“Past performance is no guarantee of future results.”

For the past few years I’ve been using that phrase, which you typically find in investment literature, when making the case for innovation in supply chain management. Simply put, just because your existing people, processes, and technologies enabled you to succeed in the past does not mean that they will deliver success moving forward, especially in a fast-changing business environment.

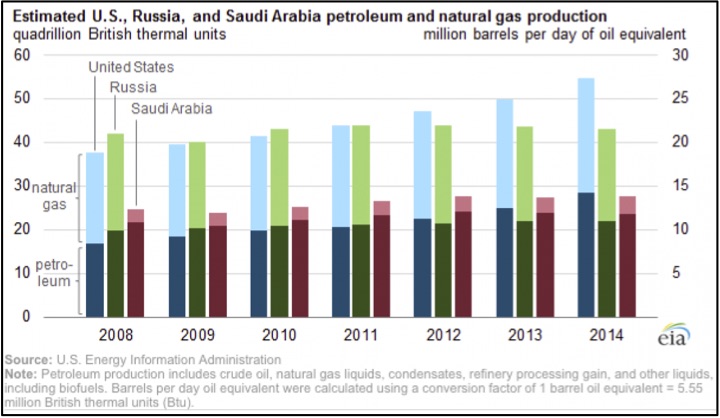

A perfect example of where this phrase applies is the Oil and Gas industry, especially here in the United States where we’ve seen significant change and volatility over the past 5+ years. As the table below shows, back in 2008, the U.S. trailed both Saudi Arabia and Russia in oil production, and it trailed Russia in natural gas production. But by 2014, the U.S. significantly surpassed both countries to become the world’s largest oil and gas producer, due in large part to shale production.

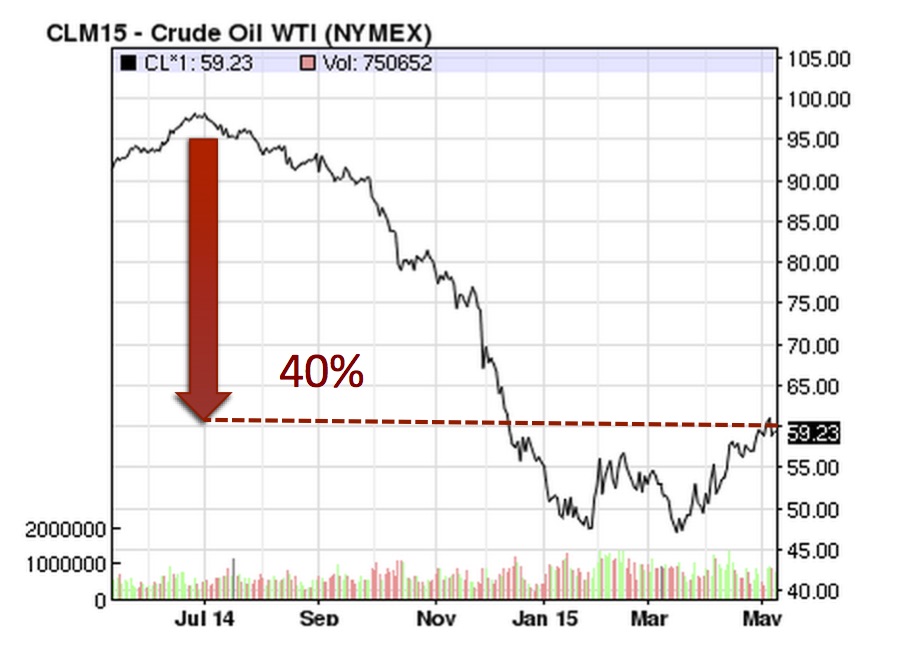

Over the same time period, we’ve seen crude oil prices bounce up and down between $140 and $40 per barrel. And in the past year, prices have dropped almost 40 percent, from near $100 per barrel last July to about $60 today. This downturn has resulted in 120,000 layoffs by energy employers around the world, including 6,800 layoffs in the U.S. since January 2015.

This rapid growth followed by market decline has led oil and gas companies to finally face reality — i.e., that they need to move up the supply chain maturity curve to enable profitable growth moving forward. A DHL whitepaper titled Building the Smarter Energy Supply Chain summarizes the situation well (emphasis mine):

Much of the present exploration and development of shale gas deposits in the US is not being made by the the traditional oil majors, but rather by new players in the market. These new participants frequently have less experience executing the development of efficient supply chains.

Logistics complexities in the conventional sector can quickly drive up costs and eat into profit margins, if not well managed. Energy companies, therefore, are placing growing emphasis on finding and eliminating waste in their supply chains.

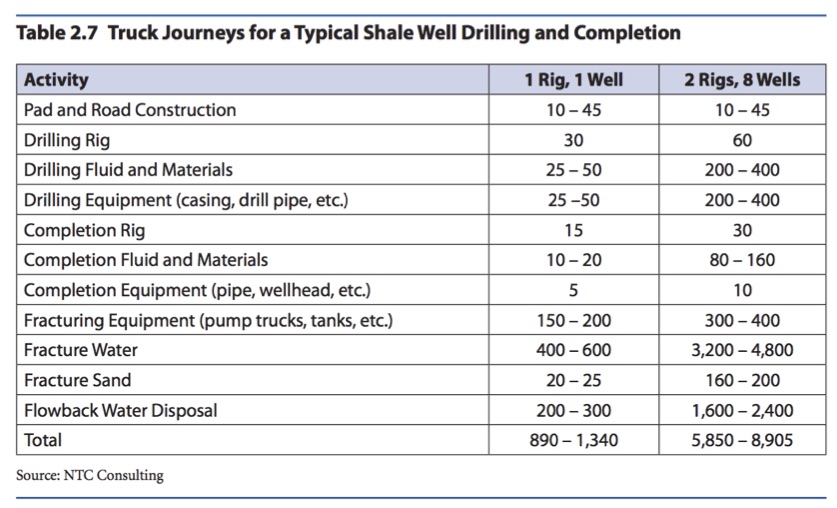

One area where significant waste exists is transportation management. Simply put, many oil and gas companies manage their transportation operations in a highly decentralized and fragmented manner with little or no technology. When you consider that a typical shale well drilling and completion operation (2 rigs, 8 wells) involves between 5,850 and 8,905 truck journeys, coupled with the limited availability of trucking capacity, it’s not surprising that many oil and gas companies suffer from poor visibility and control of their transportation spend and activities; inefficient use of labor and resources; and higher costs, poor service, and increased risks.

In response, oil and gas companies are starting to take action to improve their transportation management capabilities, with many of them looking at implementing a transportation management system (TMS) for the first time.

In a recent webcast titled Critical Transportation Challenges in the Oil, Gas, and Petrochemical Supply Chain, Florian Dussler (VP of Americas at TRANSPOREON Group) and I discuss this topic in more detail, including the core TMS capabilities companies should look for in a solution to begin their journey up the maturity curve:

- Procurement

- Execution (Tendering, Dock Scheduling, Track & Trace, Freight Audit & Pay)

- Business Intelligence and Analytics

- Network Connectivity

I encourage to watch the webcast for all the details.

The bottom line is that many oil and gas companies find themselves today where food and beverage, consumer goods, and other companies found themselves years ago: as laggards in adopting transportation management technology and best practices. If there’s a positive to the current market downturn in the oil and gas industry is that it’s serving as a catalyst for change and innovation in transportation management.