I’ve been using the word convergence to describe many of the trends occurring in the supply chain and logistics field today, and convergence was certainly evident at Roadnet’s perform 2014 User Conference a few weeks ago.

First, there’s the convergence of companies. Roadnet was acquired by Omnitracs in late 2013, and the combined entity, which also includes FleetRisk Advisors and Sylectus, is aiming to provide its joint customers (and the market in general) with a more integrated, end-to-end fleet management solution.

Roadnet has a 30+ year history in the fleet management space, with 1,300 clients in 61 countries, and its solutions route 250,000 vehicles every day. Meanwhile, Omitracs has been a leading telematics solution provider for more than 25 years, serving over 2,500 private and for-hire fleet customers and more than 270,000 vehicles throughout North America and Latin America.

The integration process is still in the early stages, and as Omnitracs CEO John Graham highlighted in his keynote presentation, some of the early work is focused on “developing the core values for the combined team,” which includes being “focused on growing our business profitably” and “We work as a team, we collaborate, we are professional, as we work to support our clients.”

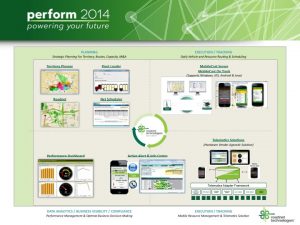

Second, there’s the convergence of technologies, namely routing and scheduling, telematics, mobile, and business intelligence and analytics. I spoke about this convergence during my keynote presentation (see some of my slides below), and also during a recent Talking Logistics episode. The slide below from Roadnet illustrates this convergence from the company’s perspective, with its various solutions highlighted.

While all of these technologies play an important role in fleet management operations, it’s clear from the investments Roadnet is making, and the comments I heard from customers (I moderated a panel discussion with executives from JJ Foods, Stricycle, and Bob’s Discount Furniture), that mobile and BI/analytics are top priorities.

There were a couple of mobile solutions that were referenced several times during the conference:

Roadnet Active Alert, “an addition to Roadnet’s MobileCast® platform, that leverages actual vs. projected arrival time to proactively notify customers via email, text alert or phone call of a delivery or arrival of a mobile worker.”

Mobilecast On Track, “a low cost, durable, phone-based solution designed specifically to help track your mobile resources and provide metrics for management.”

The latter solution underscores an important trend: the rise of mobile resource management (MRM), where the focus is not just on using mobile technologies to track the location and performance of vehicles, but also on tracking the location and performance of mobile resources such as salespeople, merchandisers, field technicians, and home-care nurses. The bottom line: MRM greatly expands the market opportunity for solution providers like Roadnet, and it enables customers to leverage these solutions (not just mobile, but routing and scheduling too) beyond fleet management.

With regard to routing and scheduling, Roadnet has introduced several enhancements, such as the ability to plan routes with actual layover locations. But with home delivery gaining momentum, the solution that interested me the most was Roadnet NetScheduler, which integrates continuous optimization capabilities with the point of sale process. As I’ve written before, continuous optimization is a “must have” capability that enables companies to maximize the profitability of their home delivery operations, and enhance the end-customer experience too.

FreshDirect, an online grocer serving the New York City metropolitan area, is a great example. The company offers next-day delivery of groceries. Customers place orders via the web store and select from a list of 2-hour delivery time windows; they can place new orders, or modify existing ones, until a cut-off time. Prior to implementing NetScheduler, FreshDirect took at “static capacity” approach — i.e., it assigned each time window a fixed number of deliveries based on the average time per delivery. In other words, every order was treated the same regardless of location, size, or difficulty.

The problem, as Roderic Mathey from FreshDirect described it, is that “if the route runs late in the first windows, it may never recover,” and “if stops are closer together or less time-consuming than average, the routes are under-utilized.”

By implementing NetScheduler, FreshDirect was able to take a “dynamic capacity” approach, where:

- Service time is determined by order and/or location characteristics

- Drive time is determined dynamically by service location relative to other scheduled deliveries

- Routes are continuously optimized to maximize productivity while maintaining service levels (on-time performance)

The net result? FreshDirect improved average on-time performance from 96 percent to 98.5 percent, and productivity improved about 7-8 percent, with more delivery slots available to customers, lower delivery cost per order, and it also enabled the company expand its service to suburban areas (which have lower delivery density) without increased costs.

There were other highlights from the conference, but I’ll wrap up with two areas where I believe Roadnet has room to improve. First, the company needs to expand its software-as-service offerings, and take a more aggressive approach to the market with it. Simply put, until recently, Roadnet has chosen to follow in this area rather than lead. A network-based routing and scheduling solution, with a critical mass of customers using it, would open the door to innovative services, such as network-based analytics and benchmarking. Second, the company’s pallet and load building optimization solution, which has historically been a key solution for beverage companies, lacks some broader capabilities relative to other applications in the market. Expanding the breadth and depth of this solution will be important too.

——–

Excerpt of presentation delivered at Roadnet Perform 2014