Looking at the numbers and recent news, investors are betting big on the future of the logistics industry.

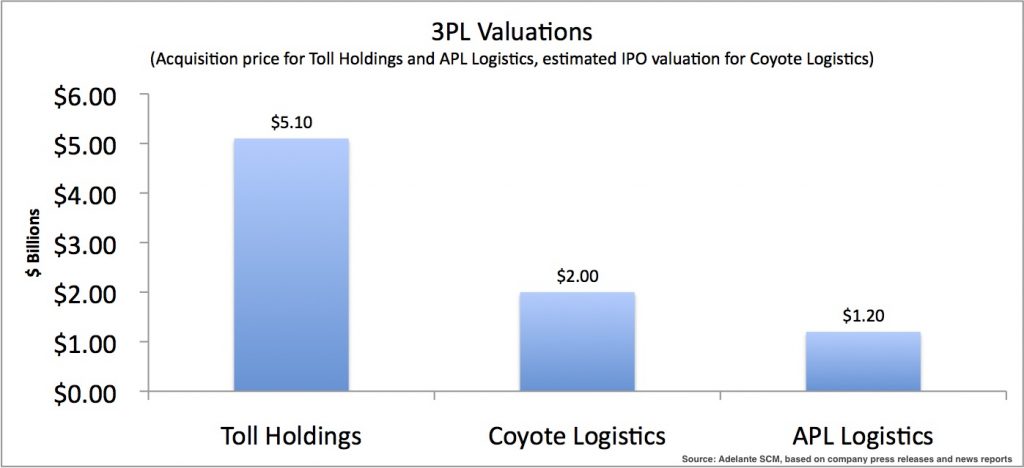

The Wall Street Journal reported on Friday that Coyote Logistics “is preparing for an initial public offering [in the second half of this year] that could value it at more than $2 billion,” and the deal “is expected to raise a few hundred million dollars.”

The road to Coyote’s IPO has been paved with various acquisitions, including Access America Transport, which the company acquired last March (read my commentary here). As the Coyote stated in the press release, “upon closing of the [AAT] transaction, the combined company will be one of the largest 3PL service providers in North America with run rate revenues of over $2 billion, 17 North American locations, approximately 40,000 contracted carriers and approximately 1,750 employees.”

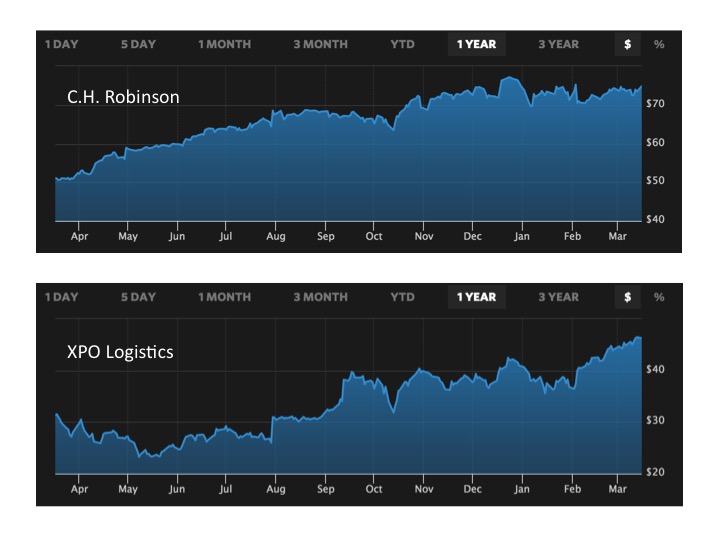

Meanwhile, over the past 12 months, we’ve seen the stock prices of C.H. Robinson (a Talking Logistics sponsor) and XPO Logistics increase 40.5% and 43.3%, respectively.

And we’ve also seen two large 3PL acquisitions in recent weeks, both originating in Asia: Japan Post Holdings Co. buying Australian logistics company Toll Holdings Ltd. for about $5.1 billion, and Kintetsu World Express Inc. buying APL Logistics Inc. for $1.2 billion.

What does this all mean?

A lot of things, I suppose. For one, it means that investors are bullish on future growth opportunities for the 3PL industry — driven by e-commerce, global trade, companies in underserved industries (such as Oil and Gas) looking to move up the supply chain maturity curve, and other factors.

It also means, I believe, that the 3PL industry is perhaps becoming barbell shaped, with small, niche providers growing and thriving at one end; very large, global providers growing and thriving at the other end; and everybody else getting squeezed out in the middle.

If you’re a 3PL in the middle, which end of the barbell will you race toward?

Post a comment and share your perspective on what’s happening in the 3PL industry today!