I didn’t do it.

I came back from vacation on Monday to find almost 1,000 emails in my inbox. I selected them all and held my finger just above the Delete key — “How liberating, how euphoric it would be,” I told myself, “a split second, that’s all it would take”…but I just couldn’t do it.

Instead, I clicked the Delete key about 985 times over the course of the week, because most of the emails were either junk, outdated, or not worth keeping. I spent hours and days to accomplish what I could have done in a split second, if only I had listened to the artist in my brain instead of the engineer.

One of the emails I did keep and read with interest was the first item in this week’s supply chain and logistics news…

- Infor to Acquire GT Nexus

- GEODIS acquires OHL (Ozburn-Hessey Logistics) and enhances its Freight Forwarding and Contract Logistics offering in the US

- JDA Creates a More Profitable Omni-Channel Supply Chain

- New Target COO’s headache: Too few goods to keep shelves filled (Reuters)

- Google Express Plans to Shut Down Its Two Delivery Hubs (Re/Code)

- U.S. Postal Service Tries Hand as Fishmonger, Grocer (WSJ – sub. req’d)

- Oakland port terminals plan PierPass-style program (JOC)

- ATA Truck Tonnage Index Jumped 2.8% in July

Now that I have had a few days to digest the Infor-GT Nexus news, here are some of my thoughts:

First, this deal signals, I believe, the acceleration of traditional enterprise software vendors and customers embracing the fact that for business processes involving many external trading partners, network-based solutions (what I call Supply Chain Operating Networks) are the best platform. As Joe Dixon, SVP of Supply Chain at Brooks Brothers, commented at the GT Nexus Bridges 2015 conference a few weeks ago: “SAP is our internal ERP system, GT Nexus is our external [supply chain] ERP system.”

In the ERP space, SAP made the first move toward network-based solutions when it acquired Ariba more than three years ago, and it made another move just last month when it announced a partnership with Descartes for TMS connectivity (see my post, Software is Not Enough: SAP and Descartes Partner on TMS Connectivity). Now that Infor has acquired one of the leading Supply Chain Operating Networks on the market, I expect other traditional software vendors to explore strategic partnerships or acquisitions in this area.

Although the $675 million price tag for GT Nexus limited the number of potential acquirers, I was surprised at first when I saw that Infor was the buyer, partly because they are not on my radar very often. But after thinking about it, and considering all of the other possible acquirers, I believe Infor is a good fit for GT Nexus, due in large part to its leadership team, and its CEO, Charles Phillips, in particular.

Back in April 2000, Charles Phillips and Mary Meeker, both at Morgan Stanley Dean Witter at the time, wrote The B2B Internet Report: Collaborative Commerce, an influential paper at the time. Although the paper focused primarily on B2B e-commerce and the emergence of online marketplaces and exchanges (many of which failed during the dotcom bust), it also discussed the eventual emergence of “Communities of Commerce” and “Collaborative Commerce”:

Phase 3 [of B2B commerce] is unfolding and represents the rise of vortexes — third-party Web destinations that bring together trading partners into a common community…Communities have a value unto themselves. The intersection of buyers and sellers with related interests creates an opportunity to serve a larger percentage of those interests.

Collaborative commerce builds on Phase 3 by adding support for other business processes before, during, and after the order. The broad range of interactions that make the chain of commerce work can also be moved online.

Simply put, of all the ERP CEOs today, Charles Phillips understands the value and potential of online B2B networks the most. He and Mary Meeker wrote the paper on it more than 15 years ago, and although getting to “communities of commerce” took a different path than they had envisioned, we are there nonetheless in the form of Supply Chain Operating Networks.

From a software application standpoint, there is also good synergy between Infor and GT Nexus. For example, although Infor has acquired various transportation management system applications over the years (CAPS Logistics, Arzoon, ShipLogix), GT Nexus offers a more modern, network-based solution for clients, and as I discussed earlier this week in my takeaways from the GT Nexus Bridges 2015 conference, GT Nexus is making significant investments in expanding and enhancing its TMS capabilities and footprint.

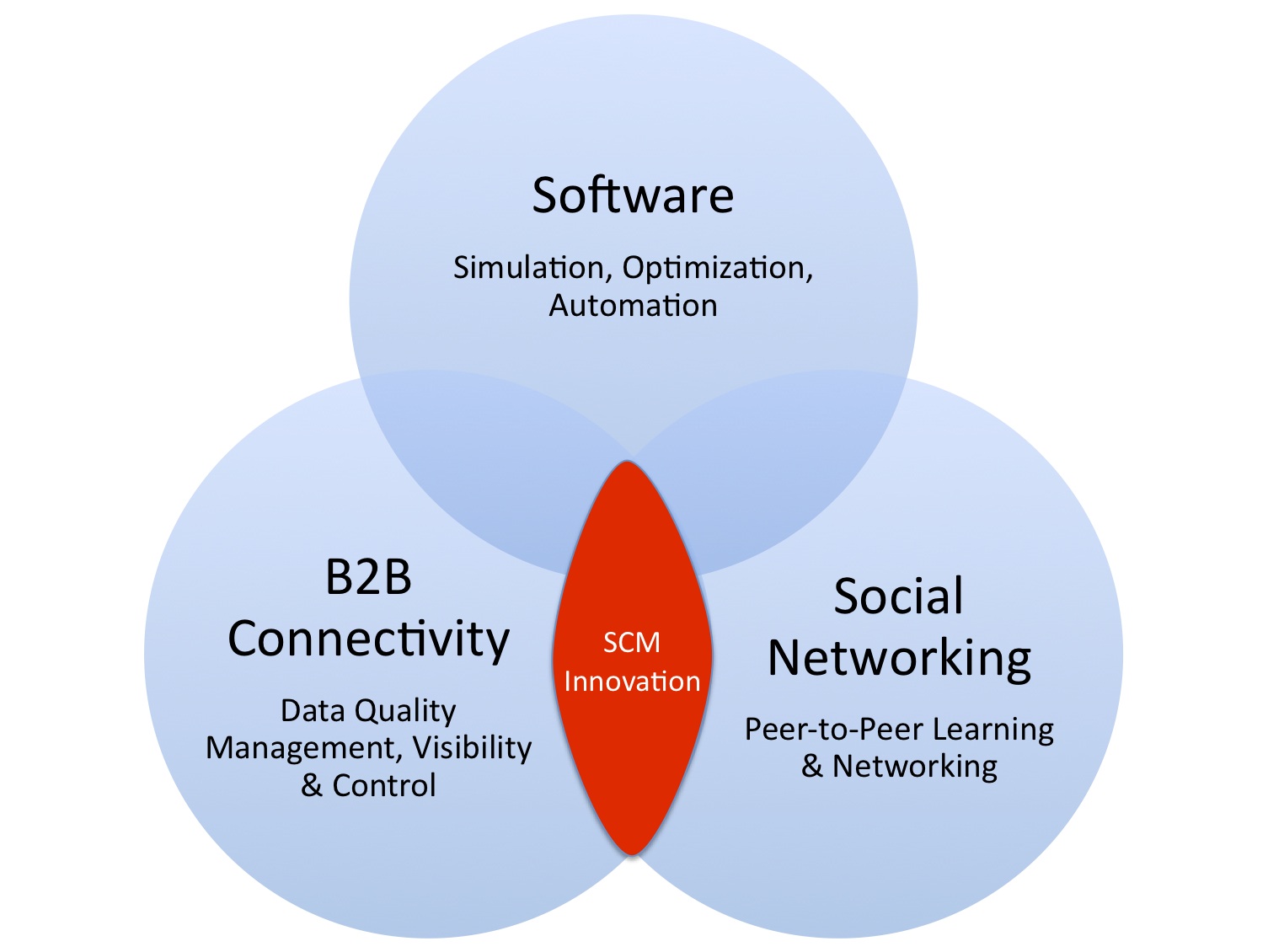

Another great opportunity is for GT Nexus to leverage Infor’s Ming.le technology to enhance its user interface and introduce social networking capabilities, which I view as the next frontier for Supply Chain Operating Networks (see Where to Find Supply Chain Innovation).

The biggest risk, in my opinion, is for Infor to try to make GT Nexus into something that it is not. Just like a square is a rectangle but a rectangle is not a square, a network-based solution is a cloud solution but a cloud solution is not necessarily a network-based one, especially if cloud is equated with “hosted.” The press release states that “the addition of Infor CloudSuite technology to the GT Nexus network will enable businesses to go further by integrating merchandising, marketing, and demand data instead of extrapolated forecasts for improved sales, operations, and production planning.” How Infor ultimately defines and executes the integration of its CloudSuite technology and the GT Nexus network is where I see the biggest risk.

On the plus side, keeping GT Nexus as an independent business unit is a good move. Ideally, moving forward, the Infor and GT Nexus teams will be equal partners in defining their future direction and strategy, versus having the Infor team alone calling the shots.

The other big news this week is yet another large acquisition in the 3PL market: GEODIS is acquiring OHL for a reported $800 million. According to the press release:

Founded in 1951, OHL is one of the leading 3PL companies in the world, operating more than 120 value-added distribution centers in North America with over 36 million square feet of flexible warehouse space, and providing integrated global supply chain management solutions including transportation, warehousing, customs brokerage, freight forwarding, and import and export consulting services.

Employing over 8,000 transportation and fulfillment professionals, OHL has unparalleled experience in direct-to-consumer fulfillment, serving a wide range of business sectors from specialty retail to manufacturing. OHL specializes in the sectors of apparel, electronics, healthcare, food and beverage, and consumer packaged goods. OHL’s annual revenue is reported at €1.2 billion.

Yes, the convergence continues in the 3PL industry. Stay tuned for an article I wrote for CSCMP’s Supply Chain Quarterly on this trend, which will be published in the coming days.

And with that, have a happy weekend!

Song of the Week: “Heaven Sent” by INXS

Note: Descartes and GT Nexus are Talking Logistics sponsors.