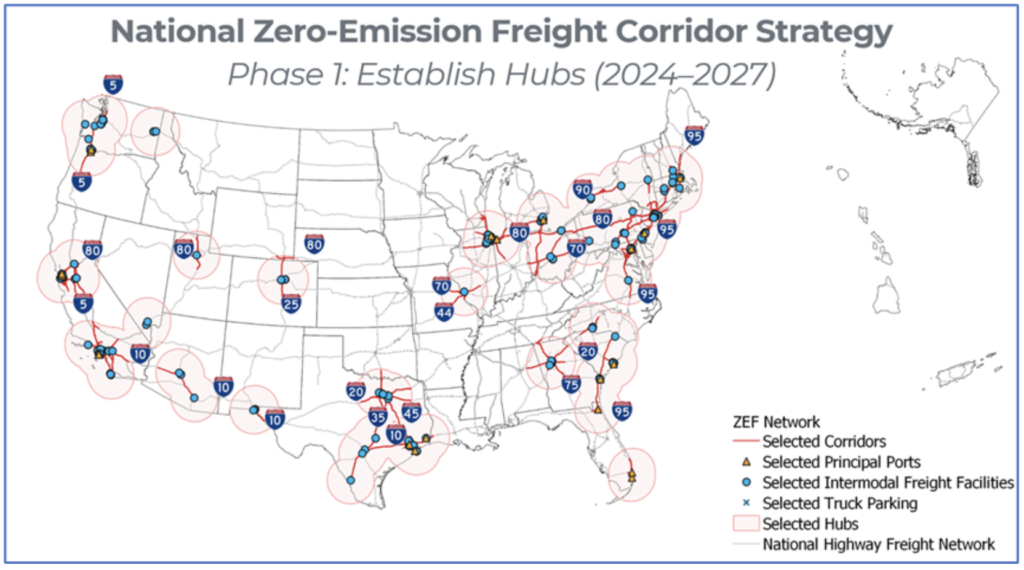

Last week, The Biden-Harris Administration released the National Zero-Emission Freight Corridor Strategy to “guide the deployment of zero-emission medium- and heavy-duty vehicle (ZE-MHDV) charging and hydrogen fueling infrastructure from 2024 to 2040.” Here’s an excerpt from the press release:

Providing ubiquitous and convenient access to electric vehicle (EV) charging and hydrogen refueling along our nation’s freight corridors and at intermodal freight facilities and high-usage ports is key to achieving U.S. goals to promote at least 30 percent ZE-MHDV sales by 2030 and 100 percent sales by 2040. The goal of the Strategy is to align public policy and investments by prioritizing, sequencing, and accelerating infrastructure along the National Highway Freight Network (NHFN) in four phases. A core objective of the Strategy is to meet freight truck and technology markets where they are today, determine where they are likely to develop next, and set an ambitious pathway that mobilizes actions to achieve decarbonization.

The lack of charging infrastructure is certainly one of the limiting factors to broader adoption of electric heavy-duty trucks, especially for long haul operations. Putting a strategy together to address this limiting factor is certainly an important step. At a minimum, it provides all stakeholders a framework for discussion and action.

But as I highlighted last April in “Electric Freight Trucks: Not Happening Anytime Soon For Long-Haul Moves,” there are several other hurdles to overcome. Andrew Boyle, ATA first vice chair and co-president of Massachusetts-based Boyle Transportation, highlighted the following hurdles in his testimony last April before a Senate Environment and Public Works Subcommittee on the future of clean vehicles:

- A clean diesel truck can spend 15 minutes fueling anywhere in the country and then travel about 1,200 miles before fueling again. In contrast, today’s long-haul battery electric trucks have a range of about 150-330 miles and can take up to 10 hours to charge.

- A new, clean-diesel long-haul tractor typically costs in the range of $180,000 to $200,000. A comparable battery-electric tractor costs upwards of $480,000. That $300,000 upcharge is cost-prohibitive for the overwhelming majority of motor carriers.

- Battery-electric trucks, which run on two approx. 8,000-lb. lithium iron batteries, are far heavier than their clean-diesel counterparts. Since trucks are subject to strict federal weight limits, mandating battery-electric will decrease the payload of each truck, putting more trucks on the road and increasing both traffic congestion and tailpipe emissions.

There’s another big constraint: our electrical grid. As I wrote back in April, even if the range, weight, and cost challenges associated with electric freight trucks can be overcome, our electric utilities might crumble under the added demand for electricity, especially when you factor in the drive to replace gasoline consumer cars with electric ones, and the push in some states to replace natural gas appliances with electric ones.

All that said, some startups are betting on the future of electric trucks. In April 2023, Daimler Truck North America, LLC (DTNA), NextEra Energy Resources, LLC and BlackRock Alternatives announced Greenlane™, a joint venture “to design, develop, install and operate a U.S. nationwide, high-performance zero-emission public charging and hydrogen fueling network for medium- and heavy-duty battery-electric and hydrogen fuel cell vehicles.” Here are some excerpts from the press release:

Greenlane’s first site will be in Southern California, and multiple additional sites are being acquired along various freight routes…The network of charging sites will be built on critical freight routes along the east and west coasts and in Texas. Where synergistic, Greenlane™ will leverage existing infrastructure and amenities while also adding complementary greenfield sites to fulfill anticipated customer demand. Greenlane’s initial focus will be on battery-electric medium- and heavy-duty vehicles, followed by hydrogen fueling stations for fuel cell trucks, with plans to expand access to light-duty vehicles in the future to serve the greater goal of electrifying mobility.

Here’s a video by Greenlane that shows a rendering of their charging facilities:

All I kept thinking while watching the video was how those trucks in the canopies would be at the pump for up to 10 hours charging. Or maybe just 2 hours. Either way, that’s way longer than 15 minutes for diesel trucks, so how many trucks can these facilities charge per day if they each take so long to charge?

The bottom line, as I said last April, is that the “sweet spot” for using electric trucks today, beyond last-mile delivery, is for short-haul moves, particularly at ports and intermodal facilities. Replacing diesel trucks with electric ones for long-haul moves is not happening any time soon. There are just too many hurdles and constraints, which will take time and a whole lot of money to resolve. And who’s going to pay for it at the end of the day?

What are your thoughts on the future of electric trucks for long-haul moves? Post a comment and let me know.