Editor’s Note: The following is an excerpt of a research report published last week, “Transportation Pulse Report 2025 – The Year to Begin Doing.” The research, conducted by Adelante SCM and commissioned by Transporeon, highlights shipper and carrier expectations for 2025, their strategic priorities, and why companies must start taking action now to respond effectively to the challenges and opportunities ahead. The report includes data and insights from interviews conducted with industry executives at Transporeon Summit 2024 (including Michelin, Shell Chemicals Europe, ArcelorMittal, Beiersdorf, Burgo Group, Aurubis, Wuppermann, LKW Walter, Rohlig Suus, and C.H. Robinson) and from more than 100 respondents to a web survey conducted with Indago research community members and Transporeon’s shipper and carrier community. Please visit the report page for more information about the research and to download the full report.

If you had to describe in one word what you expect the transportation market will be in 2025, what would it be?

We asked 105 supply chain and logistics executives that question, including members of Indago’s supply chain research community and Transporeon’s shipper and carrier customers, in a September 2024 survey. We also asked several shipper and carrier executives in video interviews conducted at Transporeon Summit.

Challenging was the word submitted the most times, along with other related words such as volatile, unstable, and dynamic. But other executives submitted more optimistic words, such as growing, expanding, and possibilities. Not surprising, AI was mentioned several times, as well as digitization and innovation.

Here is how some of the executives interviewed at Transporeon Summit answered the question:

“Transformation because we have a lot of changes in front of us in many aspects of the industry, including sustainability, AI, and all the changes associated [with those things] which we shouldn’t underestimate.” — Sanaz Shirzadi, Global Category Manager, Indirect Logistics Services, at Beiersdorf.

“Volatility because our behavior as a shipper will be focused on fulfilling customer expectations and they are becoming a bit more difficult to predict and they tend to change more rapidly today than in the past. So, we need to be adaptive to be better positioned for success in a volatile environment.” — Giancarlo Di Benedetto, Global Category Manager Logistics at Aurubis.

“Opportunities because there are so many things going on in our industry and it’s really crucial that we stay really close to our shippers and carriers to understand what they need [so that we can support them effectively].” — Tom Fisher, Senior Manager, Carrier Ecosystem at C.H. Robinson.

Overall, the dominant themes emerging from the survey responses indicate that executives anticipate 2025 to be a year marked by technological innovation, growth opportunities and adaptation to change, but they also expect volatility and market challenges.

This mix of optimism and caution reflects the complexity of navigating the evolving transportation market.

Carriers Feeling Optimistic About 2025 (Shippers Less So)

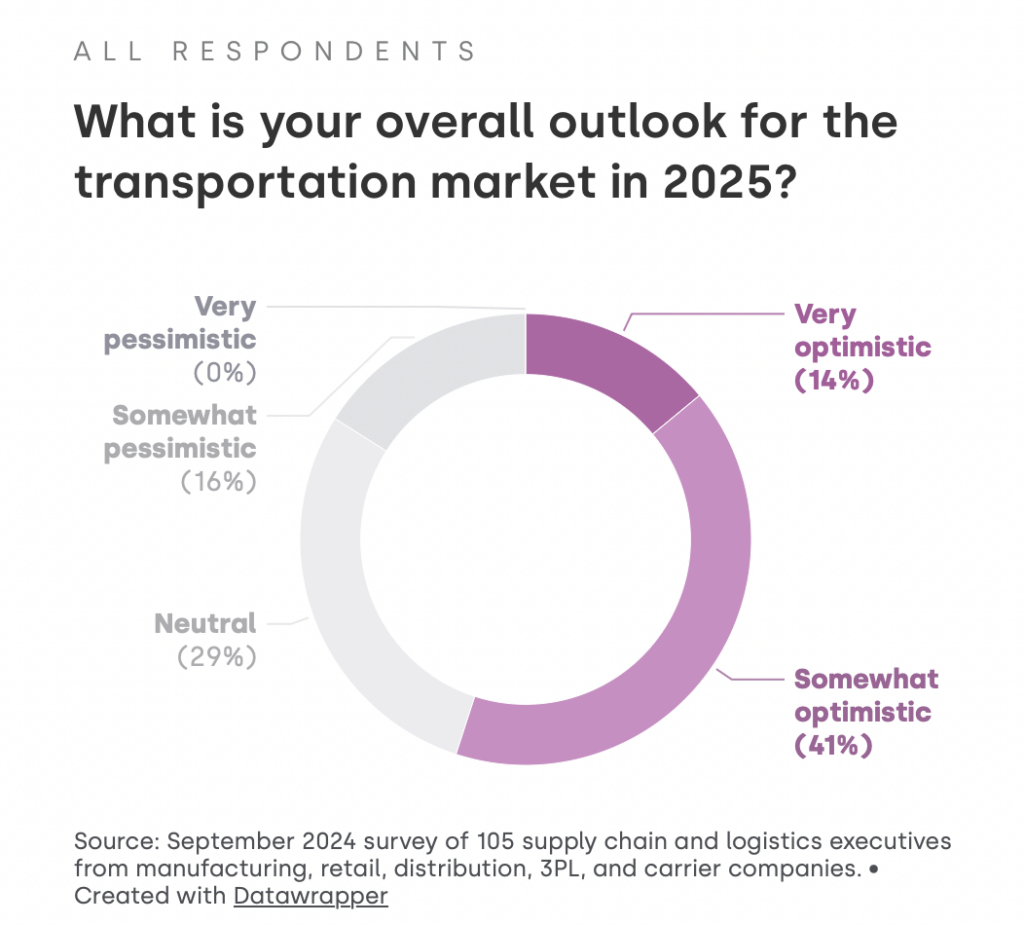

Overall, more than half the survey respondents (55%) said they were either “Very optimistic” (14%) or “Somewhat optimistic” (44%) about the transportation market in 2025, with only 16% saying they were “Somewhat optimistic.”

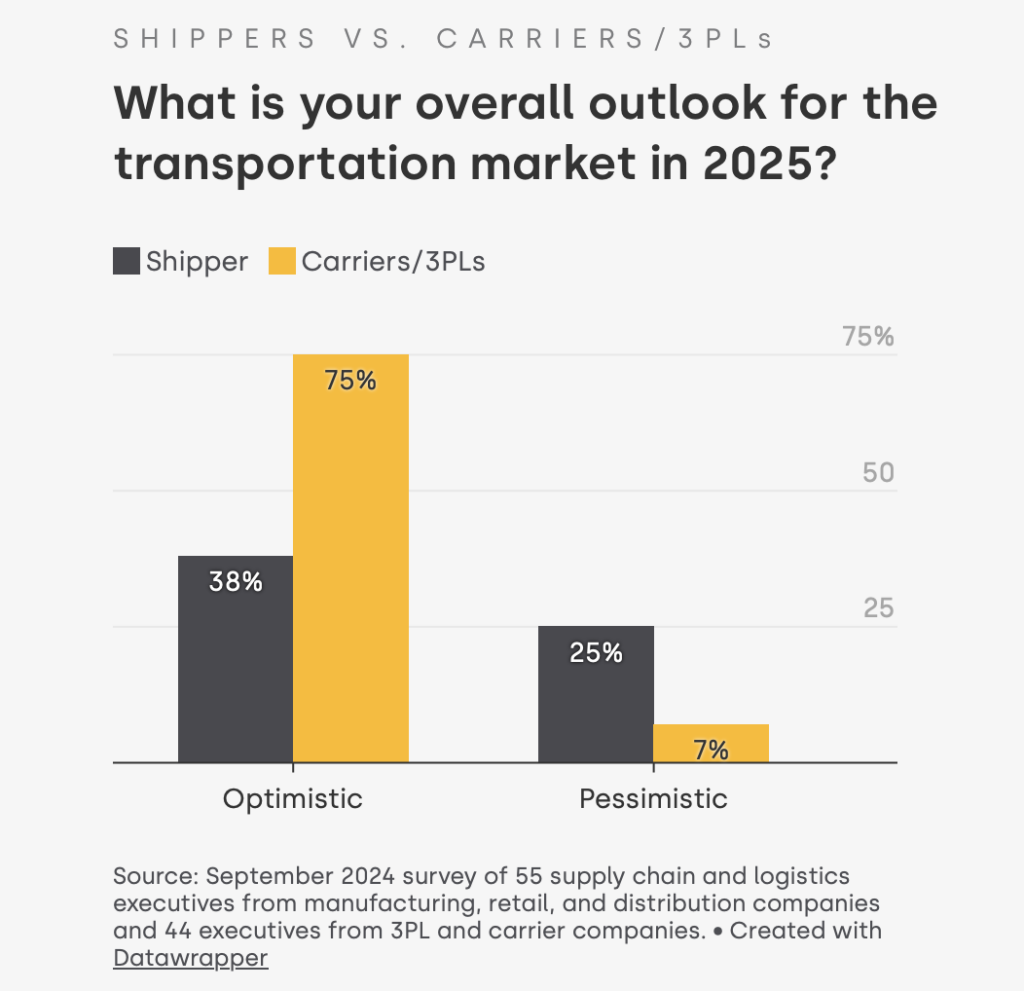

Shippers and carriers/3PLs, however, have different outlooks for the year ahead. A much higher percentage of carriers and third-party logistics providers (75%) have an optimistic view of the transportation market in 2025 compared to shippers (38%).

The likely explanation for the difference is that carriers, in general, have been dealing with lower demand, depressed rates, excess capacity, and higher operating costs for almost two years. “It can only get better from here!” is the prevailing thinking among many carriers and logistics service providers.

“We see that operating costs for carriers are rising and they won’t come down anytime soon,” said Tom Fisher, Senior Manager, Carrier Ecosystem at C.H. Robinson when interviewed at Transporeon Summit. “This [correlates] with Transporeon Market Insights data which shows that operating costs are sometimes higher than contracted rates, and sometimes spot rates are below contracted rates. So, how do you operate a sustainable business model, especially when you consider that most of the carriers in the European market are small and mid-sized companies that don’t always have the means to get contracted business but still have to operate their business [profitably]?”

Shippers, on the other hand, have benefited from having access to plenty of capacity and lower rates over this time. “The good times are bound to end sometime!” is what many shippers are thinking at the moment.

For additional insights from shipper and carrier executives and the rest of the research results, please download the research report.