Editor’s Note: The following is an excerpt of a research report published recently, “The State of Digitization in Freight Forwarding 2025.” The research, conducted by Adelante SCM and commissioned by Magaya, highlights digitization trends and priorities in the freight forwarding industry. The report includes data and insights from a survey conducted in November 2024 with 71 qualified and verified freight forwarders and logistics service providers. We also surveyed members of the Indago supply chain research community to get their perspectives on the technological capabilities of their freight forwarding and LSP partners. Please download the full report for all the research results, and register for the webcast on February 25th at 2:00 pm ET where Adrian Gonzalez, Alfred Murgado, and Gustavo Gomez will analyze and discuss the findings of the report.

“The art of progress is to preserve order amid change and to preserve change amid order.”

That quote by the English mathematician and philosopher Alfred North Whitehead encapsulates nicely the difficult balance freight forwarders and other logistics service providers (LSPs) must achieve to remain relevant and successful in today’s dynamic and unpredictable business environment.

On the one hand, they have to maintain operational excellence in executing the fundamentals of their business regardless of the change happening around them, but on the other hand, they also have to keep innovating and transforming their ways of working. If they focus too much on one and not the other, they either risk getting left behind by the competition or they risk going out of business by investing too much time, money, and resources on things that don’t deliver meaningful business benefits.

Achieving the right balance between operational excellence and continuous innovation is also at the heart of digital transformation. Unfortunately, many freight forwarders and LSPs remain laggards when it comes to digital transformation. “Characterized by low-margin business models, Freight & Logistics (F&L) companies have had very limited scope to invest in the digital initiatives advancing other industries,” states a 2023 report published by Accenture based on a survey of more than 600 C-suite executives, vice presidents and directors from leading F&L companies in 10 countries.

Research conducted by Magaya in 2023 provides a similar perspective of the industry. As highlighted in the report “The State of Digitization in Freight Forwarding 2023,” 24% of the 70 freight forwarders, 3PLs, and NVOCCs surveyed at the time “still had completely manual processes, as in no ERP or specialized freight forwarding software.”

Over the past 18-24 months, have freight forwarders and LSPs made progress moving up the digitization maturity curve? What factors are driving their digitization efforts? Which areas of their business are they prioritizing for technology-enabled improvements? What are the biggest challenges or obstacles they continue to face?

Those are the main questions we explore in this report. Before analyzing the research results, we will address a basic (yet important) question: Why is digitization important?

There are many reasons why digitization is imperative for freight forwarders and logistics service providers, too many to discuss here. But the following three factors rise to the top today and should serve as a catalyst for digitization in 2025 and beyond: Shifting Trade Policies and Regulations; Growing Labor Constraints; and Technology is a Competitive Differentiator.

Technology Is a Competitive Differentiator for LSPs

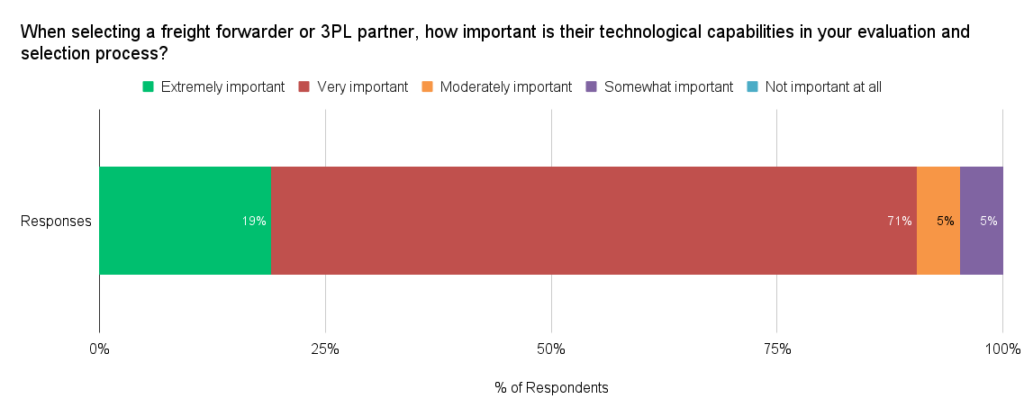

90% of the Indago members surveyed in November 2024 said that technological capabilities are either “Extremely important” (19%) or “Very important” (71%) when evaluating and selecting 3PLs/freight forwarders.

Source: November 2024 Indago survey of 24 qualified and verified supply chain and logistics executives from manufacturing, retail, and distribution companies.

“As the pace of business continues to increase, so does the need for direct, near real time digital connections into our 3PLs,” said one supply chain executive. “It is no longer acceptable to live in a ‘black box’ environment where 3PLs only feed limited information to my organization. We need transparency to collaborate and improve processes together. If we do not have this, the benefits of utilizing 3PLs diminishes and I have a much stronger case to bring warehousing [back in house] where I can fully control improvements.”

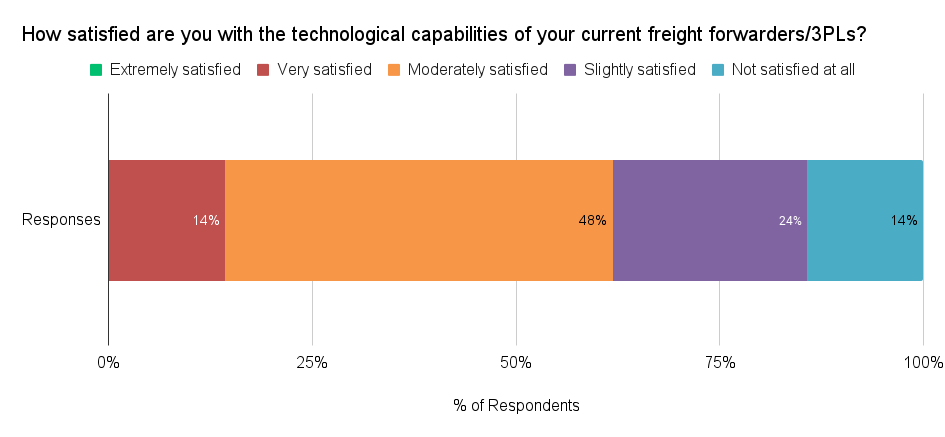

Unfortunately, more than a third of the respondents (38%) said they are only “Slightly satisfied” (24%) or “Not satisfied at all” (14%) with the technological capabilities of their 3PLs or freight forwarders; none are “Extremely satisfied” and only 14% are “Very satisfied.”

Source: November 2024 Indago survey of 24 qualified and verified supply chain and logistics executives from manufacturing, retail, and distribution companies.

As one executive put it, “We have some logistics partners who have best-in-class technology, while others lag behind with limited visibility and delays in messaging. We’re actively working to rid ourselves of the latter.”

The implication is clear: Freight Forwarders and Logistics Service Providers that fail to meet the technology expectations of their customers risk losing business, while those that meet or exceed customer expectations are better positioned to gain market share.

For additional insights from the research, please download the full report and register for the webcast on February 25th at 2:00 pm ET.