There is a constant focus on contract rates and spot rates in truckload transportation. But there is another cost factor that, like a little brother or sister, sometimes gets overlooked: fuel surcharges.

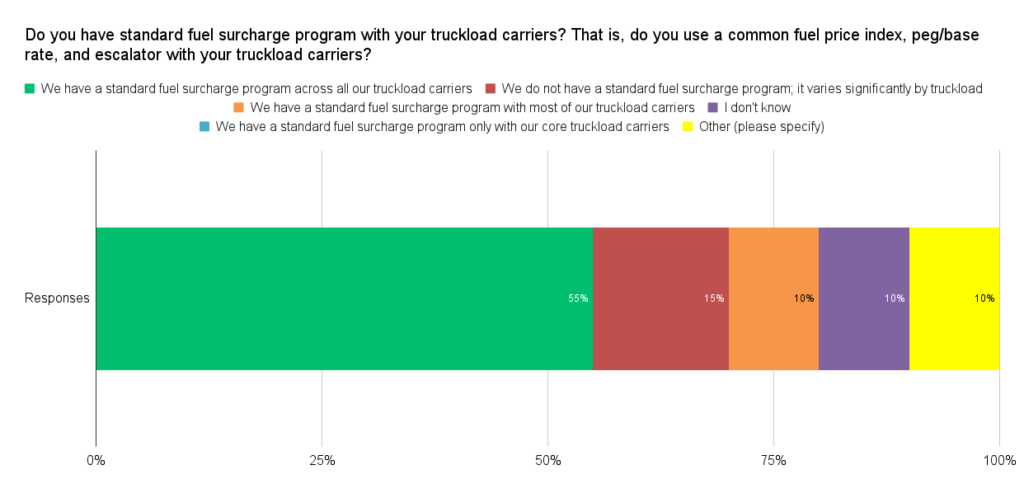

In the United States, according to the DOE, on-highway diesel fuel prices were $5.134 per gallon on 3/21/22, up $1.940 from a year ago. This sharp increase in fuel costs ultimately gets passed on to shippers via fuel surcharges. Do you have a standard fuel surcharge program with your truckload carriers — i.e., use a common fuel price index, peg/base rate, and escalator?

We asked members of our Indago supply chain research community that question in a recent survey. The response rate for this survey, which was sent to U.S. members only, was relatively low because (as several respondents indicated) this topic was outside their realm of knowledge or expertise. That said, almost two-thirds of the respondents (65%) have a fuel surcharge program with all (55%) or most (10%) of their truckload carriers.

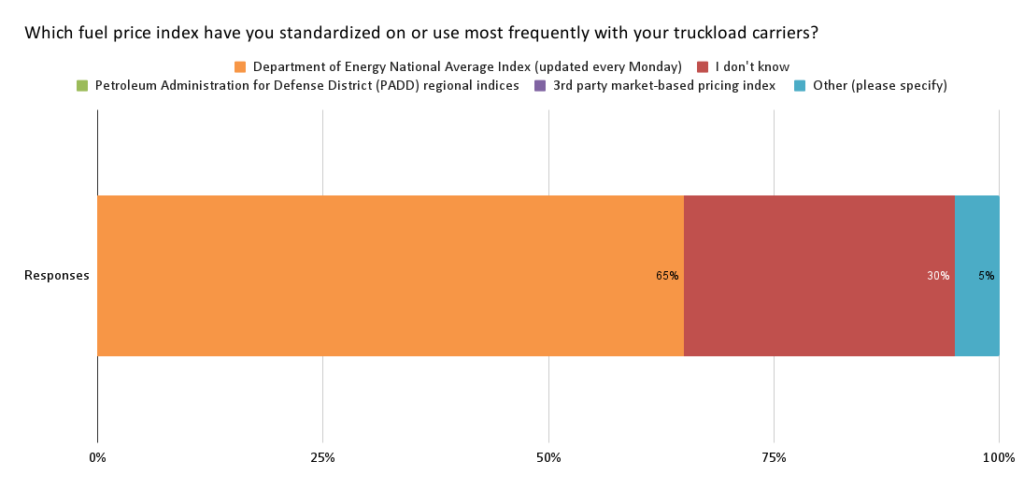

65% of the respondents said they are using the DOE National Average Index as their fuel index; the “Other” index mentioned was Breakthrough.

“Our current approach does not involve much management,” said one Indago supply chain executive. “Up until this point, fuel surcharges were seen as a cost of doing business, but we may start thinking more strategically about it to ensure we are hedging against increasing rates and costs.”

Here are some other value-added comments from Indago members, who are all supply chain and logistics professionals from manufacturing, retail, and distribution companies:

“We ‘set it and forget it’ — we should see what others are doing.”

“Current tools to adjust to changing freight charges are manual and do not react quickly enough to protect margins. We are looking to make the tool more dynamic and reactive.”

“Our 3PL manages this with the underlying carriers and does a poor job of giving us visibility.”

“Fuel surcharges [FSC] are 100% profit makers for carriers. For truckload carriers, despite the matrix I ask them to use, it’s a bottom-line price they look for and if we don’t ‘give in’ we don’t get equipment…FSC were meant to compensate carriers for their added costs of fuel. Years ago, and well into today, it’s a profit center for them.”

“High diesel rates (and, therefore, higher surcharges) are an added incentive to evaluate alternative fuel and power options in order to reduce exposure to the high cost of diesel while also meeting sustainability objectives.”

We also asked our Indago members, “What escalator — that is, the amount fuel price must increase by over the base to trigger higher payouts — have you standardized on or use most frequently with your truckload carriers?” We also asked them, “What changes, if any, do you plan to make in the future in how you structure/manage your truckload fuel surcharge program?” The results are available to Indago members.

Overall, the survey results suggest that for many companies there is probably a lot of room for improvement in how they manage fuel surcharges with their truckload carriers. What do you think? How do you manage this cost factor? Post a comment and share your experience and advice.

Join Indago

If you’re a supply chain or logistics practitioner from a manufacturing, retail, or distribution company, I encourage you to learn more about Indago and join our research community. It is confidential, there is no cost to join and the time commitment is minimal (2-5 minutes per week) — plus your participation will help support charitable causes like JDRF, American Logistics Aid Network, American Cancer Society, Feeding America, and Make-A-Wish.

You can also follow us on LinkedIn to stay informed of our latest research results and news.