In case you missed it, the Wall Street Journal and others reported last week that Sealed Air Corp., the makers of Bubble Wrap, have developed a new version of the product called iBubble Wrap that doesn’t pop. The reaction on Twitter was quick and furious:

It’s a sad, sad day in our nation’s history. http://t.co/5XcLiMMDQP

— Al Yankovic (@alyankovic) July 2, 2015

Oh, my God! They killed bubble wrap! You bastards! http://t.co/AIdKJeGHKZ pic.twitter.com/GvayQojjRb — Jeff Jacoby (@Jeff_Jacoby) July 2, 2015

Bubble Wrap No Longer Popable, Life No Longer Worth Living http://t.co/HDu1BwpO2D pic.twitter.com/J1xXZxKDAF

— Cosmopolitan (@Cosmopolitan) July 2, 2015

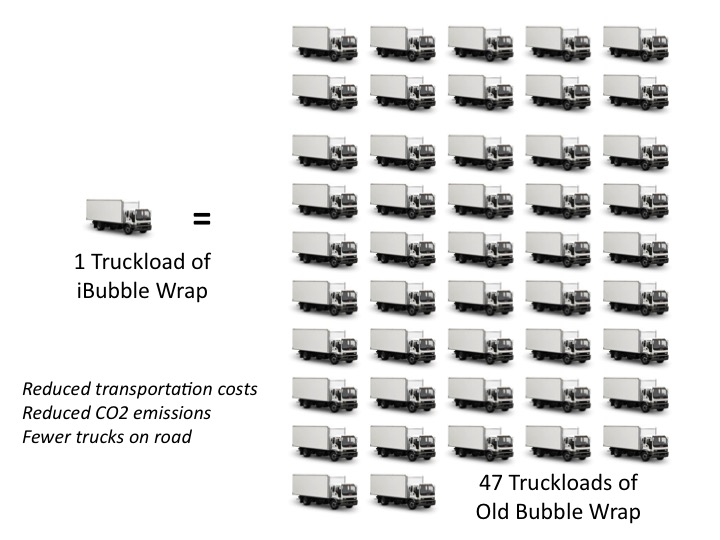

A sad day indeed for toddlers and adults alike who have enjoyed popping those bubbles since 1960. But for supply chain and logistics folks, it’s the story behind the headline that is most interesting. It turns out that the main driving force behind the product change was logistics costs. As reported in the WSJ, “[Sealed Air Corp.] rarely sends Bubble Wrap to customers more than 150 miles from its factories because its bulky size makes it prohibitively expensive to ship long distances.” The new iBubble Wrap is sold as flat plastic sheets that customers fill with air at their locations using a custom-made pump. The new design distributes air across the bubbles, which means they will no longer pop, but by shipping as flat sheets instead of bulky rolls, one truckload of iBubble Wrap contains as much packing material as 47 truckloads of the old product!

This is yet another example of how changes in packaging can translate into significant cost savings and sustainability benefits in transportation (see The Better Goal: More Efficient Trucks or Using Fewer Trucks? which highlights how IKEA is designing its packaging with shipping in mind).

Then there’s the space the old Bubble Wrap takes up at warehouses and its storage cost. The WSJ article gives an example:

Ozburn-Hessey Logistics LLC, which spends 20% of its filler-packaging budget on bubble packaging, said the logistics industry earns an average of $25 in revenue a square foot—so if a facility were to use 3,000 square feet of space to store Bubble Wrap, it loses $75,000 a year in potential revenue, according to the company.

The storage cost savings for customers, coupled with the lower price for the new product, should make up for the custom air pump cost ($5,500 today, which Sealed Air Corp. hopes to lower to $1,000 by 2017).

Are the logistics costs savings and sustainability benefits worth losing the ability to pop Bubble Wrap? This question will divide many, but if Sealed Air Corp. ultimately discontinues the old product, we can at least satisfy our need to pop bubbles with virtual bubble wrap. A poor substitute, I know, but progress sometimes requires sacrifices.