Editor’s Note: The following is an excerpt of a research report published recently, “The Road Ahead: Key Trends and Capabilities Shaping the North American Freight Transportation Market.” The research, conducted by Adelante SCM and commissioned by Transporeon, highlights several important industry trends that shippers and carriers must factor into their transportation strategies and objectives, as well as several key capabilities companies will need to effectively manage their transportation operations moving forward. The report includes data and insights from Indago’s research community members and Transporeon’s shipper and carrier community. Please visit the report page to download the full report. Also, register for the “Smart Solutions for Freight Challenges in North America” webinar on August 15th at 11:00 am ET where Adrian Gonzalez and an esteemed panel of industry experts will discuss many of the trends and topics featured in the report.

What is the current state of the freight transportation market in North America?

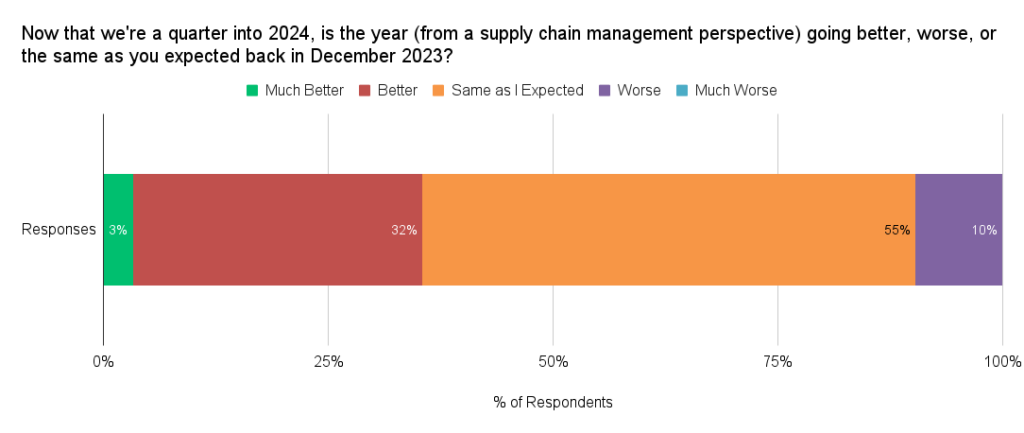

The answer depends on whom you ask. In April 2024, for example, members of Indago’s supply chain research community — who are all supply chain and logistics executives from manufacturing, retail, and distribution companies — were asked, “Is 2024 going better, worse, or the same as you expected in December 2023?” More than a third of the member respondents (35%) said that from a supply chain management perspective 2024 is going “Better” (32%) or “Much Better” (3%) than they had expected, and only 10% said that the year is going “Worse.”

Source: April 2024 Indago survey of 31 qualified and validated supply chain and logistics executives from leading manufacturing, retail, and distribution companies.

As the Senior Director of Global Logistics at a leading Industrial Manufacturer commented, “The supply chain in 2024 is behaving as expected for the most part, as inflation and consumer demand for products remains flat in a market with ample supply chain capacity.”

Indago members, however, are all shippers. If carriers had been asked the same question, the responses would have been just the opposite.

While some analysts believe that we’ll see an improvement in this “freight recession” in the second half of 2024, the truth is that predicting what will happen in the transportation market in the weeks and months ahead is a fool’s errand. As the management consultant Peter Drucker put it, “Trying to predict the future is like trying to drive down a country road at night with no lights while looking out the back window.” This is particularly true in the transportation market because of all the variables and uncertainties involved (e.g., economic conditions, consumer sentiment, geopolitical factors, weather, fuel prices, regulations, etc.).

Therefore, the better question to ask is, “Do we have what we need to respond quickly, intelligently, and effectively to whatever happens down the road?”

We address that question in “The Road Ahead” report, highlighting several key capabilities companies will need to effectively manage their transportation operations moving forward. We also highlight several important industry trends that shippers and carriers must factor into their strategies and objectives. But first, here’s a snapshot of current market conditions.

Market Snapshot: Too Much Supply, Too Little Demand

Like all markets, the transportation market is governed by the law of supply and demand.

On the supply side, the main issue is that there is still too much capacity. From June 2020 through March of 2022, driven in part by the Covid pandemic, there was a big surge in the number of new carriers entering the market. According to FTR Transportation Intelligence, from January 2014 through May 2020, monthly new carrier registrations ranged between 2,212 and 4,273. In July 2020, however, new registrations climbed to 5,396, and it kept increasing until reaching a peak of 10,904 new carrier registrations in March 2022.

Although fewer carriers are entering the market today — and a greater number of carriers are also exiting the market — new carrier registrations are still above the pre-2020 monthly average. There are various reasons why new carrier registrations remain relatively strong, as FTR highlights in an August 2023 Food Shippers of America blog post:

Technology certainly is a major factor. Digital freight management platforms have allowed intermediaries to manage capacity from the numerous very small carriers more effectively.

Another contributor is California’s AB 5 law, which outlaws use of the leased owner-operator model and, thus, encourages such operations to establish firms under their own authority. The percentage of new carriers that are based in California jumped sharply a year ago after the U.S. Supreme Court cleared the state to enforce AB 5 on motor carriers.

The rise of power-only options [which reduce equipment and maintenance costs for carriers] probably has bolstered new entries as well.

The demand side of the equation is a bit more complex — that is, there are many factors that influence it. In a May 2024 LinkedIn post, Professor Jason Miller from Michigan State University highlights 11 different sources of trucking demand. “I bring up this list because I tend to find folks in this industry are excessively focused on freight oriented towards personal consumption (e.g., shipments to retailers’ warehouses), while not paying as much attention to these other sources,” says Miller

What will the remainder of 2024 be like in the truckload market? Well, as stated earlier, predicting the future with any certainty is a fool’s errand, but here’s how Professor Miller summarized the outlook in an April 2024 LinkedIn post:

“For the dry van truckload market to turn from bear to bull, we either need a much larger loss of capacity (unlikely to happen quickly) or for demand to improve substantially, which will require a sharp rebound in domestic manufacturing activity (also unlikely to happen quickly). As such, I would pencil in ‘blah’ conditions for the immediate future.”

“Blah” is as good a word as any to characterize the truckload market today and for the rest of 2024.

For additional insights on the trends shaping the North American freight transportation market and the rest of the research results, please download the research report. And register today for the “Smart Solutions for Freight Challenges in North America” webinar to join the conversation on August 15th at 11:00 am ET!