So you’re a shipper intrigued by Big Data tools and technology to improve transportation management initiatives. Should you implement a technology solution from a third-party logistics provider (3PL) or is it more effective to select a pure-play TMS provider to leverage your data? Your current 3PL has a technology that seems like a neatly bundled offering, but before you agree to use their tool, consider the following strategy which delivers the best of both worlds.

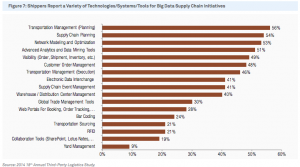

The 18th Annual CapGemini Third Party Logistics Study revealed some interesting data regarding shippers’ usage of technologies, systems, and tools to leverage Big Data in their supply chain initiatives. The chart below (click to enlarge) from the study shows that a majority of those polled reported using Big Data technologies for transportation management and supply chain network planning and optimization, while a plurality tapped tech tools for things like order management and shipment tendering and communications. So it is clear that shippers realize the potential, and those that are not currently leveraging IT for logistics are interested in doing so in increasing numbers as well.

So back to the question of whether it makes more sense to source best-in-class Big Data technologies from vendor-agnostic, third-party software providers or from 3PLs offering technologies as part of a bundled offering. Many shippers gravitate toward the 3PL supplied technology model for a number of reasons: one throat to choke, one less relationship to manage, etc. However, there is a pronounced advantage to engaging a vendor-agnostic, third-party technology tool like a TMS or optimizer which is summed up in one very important word: visibility.

I’m not suggesting that the tools offered by 3PLs don’t offer improved control and a degree of visibility to improve a shipper’s transportation management. What I am saying is that you won’t get the same breadth and depth of visibility with their tools as you would if you engaged a standalone TMS solution from any of the leading providers. This is particularly true with respect to rate data, carrier acceptance data and overall visibility into underlying carriers. For example, if your 3PL is moving your loads as your broker of record, they might not have a strong incentive to help you drill into the data to learn what is driving rates, preventing you from finding lower rates elsewhere.

It is also important to realize that using a third-party tool doesn’t preclude a shipper from having a strong relationship with their 3PL partner. But it does ensure that the shipper has full visibility into all the data the tool collects enabling much more robust and actionable Big Data analytics. This means the shipper secures greater accountability from their 3PL. It also means the shipper can effectively source capacity through both a trusted 3PL and through direct arrangements with carriers to provide even more flexibility.

Anthony Vitiello is Director of Marketing at UltraShipTMS, where he brings 20 years of success in marketing and public relations to the position. Prior to UltraShipTMS, Mr. Vitiello held marketing leadership positions with a Fortune 500 software company, an international public relations agency serving Silicon Valley companies, and an exclusive, high net-worth wealth management firm serving professional sports figures and top energy industry executives. A published columnist and prolific blogger, Mr. Vitiello is responsible for generating and curating Ultra’s Supply Chain Collaborator blog and the company’s library of technical papers, business case studies, e-newsletters and other materials. Mr. Vitiello graduated from Sarah Lawrence College with a BA in liberal arts.

A version of this post was originally published on UltraShipTMS’ Supply Chain Collaborator blog.

The Road to Big Data Visibility Doesn’t Run Through Your 3PL Technology

So you’re a shipper intrigued by Big Data tools and technology to improve transportation management initiatives. Should you implement a technology solution from a third-party logistics provider (3PL) or is it more effective to select a pure-play TMS provider to leverage your data? Your current 3PL has a technology that seems like a neatly bundled offering, but before you agree to use their tool, consider the following strategy which delivers the best of both worlds.

The 18th Annual CapGemini Third Party Logistics Study revealed some interesting data regarding shippers’ usage of technologies, systems, and tools to leverage Big Data in their supply chain initiatives. The chart below (click to enlarge) from the study shows that a majority of those polled reported using Big Data technologies for transportation management and supply chain network planning and optimization, while a plurality tapped tech tools for things like order management and shipment tendering and communications. So it is clear that shippers realize the potential, and those that are not currently leveraging IT for logistics are interested in doing so in increasing numbers as well.

So back to the question of whether it makes more sense to source best-in-class Big Data technologies from vendor-agnostic, third-party software providers or from 3PLs offering technologies as part of a bundled offering. Many shippers gravitate toward the 3PL supplied technology model for a number of reasons: one throat to choke, one less relationship to manage, etc. However, there is a pronounced advantage to engaging a vendor-agnostic, third-party technology tool like a TMS or optimizer which is summed up in one very important word: visibility.

I’m not suggesting that the tools offered by 3PLs don’t offer improved control and a degree of visibility to improve a shipper’s transportation management. What I am saying is that you won’t get the same breadth and depth of visibility with their tools as you would if you engaged a standalone TMS solution from any of the leading providers. This is particularly true with respect to rate data, carrier acceptance data and overall visibility into underlying carriers. For example, if your 3PL is moving your loads as your broker of record, they might not have a strong incentive to help you drill into the data to learn what is driving rates, preventing you from finding lower rates elsewhere.

It is also important to realize that using a third-party tool doesn’t preclude a shipper from having a strong relationship with their 3PL partner. But it does ensure that the shipper has full visibility into all the data the tool collects enabling much more robust and actionable Big Data analytics. This means the shipper secures greater accountability from their 3PL. It also means the shipper can effectively source capacity through both a trusted 3PL and through direct arrangements with carriers to provide even more flexibility.

Anthony Vitiello is Director of Marketing at UltraShipTMS, where he brings 20 years of success in marketing and public relations to the position. Prior to UltraShipTMS, Mr. Vitiello held marketing leadership positions with a Fortune 500 software company, an international public relations agency serving Silicon Valley companies, and an exclusive, high net-worth wealth management firm serving professional sports figures and top energy industry executives. A published columnist and prolific blogger, Mr. Vitiello is responsible for generating and curating Ultra’s Supply Chain Collaborator blog and the company’s library of technical papers, business case studies, e-newsletters and other materials. Mr. Vitiello graduated from Sarah Lawrence College with a BA in liberal arts.

A version of this post was originally published on UltraShipTMS’ Supply Chain Collaborator blog.

TAGS

Subscribe to Our YouTube Channel

TOPICS

Categories

Subscribe to Our Podcast

TRENDING POSTS

Sponsors