I attend and speak at many supply chain and logistics conferences throughout the year, but among my favorites are those that bring a relatively small group of executives together to discuss timely and important industry topics. In a survey I conducted a few years ago, supply chain executives viewed “direct conversations with other executives and peers” — in other words, peer-to-peer learning and networking — as the most valuable source of practical knowledge and advice.

The power of peer-to-peer learning was evident at the Kenco Customer Summit last month, where executives representing various companies and industries participated in a day-long meeting to discuss topics that they put on the agenda, including trends in the logistics labor market, network design and optimization, innovation in logistics, and the effect of 3PL mergers and acquisitions. An interesting and unique thing about the agenda: although it listed the sessions in order, there were no set start and end times for each. The idea was to let the conversation dictate how long or short each session would take, and as it turned out, each session generated a fair amount of discussion.

I kicked off the meeting with a discussion on the attributes that define a successful company and leader of tomorrow, then wrapped up the agenda with a discussion on 3PL mergers and acquisitions. The other session leaders were:

- Brian Devine, SVP at ProLogistix, on trends in logistics labor market

- Valerie Bonebrake, SVP at Tompkins International, on network design and optimization

- Kristi Montgomery, VP at Kenco Innovation Labs, on logistics innovation trends

It’s impossible for me to capture in a short blog post all of the great insights the session leaders and attendees shared during the event — as the saying goes, you really had to be there — but here are some of my takeaways from the sessions.

Becoming a Successful Company and Leader of Tomorrow

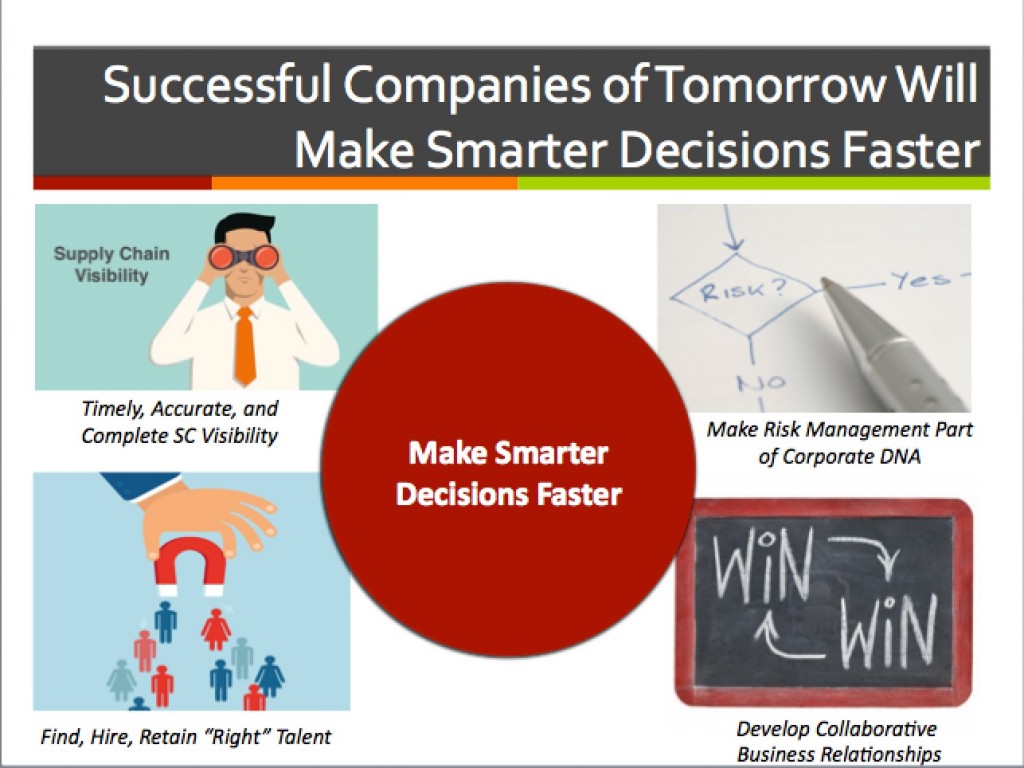

The attendees generally agreed with how I characterized the main challenge supply chain and logistics professionals face today: the “clock speeds” of every industry are accelerating, making it difficult for companies to keep pace with the rapid pace of change — from a technology, business process, and organizational (decision-making) standpoint.

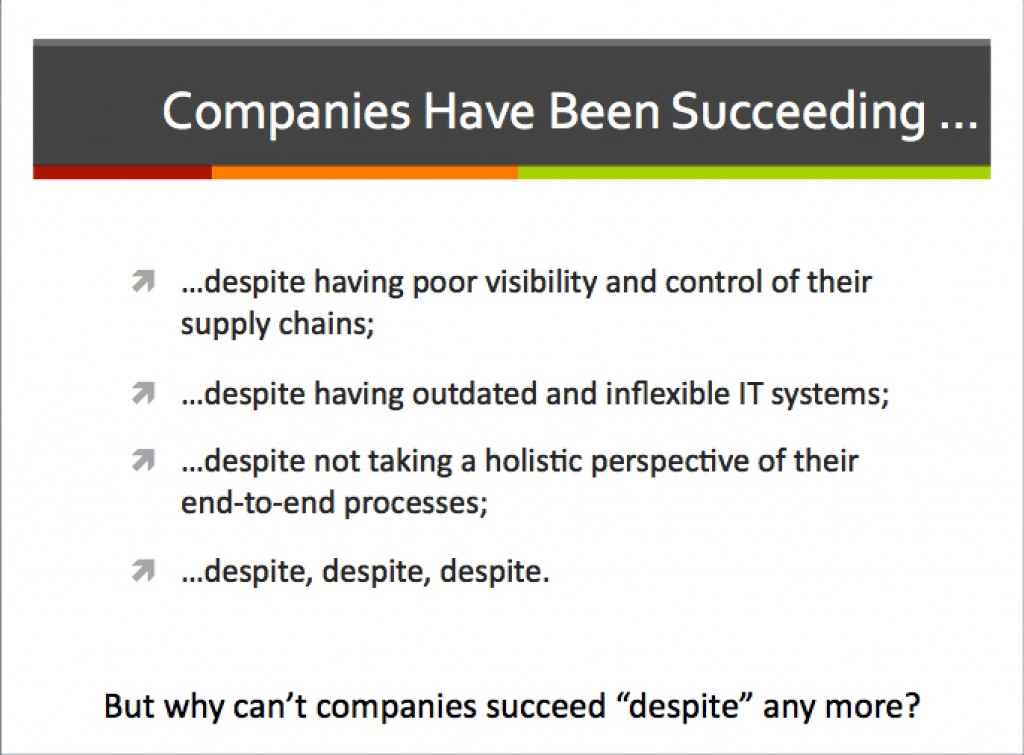

The slide that generated the most discussion was my “despite” slide, where I make the case that although companies have been succeeding to date despite all sorts of inefficient practices, they won’t be able to succeed any more moving forward without correcting those issues. Several attendees acknowledged that one or more of the problems listed on the slide existed at their companies today.

So, how do you address these long-standing issues and drive positive change? As the conversation revealed, there are no quick and easy fixes, and change cannot happen without support from the CEO and the executive leadership team. My two cents was that true transformation can only happen when companies finally break down their functional silos and enable true collaboration with external trading partners — things that have been talked about for decades, but many companies, for many reasons, have failed to take action on.

That said, when it comes to addressing their IT needs, most of the attendees viewed their 3PL partners as playing a more critical role moving forward. Generally speaking, it’s still difficult for supply chain and logistics executives to obtain IT support and funding for technology (in many cases, money and resources are tied up with other initiatives, such as multi-year ERP rollouts), so executives are looking to their 3PL partners to meet their technology needs, whether it’s software like a transportation management system (TMS) or automation technology in the warehouse.

Trends in Logistics Labor Market

“The labor market has changed by 180 degrees in the last 18 months,” said Brian Devine from ProLogistix. As unemployment rates near all-time lows, the most “qualified” applicants are already working and it takes a $1.00 or more per hour rate change to dislodge an employee from a current job, whereas in periods of high unemployment you have many qualified candidates in the pool and it only takes a $0.25 per hour rate increase to edge out another job offer.

Simply put, the pool of qualified workers is shrinking and companies need to pay more to attract and retain them.

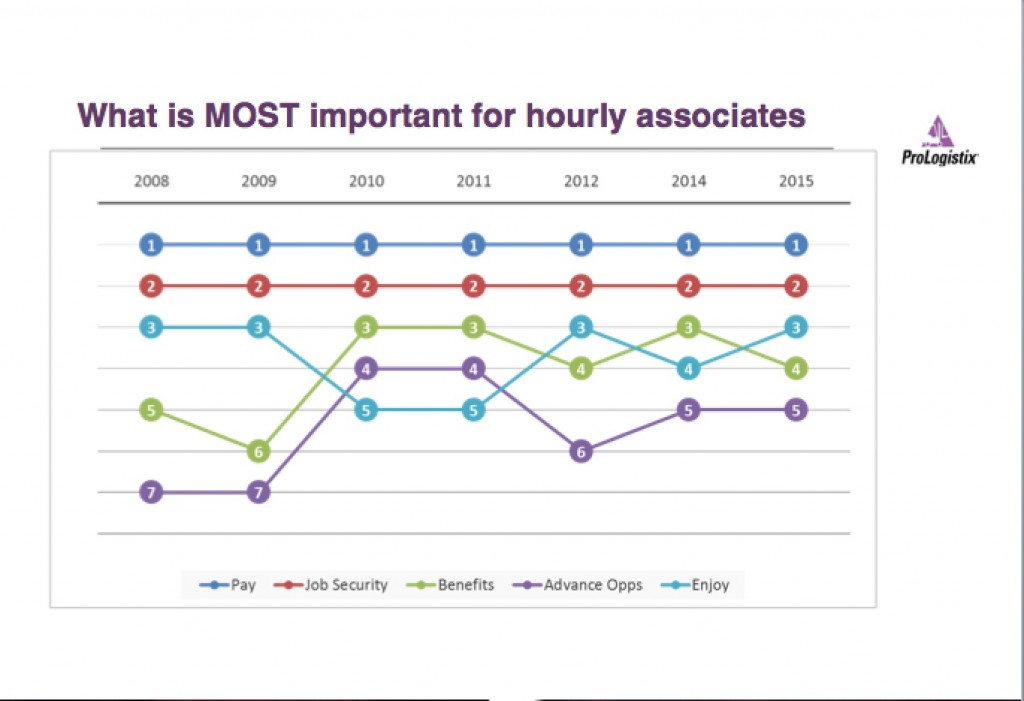

What hasn’t changed over the years are the top two priorities for hourly workers: pay (base rate) and job security.

From 2002 through today, the Consumer Price Index has increased 35.5 percent while wages have grown only 7.4 percent. This fact generated a lot of discussion about the need and desire to pay workers a living wage. Leveraging more technology, such as warehouse automation, is one way to manage rising labor costs. But as one of the attendees commented, “you can’t just focus on the labor rate, you have to look at the total cost.” His company raised pay rates from $10 to $14 per hour in the warehouse, but OS&D (over, short, and damaged) costs decreased by 50 percent!

This reminded me of what Howard Schultz, the CEO of Starbucks, said at the 2015 Council of Supply Chain Management Professionals (CSCMP) Annual Conference: “Contrary to what many people believe, investing in employees is not dilutive to a company’s financial results and shareholder value — it’s actually accretive.”

Brian concluded his session with some best practices:

- Increase hourly pay rates. This includes paying more for different shifts, more complex positions, and for short-term peak seasons.

- Segment the hourly workforce. Simply put, compensate employees in essential positions — that is, positions that are very important, difficult to fill, and where turnover hurts to the most — differently than employees in less essential positions.

- Adjust physical requirements of the job to attract more employees. For example, reduce maximum weight from 50 lbs to 35 lbs.

- Add part-time shifts to attract employees who only want 20 hours per week.

Network Design and Optimization

One of my predictions for this year was that more companies will treat Supply Chain Design as a continuous business process instead of a standalone project or a once-a-year exercise. Based on what I heard from the attendees in the meeting, it seems like this prediction has come true.

Valerie Bonebrake from Tompkins International cited several factors driving this trend, including the growing complexity of supply chains (including SKU proliferation), more demanding customer service expectations, and the rising importance of risk mitigation and contingency planning.

Most of the attendees are doing supply chain design in-house, using tools from software vendors such as LLamasoft and i2 Technologies. But most are also using partners, such as consultants and 3PLs, to assist them as needed depending on the specific design problem and expertise required.

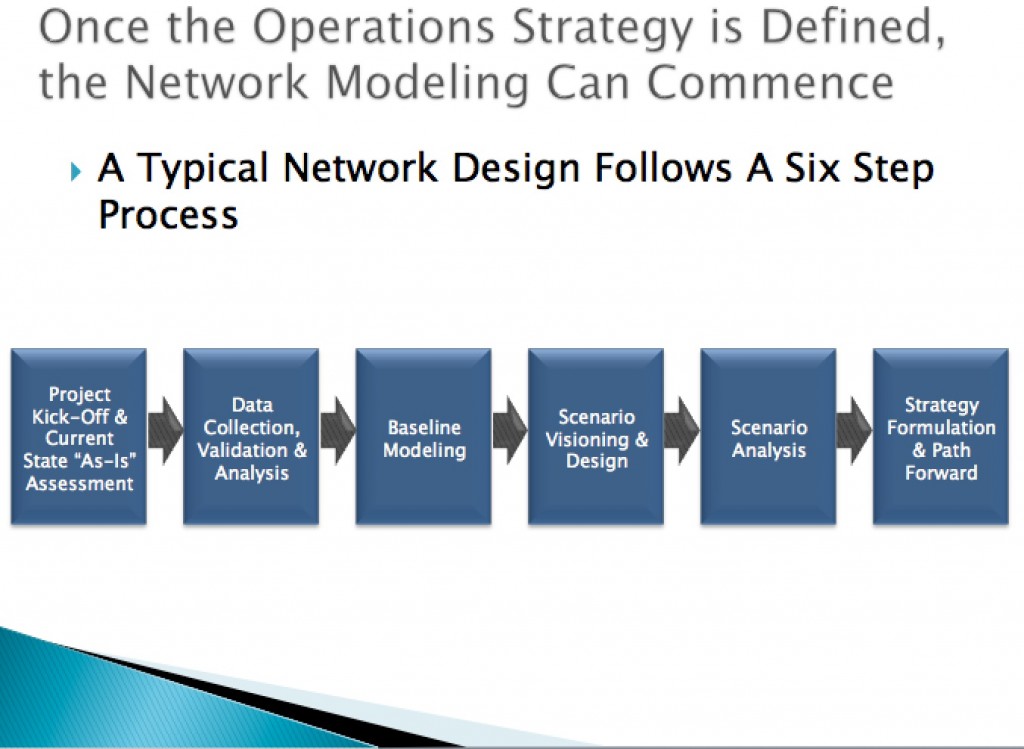

“Before starting a network design analysis, you first have to define your operations strategy,” advised Valerie. This involves asking and answering some basic questions: What factors are influencing network design? What questions need to be answered by the analysis? What capabilities are needed? Once the operations strategy is defined, you can begin the network design process, which Valerie broke down into six steps.

I don’t have the time or space to dive into these steps, but here are some of the best practices Valerie shared:

- Align supply chain network with business strategy

- Engage your supply chain partners

- Identify and prioritize design initiatives

- Utilize the best analytical tool for the project objectives

- Analyze alternative processes

- Maintain the data set and automate access to data

Logistics Innovation Trends

Kristi Montgomery, VP at Kenco Innovation Labs, began the session with an interesting exercise for the attendees: grab a pen, a blank sheet of paper, and draw supply chain innovation. Try it at your next team meeting and see what people come up with in 5 minutes. I didn’t save my original drawing, but it looked something like this:

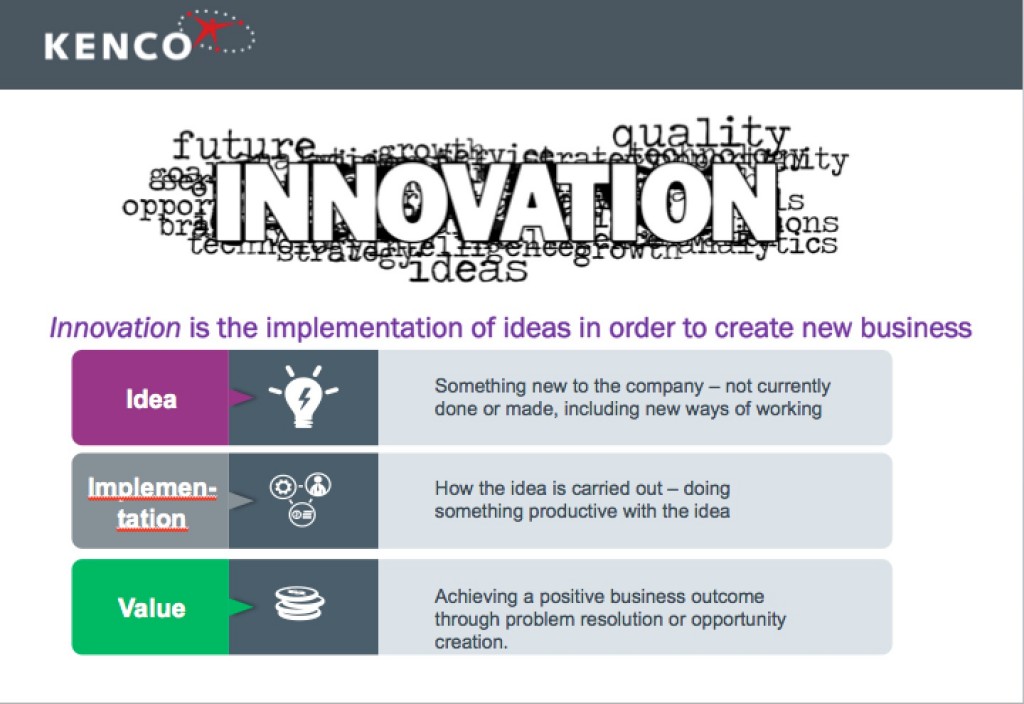

It was a fun exercise to demonstrate the various ways people (and, by extension, companies) define innovation. Kristi proposed the following definition: “Innovation is the implementation of ideas in order to create new business value.” She then defined idea, implementation, and value.

I liked Kristi’s definition of idea — “something new to the company” — because it reveals an important point many people overlook: not all innovation has to be bleeding edge; you can also innovate by implementing practices and technologies that are well-established at other companies but are new to you (e.g., replacing manual processes with a TMS, implementing Lean practices). This point reminded me of a post I wrote a couple of years ago where I argued that companies should forget about innovation if they can’t execute the small stuff.

Kristi then discussed several emerging trends, including drones, 3D printing, augmented reality, and AGVs — all of which Kenco Innovation Labs is exploring in its dedicated simulation warehouse in Tennessee.

Kenco Innovation Labs was launched by Kenco earlier this year. It’s a dedicated department focused on “researching and developing novel approaches to supply chain management challenges…Its dedicated team of innovation specialists collaborate with customers to identify, research, and prototype leading-edge ideas and processes. This team also partners with entrepreneurs and vendors from multiple industries to identify trends that can be cost-effectively applied in the warehouse, enabling us to think outside the box and create unique, customer-driven solutions.”

Last week, for example, Kenco announced that it’s working with PINC Solutions on exploring the potential to deploy drones for yard management at Kenco distribution facilities. As Kristi explains in the press release, “Kenco wants to use drones for managing real-time data gathering in outside yard operations. PINC’s patented RTLS sensor platform captures locations of assets and inventory, and can provide up-to-the-minute information that would allow Kenco to customize and segment yard operations based on customer needs and business rules.”

My main takeaway from this session, based on what I heard from the attendees, is that supply chain and logistics executives want their 3PLs partners to keep a strong pulse on emerging technologies, and they want them to determine how to best use these technologies to provide them with enhanced value and benefits.

3PL Mergers and Acquisitions

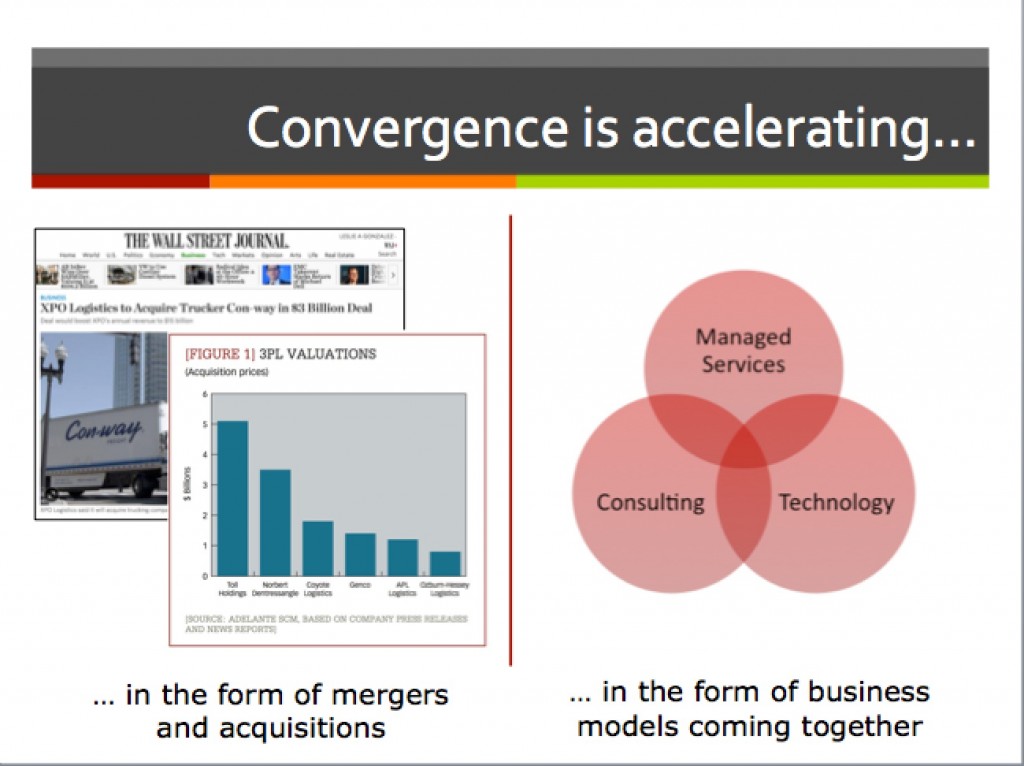

The final discussion of the day focused on the convergence taking place in the 3PL industry — both in the form of mergers and acquisitions, and in the form of business models coming together.

I kicked off the discussion with a simple question: Is this convergence a positive or negative development?

The answers I received were less simple or straightforward, but if I had to aggregate them into a single statement, it would be this: If the net result of all this convergence is that 3PLs will be in a better position to provide me with the right mix of technology, managed services, and advice — in a more flexible manner — then it’s a positive development.

The one thing that remains the same, however, is the most critical attribute of a successful 3PL-customer relationship: alignment of company cultures, which all of the attendees agreed is still an important factor in selecting a 3PL partner, regardless of how big or small they are.