A 2005 study on the impact of supply chain disruptions revealed there is significant damage to a company’s financials and brand when a crisis or stoppage occurs. The report shows, for example, that firms suffering from supply chain disruption experience 33% to 40% lower stock returns compared to their peers. Other stats related to disruption include:

- 107 % drop in operating income

- 7 % lower sales growth

- 11 % growth in cost

The stakes are high – as is the level of risk. In today’s complex global supply chains, where production is increasingly outsourced, managing disruption-related risk is a priority. But surprisingly, a significant number of manufacturers are not being very proactive.

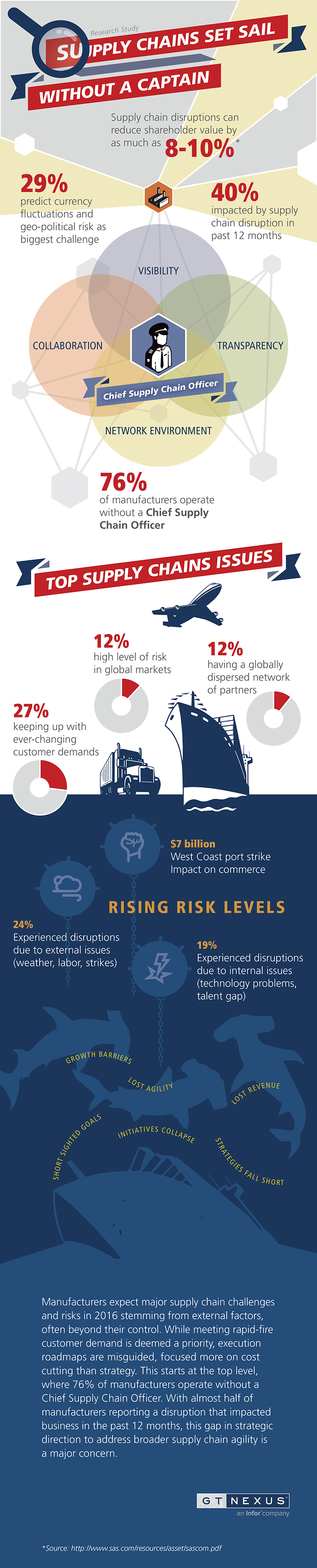

In December 2015, GT Nexus and YouGov surveyed 250 senior manufacturing executives to gauge their outlooks for supply chains in 2016. Many questions targeted their thoughts on disruptions and steps being taken to address risk. We set out to learn executives’ top concerns, challenges, goals, and opportunities.

The study shows uncertainty and risk are, in fact, top issues. Manufacturers see challenges everywhere: Political issues. Currency fluctuations. Labor strikes. Raw material costs. Regulations.

These can all lead to disruption. However, the findings also point to some confusion and misalignment in addressing these risk factors.

The Findings

40% of manufacturers have been impacted by a supply chain disruption in the last 12 months. External research has shown the numbers could be even higher. As manufacturers increasingly outsource production and rely on highly-orchestrated supply chains, the potential for disruption grows, along with the impact. For example, in 2015 the West Coast port slowdown had an estimated $7 billion impact on commerce.

40% of manufacturers have been impacted by a supply chain disruption in the last 12 months. External research has shown the numbers could be even higher. As manufacturers increasingly outsource production and rely on highly-orchestrated supply chains, the potential for disruption grows, along with the impact. For example, in 2015 the West Coast port slowdown had an estimated $7 billion impact on commerce.

Businesses are battling on three different fronts here: rising risk of disruption, harsher impacts from delays, and increasingly demanding customers. Factor in current economic conditions where growth is minimal, and the challenges to a healthy, profitable supply chain are further magnified. As a result of multiple economic headwinds, manufacturers are forced to move even further beyond their comfort zones to deliver products in new markets and regions to capture growth. As a result of these dynamics, manufacturers are forced to re-design their supply networks in new ways that minimize disruptions, while enabling profitable demand fulfillment. For example, there’s a movement in many industries to “produce locally, sell locally” – or produce closer to customers – to serve overseas markets while keeping costs low. Expect to see more innovative moves in supply network design to address disruptions and challenges around fulfilling demand profitably. But planning and executing strategic initiatives like these require broad vision, input, and buy-in from across the enterprise.

Addressing Risk at the C-level

A supply chain disruption or disaster, such as a factory collapse or explosion, massively affects revenue and the brand. Consider variables such as currency fluctuations, geopolitical crises, changing laws and regulations, costs of materials and labor, and the landscape grows more daunting. So much is at stake in a complex environment littered with pitfalls. As a result, investors, analysts, customers, and other constituents are focusing intensely on the supply chain.

This being the case, it’s surprising to see so few companies placing supply chain at the C-level. Our study shows 76% of manufacturers operate without a Chief Supply Chain Officer. Consider how many parts of an organization the supply chain touches directly or indirectly. The supply chain is an extension of the business. It’s the extra-enterprise that has no boundaries. When it comes to a grinding halt, it has an immense impact that’s felt across the entire business ecosystem. Lack of a single component or part in the automotive or high tech space, for instance, can have a rippling effect that prevents thousands of cars or smartphones from being delivered.

The supply chain network has to be managed and controlled. Visibility, transparency, and collaboration are essential to making this happen. Unfortunately, without a visionary C-level leader, supply chain strategies are shorthanded or misguided. Without a champion of end-to-end visibility or a strategic thinker who can move the enterprise towards a supply network approach, many initiatives collapse. As more manufacturers evolve upward in the supply chain maturity curve, the need for chief supply chain officers will become clearer.

The Outlook

41% of manufacturing executives in this study said their most important supply chain goal for the near future is reducing costs. Consider the plethora of proactive supply chain strategies being written about and discussed by the specialists, consultants and analysts of the world. We hear about visibility, traceability, collaboration, agility, resiliency, or a networked environment to align supply and demand… yet the top 2016 priority is to cut costs. This clearly indicates that uncertainty is driving strategy. As a result, plans are centered on conservative moves to carve out savings, instead of driving growth by innovation and transformation.

It is sometimes said that in a bear market you should cut costs. You pull back, carve out efficiencies. This may be true. But it can’t be at the expense of long-term vision and growth. Investments in supply chain visibility provide the foundation for long-term innovation and growth, while setting up new possibilities for removing costs. Moves that reduce inventory, remove days from cycle times, extract capital costs from transactions, or eliminate distribution centers or domestic handling costs.

Cost cutting in 2016 may help the bottom line in the short term, but it’s the strategic supply chain programs that look ahead at innovation, network agility, and end-to-end visibility – driven by a C-level executive – that will deliver a winning formula in 2016 and beyond.

Look at the increasingly dispersed nature of supply chain networks today, and the challenges that arise from parties operating on different systems with different workflows and processes. Data and visibility are extremely fragmented. Supply chain data that resides in a silo provides no value to the network.

When manufacturers can collect and share data across the network and use it for greater visibility and execution, they can mitigate risk, and the opportunities to drive growth spike. Supply chains and their leaders have to be tech-savvy visionaries in 2016 to address risk and maintain control of their business beyond their four walls. Disruptions are high profile, impactful events. Managing supply chain issues and risk requires a tight handle on the steering wheel from senior leadership at the C-level.

Bryan Nella is Director of Corporate Communications at GT Nexus, an Infor company, the world’s largest cloud-based supply chain network. He has more than 15 years of experience distilling complex solutions into simplified concepts within the enterprise software and extra-enterprise software space. Prior to joining GT Nexus, Nella held numerous positions in the technology practice at global public relations agency Burson-Marsteller, where he delivered media relations and communications services to clients such as SAP. In previous roles he has worked with clients such as IBM, MasterCard and U.S. Trust. Nella holds a BA in Mass Communications from Iona College and a MS in Management Communications from Manhattanville College.

Bryan Nella is Director of Corporate Communications at GT Nexus, an Infor company, the world’s largest cloud-based supply chain network. He has more than 15 years of experience distilling complex solutions into simplified concepts within the enterprise software and extra-enterprise software space. Prior to joining GT Nexus, Nella held numerous positions in the technology practice at global public relations agency Burson-Marsteller, where he delivered media relations and communications services to clients such as SAP. In previous roles he has worked with clients such as IBM, MasterCard and U.S. Trust. Nella holds a BA in Mass Communications from Iona College and a MS in Management Communications from Manhattanville College.

Missing: C-level Engagement to Address Supply Chain Disruption Risk

A 2005 study on the impact of supply chain disruptions revealed there is significant damage to a company’s financials and brand when a crisis or stoppage occurs. The report shows, for example, that firms suffering from supply chain disruption experience 33% to 40% lower stock returns compared to their peers. Other stats related to disruption include:

The stakes are high – as is the level of risk. In today’s complex global supply chains, where production is increasingly outsourced, managing disruption-related risk is a priority. But surprisingly, a significant number of manufacturers are not being very proactive.

In December 2015, GT Nexus and YouGov surveyed 250 senior manufacturing executives to gauge their outlooks for supply chains in 2016. Many questions targeted their thoughts on disruptions and steps being taken to address risk. We set out to learn executives’ top concerns, challenges, goals, and opportunities.

The study shows uncertainty and risk are, in fact, top issues. Manufacturers see challenges everywhere: Political issues. Currency fluctuations. Labor strikes. Raw material costs. Regulations.

These can all lead to disruption. However, the findings also point to some confusion and misalignment in addressing these risk factors.

The Findings

Businesses are battling on three different fronts here: rising risk of disruption, harsher impacts from delays, and increasingly demanding customers. Factor in current economic conditions where growth is minimal, and the challenges to a healthy, profitable supply chain are further magnified. As a result of multiple economic headwinds, manufacturers are forced to move even further beyond their comfort zones to deliver products in new markets and regions to capture growth. As a result of these dynamics, manufacturers are forced to re-design their supply networks in new ways that minimize disruptions, while enabling profitable demand fulfillment. For example, there’s a movement in many industries to “produce locally, sell locally” – or produce closer to customers – to serve overseas markets while keeping costs low. Expect to see more innovative moves in supply network design to address disruptions and challenges around fulfilling demand profitably. But planning and executing strategic initiatives like these require broad vision, input, and buy-in from across the enterprise.

Addressing Risk at the C-level

A supply chain disruption or disaster, such as a factory collapse or explosion, massively affects revenue and the brand. Consider variables such as currency fluctuations, geopolitical crises, changing laws and regulations, costs of materials and labor, and the landscape grows more daunting. So much is at stake in a complex environment littered with pitfalls. As a result, investors, analysts, customers, and other constituents are focusing intensely on the supply chain.

This being the case, it’s surprising to see so few companies placing supply chain at the C-level. Our study shows 76% of manufacturers operate without a Chief Supply Chain Officer. Consider how many parts of an organization the supply chain touches directly or indirectly. The supply chain is an extension of the business. It’s the extra-enterprise that has no boundaries. When it comes to a grinding halt, it has an immense impact that’s felt across the entire business ecosystem. Lack of a single component or part in the automotive or high tech space, for instance, can have a rippling effect that prevents thousands of cars or smartphones from being delivered.

The supply chain network has to be managed and controlled. Visibility, transparency, and collaboration are essential to making this happen. Unfortunately, without a visionary C-level leader, supply chain strategies are shorthanded or misguided. Without a champion of end-to-end visibility or a strategic thinker who can move the enterprise towards a supply network approach, many initiatives collapse. As more manufacturers evolve upward in the supply chain maturity curve, the need for chief supply chain officers will become clearer.

The Outlook

41% of manufacturing executives in this study said their most important supply chain goal for the near future is reducing costs. Consider the plethora of proactive supply chain strategies being written about and discussed by the specialists, consultants and analysts of the world. We hear about visibility, traceability, collaboration, agility, resiliency, or a networked environment to align supply and demand… yet the top 2016 priority is to cut costs. This clearly indicates that uncertainty is driving strategy. As a result, plans are centered on conservative moves to carve out savings, instead of driving growth by innovation and transformation.

It is sometimes said that in a bear market you should cut costs. You pull back, carve out efficiencies. This may be true. But it can’t be at the expense of long-term vision and growth. Investments in supply chain visibility provide the foundation for long-term innovation and growth, while setting up new possibilities for removing costs. Moves that reduce inventory, remove days from cycle times, extract capital costs from transactions, or eliminate distribution centers or domestic handling costs.

Cost cutting in 2016 may help the bottom line in the short term, but it’s the strategic supply chain programs that look ahead at innovation, network agility, and end-to-end visibility – driven by a C-level executive – that will deliver a winning formula in 2016 and beyond.

Look at the increasingly dispersed nature of supply chain networks today, and the challenges that arise from parties operating on different systems with different workflows and processes. Data and visibility are extremely fragmented. Supply chain data that resides in a silo provides no value to the network.

When manufacturers can collect and share data across the network and use it for greater visibility and execution, they can mitigate risk, and the opportunities to drive growth spike. Supply chains and their leaders have to be tech-savvy visionaries in 2016 to address risk and maintain control of their business beyond their four walls. Disruptions are high profile, impactful events. Managing supply chain issues and risk requires a tight handle on the steering wheel from senior leadership at the C-level.

TAGS

Subscribe to Our YouTube Channel

TOPICS

Categories

Subscribe to Our Podcast

TRENDING POSTS

Sponsors