand/supplier volatility¹. The good thing is that companies are beginning to appreciate the importance of inventory form and function instead of narrowing it down to just setting optimal safety stock targets. Often companies believe they are holding too much inventory in their supply chain and view inventory optimization as inventory “reduction.” However, inventory right-sizing is a more accurate approach as in some cases companies could elect to hold more inventory in order to meet target customer service levels.

Asking the Right Inventory Questions

Before determining a go-forward inventory strategy, organizations must first ask the right questions to assess their current inventory state and pinpoint key challenges: What are the buying behaviors of my customers? Do I have the right distribution network (for example, centralized stocking strategies for my slow movers)? Do I have the right ordering frequencies and lot sizes? Where, in what form, and how much to stock? What are my target service levels? How do I handle seasonal demand/promotions? How much am I currently expediting due to poor service levels? What are my lost sales? How can I reduce supplier lead times?

There are different types of inventory that each serve a different challenge. It’s important to look at each piece holistically when implementing an inventory strategy:

- Safety stock protects against demand and supply variability and uncertainty

- Cycle stock accounts for lot/batch/shipment sizes, minimum order quantities, and production/ replenishment frequencies and lead times

- Pre-build inventory helps plan ahead of time due to insufficient capacity to support seasonal demand spikes

- Promotional inventory accounts for created spikes in demand driven by marketing and/or customers

Other common inventory types, such as inventory in-transit, work-in-progress (WIP), and pipeline inventory, also play a significant role when looking at a holistic snapshot of inventory within a given organization.

Where and in What Form Should Inventory Be Held?

Another key aspect of inventory optimization is to determine in what form inventory needs to be held: raw materials vs. intermediates vs. finished goods? Multi-echelon inventory optimization is a powerful technology to help determine where, when, and in what form does inventory need to be positioned to optimally meet customer service and take advantage of risk pooling and postponement strategies.

For example, a major retailer faced the challenge of not applying demand classification on the SKU level, making it difficult for them to determine the right amount of inventory to hold on a given product, resulting in upwards of $75M in lost sales. By implementing inventory optimization and network optimization, the retailer was able to pinpoint which SKUs to apply capital to and in which locations.

Customer buying patterns and their cascaded effect upstream play a key role when determining how much working capital gets tied into inventory. Not all demand is smooth/normally distributed. Depending on the SKU (slow vs. fast movers) and customer buying patterns, a given SKU could be classified into one of five different classifications (Non-Intermittent; Smooth or Erratic and Intermittent; Highly Variable; Slow; or Lumpy) at a given node in the supply chain. Production batching at plants and ordering policies at distribution centers could significantly influence the way customer demand is seen upstream which in turn has a direct implication on inventory.

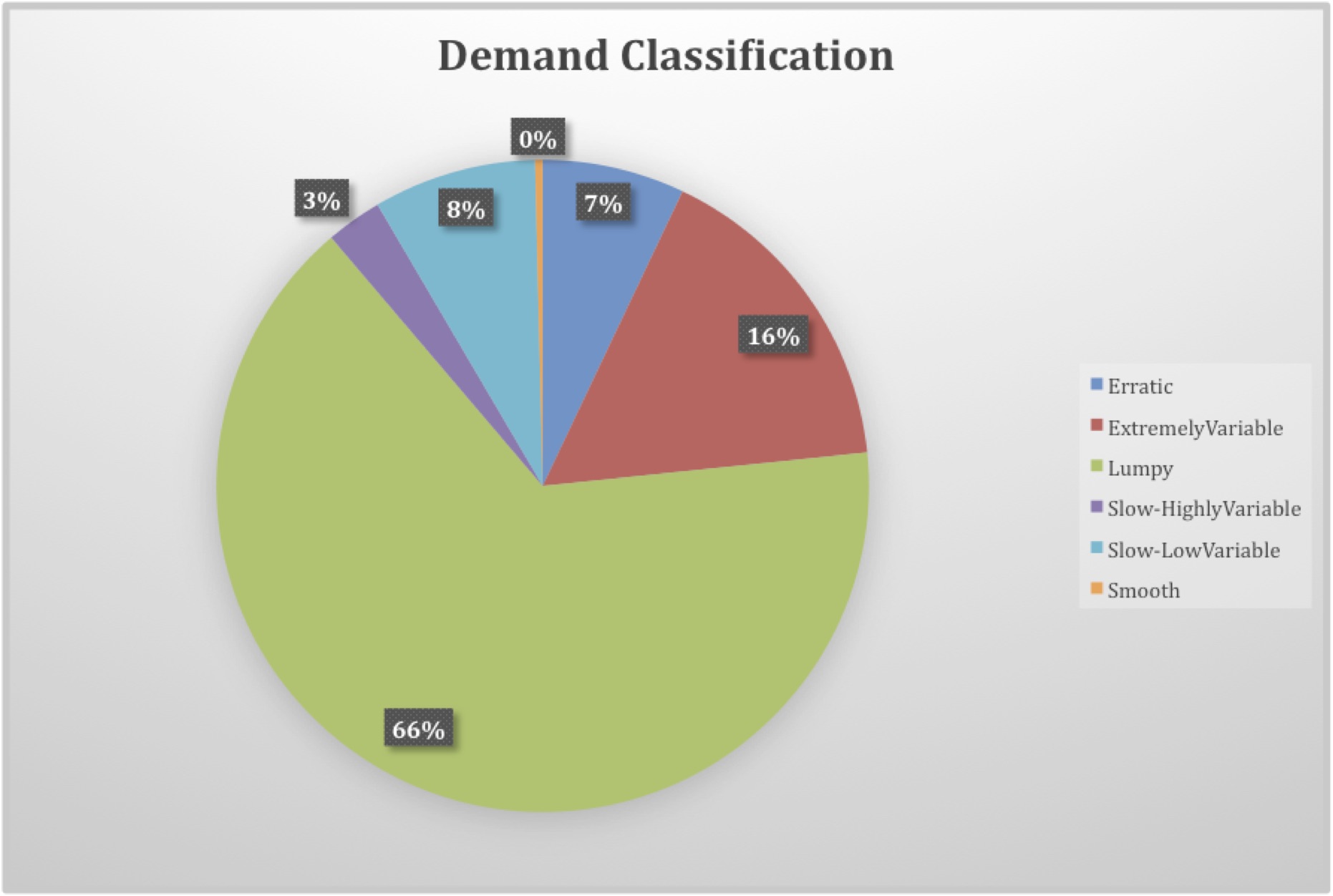

The example below is from a large energy management equipment manufacturer study where almost all of their demand was not normal/smooth (less than 0.2 percent). Applying analytics that assume normality can provide misleading inventory recommendations as it does not capture true customer buying behavior.

Not only does assuming normality not reflect reality, it can lead to non-strategic business decisions. One large manufacturer of latches, screws, and hinges needed to set inventory targets at a monthly planning level. In order to provide an accurate inventory on the SKU level, planners had to manually review demand to set safety stock levels based on variability of the SKU. This process was inefficient and not scalable. The manufacturer utilized network optimization to run a multi-echelon inventory optimization based on the optimal network design. The customer uncovered savings in inventory holding costs of 15 percent by postponing production and taking risk pooling into account thanks to this analysis.

Finally, modeling technology that enables an end-to-end view of inventory levels and policies can be used to design the right inventory strategy and be used on a monthly planning basis. Simulation of the recommended inventory policies from the optimization analysis can help validate operational feasibility of advanced inventory analytics along with detailed visibility into supply chain performance/KPIs.

¹ Chief Supply Chain Officer Insights, June 2011

Vikram Srinivasan is Product Manager of Inventory Optimization at LLamasoft and is primarily responsible for managing the inventory product life cycle, defining and prioritizing market requirements. Vikram’s expertise spans across Network & Inventory optimization. Prior to his Product Manager role, Vikram worked as a Senior Consultant at LLamasoft on multiple projects solving various supply chain design problems. He received his M.S in Industrial Engineering (Major: Operations Research) at The Ohio State University.

Vikram Srinivasan is Product Manager of Inventory Optimization at LLamasoft and is primarily responsible for managing the inventory product life cycle, defining and prioritizing market requirements. Vikram’s expertise spans across Network & Inventory optimization. Prior to his Product Manager role, Vikram worked as a Senior Consultant at LLamasoft on multiple projects solving various supply chain design problems. He received his M.S in Industrial Engineering (Major: Operations Research) at The Ohio State University.

Taking a Holistic View on Inventory May Lead to Change in Strategy

Inventory optimization has always been a challenge while designing and planning a supply chain. A variety of barriers can impact an effective inventory strategy, such as working in functional silos and demand/supplier volatility¹. The good thing is that companies are beginning to appreciate the importance of inventory form and function instead of narrowing it down to just setting optimal safety stock targets. Often companies believe they are holding too much inventory in their supply chain and view inventory optimization as inventory “reduction.” However, inventory right-sizing is a more accurate approach as in some cases companies could elect to hold more inventory in order to meet target customer service levels.

Asking the Right Inventory Questions

Before determining a go-forward inventory strategy, organizations must first ask the right questions to assess their current inventory state and pinpoint key challenges: What are the buying behaviors of my customers? Do I have the right distribution network (for example, centralized stocking strategies for my slow movers)? Do I have the right ordering frequencies and lot sizes? Where, in what form, and how much to stock? What are my target service levels? How do I handle seasonal demand/promotions? How much am I currently expediting due to poor service levels? What are my lost sales? How can I reduce supplier lead times?

There are different types of inventory that each serve a different challenge. It’s important to look at each piece holistically when implementing an inventory strategy:

Other common inventory types, such as inventory in-transit, work-in-progress (WIP), and pipeline inventory, also play a significant role when looking at a holistic snapshot of inventory within a given organization.

Where and in What Form Should Inventory Be Held?

Another key aspect of inventory optimization is to determine in what form inventory needs to be held: raw materials vs. intermediates vs. finished goods? Multi-echelon inventory optimization is a powerful technology to help determine where, when, and in what form does inventory need to be positioned to optimally meet customer service and take advantage of risk pooling and postponement strategies.

For example, a major retailer faced the challenge of not applying demand classification on the SKU level, making it difficult for them to determine the right amount of inventory to hold on a given product, resulting in upwards of $75M in lost sales. By implementing inventory optimization and network optimization, the retailer was able to pinpoint which SKUs to apply capital to and in which locations.

Customer buying patterns and their cascaded effect upstream play a key role when determining how much working capital gets tied into inventory. Not all demand is smooth/normally distributed. Depending on the SKU (slow vs. fast movers) and customer buying patterns, a given SKU could be classified into one of five different classifications (Non-Intermittent; Smooth or Erratic and Intermittent; Highly Variable; Slow; or Lumpy) at a given node in the supply chain. Production batching at plants and ordering policies at distribution centers could significantly influence the way customer demand is seen upstream which in turn has a direct implication on inventory.

The example below is from a large energy management equipment manufacturer study where almost all of their demand was not normal/smooth (less than 0.2 percent). Applying analytics that assume normality can provide misleading inventory recommendations as it does not capture true customer buying behavior.

Not only does assuming normality not reflect reality, it can lead to non-strategic business decisions. One large manufacturer of latches, screws, and hinges needed to set inventory targets at a monthly planning level. In order to provide an accurate inventory on the SKU level, planners had to manually review demand to set safety stock levels based on variability of the SKU. This process was inefficient and not scalable. The manufacturer utilized network optimization to run a multi-echelon inventory optimization based on the optimal network design. The customer uncovered savings in inventory holding costs of 15 percent by postponing production and taking risk pooling into account thanks to this analysis.

Finally, modeling technology that enables an end-to-end view of inventory levels and policies can be used to design the right inventory strategy and be used on a monthly planning basis. Simulation of the recommended inventory policies from the optimization analysis can help validate operational feasibility of advanced inventory analytics along with detailed visibility into supply chain performance/KPIs.

¹ Chief Supply Chain Officer Insights, June 2011

TAGS

Subscribe to Our YouTube Channel

TOPICS

Categories

Subscribe to Our Podcast

TRENDING POSTS

Sponsors