At a conference earlier this month, I was speaking with a supply chain executive at a large retailer who mentioned his company was bringing part of its outsourced logistics operations back in-house. When I asked him why, he responded, “We want more control.”

Last week, DC Velocity published an article stating that Amazon “is moving quickly to revamp its delivery network to gain more control [emphasis mine] over its fulfillment infrastructure” and is building a private fleet to serve its Top 40 markets.

A couple of years ago, GlaxoSmithKline (GSK) brought some outsourced manufacturing and other supply chain functions back in-house “in part to gain control.” And it’s the same reason why Eaton and CNH brought their logistics operations back in-house a few years ago: To gain more control.

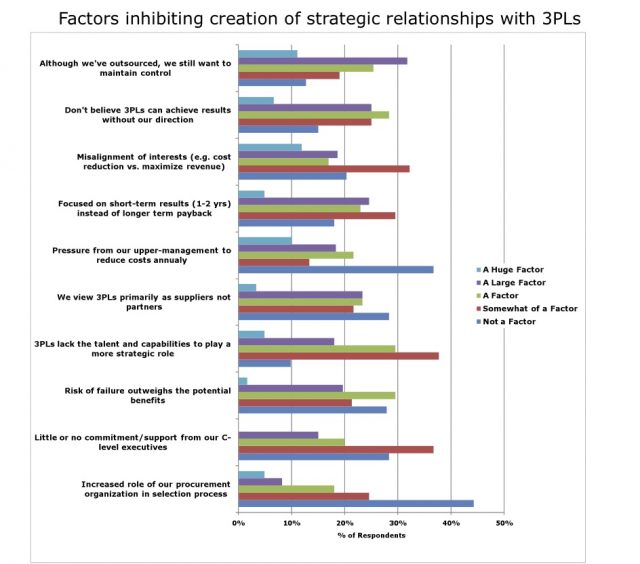

3PL customers have always been wary of giving up control. In a survey I conducted a few years ago, I asked 3PL customers what factors inhibited the creation of strategic partnerships with their logistics service providers. As the chart below shows, the top response was, “Although we’ve outsourced, we still want to maintain control.”

Back in 2008, as cases like CNH started to emerge, I wrote a blog post questioning whether logistics outsourcing was still a one-way street. It’s clear to me now that the old adage “Once you outsource, you never bring it back” is no longer true, especially in transportation.

What’s changed?

Software solutions like transportation management systems (TMS) and warehouse management systems (WMS) are much more affordable, flexible, and easier to deploy today than they were in the past. For example, a company can deploy a software-as-a-service TMS in just a few weeks, with minimal upfront investment and IT support. In the past, part of a 3PL’s value proposition was eliminating the need for customers to spend millions of dollars on IT. This value proposition is not as strong anymore.

Companies are also placing greater value on working directly with carriers instead of through a third party. In short, companies want to take control of their own destiny when it comes to securing capacity and negotiating strategic carrier relationships that ultimately impact rates and coverage.

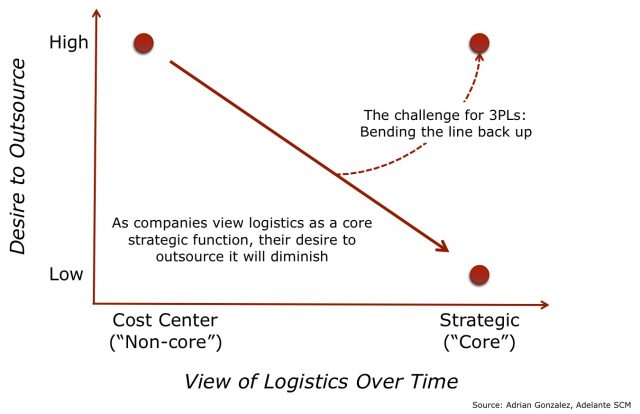

But I believe another factor is at play. For many years, companies viewed logistics as a cost center, a “non-core” business function that made more sense for a third party to manage. Logistics professionals, as well as analysts and consultants, always hated this “cost center’ characterization, and they tried (with limited success) to change upper management’s perspective. Well, it seems like the CEO finally got the memo. Companies are starting to realize that logistics is indeed a strategic function and a competitive differentiator. Nowhere is this trend more evident than in omni-channel fulfillment, where retailers are providing customers with a wide range of delivery options — including ship-from-store and same-day delivery — to win the sale, whether it happens online or at a store.

My hypothesis is that as manufacturers and retailers start to view logistics as a core strategic function, their desire to take more control will increase, and so their desire to outsource will diminish.

What does this mean for 3PLs? It means that your biggest competitor moving forward might not be other 3PLs, but your own customers.

It means that you have to convince your customers and prospects that outsourcing does not necessarily mean loss of control.

It means that outsourcing relationships are becoming more dynamic. The services 3PLs provide to customers today will be different than what they will provide to customers in five years. Customers might bring some functions back in house because they now view them as core competencies, but they will likely outsource other functions that they’re currently managing in-house today. This implies 3PLs must innovate their business models, and the nature of how 3PLs and customers manage their relationships must also change.

I plan to explore this topic further in future posts. But what do you think? Do you agree with my hypothesis? Post a comment and let me know.