Is there any place in the U.S. that isn’t freezing cold or burning at the moment?

The house my niece and her fiance were renting in California burned down in the fires. Her car was burned to a crisp too. So, after 9 years in La La Land, they are moving to Massachusetts, back to where she was born. To start again.

It was 7 degrees yesterday morning when I went outside to get the newspaper from the driveway. Yes, I still get the paper delivered. I’m an old-school reader, I like to turn pages. How long will it take me to feel cold? I stood in the driveway in my pajamas, breathing in the crisp air, for one, two, three…

I want to be

in the inbetween.

—-

Okay, enough of that. Here’s the supply chain and logistics news that caught my attention this week:

- Trump Keeps China Guessing on Tariff Threats (WSJ – sub. req’d)

- Trump threatens steep tariffs against Canada and Mexico (CBS News)

- Trump slams trade relationship with European Union: ‘We have some very big complaints’ (CNBC)

- Yemen’s Houthis signal they’ll now limit their attacks in the Red Sea corridor to Israeli ships (AP)

- Congo files criminal complaints against Apple in Europe over conflict minerals (Reuters)

- Why truck volumes, rates will improve in 2025, according to analysts (FleetOwner)

- Descartes Study: 74% of Supply Chain Leaders See Technology as Key to Growth Amid Rising Global Trade Complexities

- Burq Launches Last-Mile Delivery Innovations to Transform Grocery, Retail, and Beyond in 2025

- YMX Logistics Acquires Leading Yard Management System (YMS)

- Package.ai Secures $14M Series A Funding to Modernize Retail Operations with AI

- ATA Truck Tonnage Index Contracted 1.1% in December

- Rose grower sues DSV over ‘bait and switch’ forwarding move (The Loadstar)

Trump Tariffs on Friends and Foes

It’s Week One of Trump 2.0 and tariffs dominate the news, as expected. China, Mexico, Canada, and Europe are all on the target list, friends and foes alike.

“Trump directed federal agencies to evaluate the economic relationship with China, rather than impose tariffs immediately as he had threatened,” reported Chun Han Wong in the Wall Street Journal. Wong adds that Trump also “called for more Chinese cooperation in ending the Ukraine war and stopping fentanyl flows into the U.S., and warned that he could impose a 10% tariff on imports from China starting February.”

To our friends on our northern and southern borders, “[The Trump administration] is considering 25% tariffs on Canada and Mexico as soon as Feb. 1 unless they take stronger measures to stop the flow of unauthorized migrants and illicit drugs flowing into the U.S.,” reported Megan Cerullo at CBS News. Cerullo adds that “When asked about his plans for blanket tariffs on U.S. imports, Mr. Trump said they remain a possibility, but ‘we’re not ready for that yet.’”

And to avoid feeling left out, “Trump on Thursday [January 23] continued to take aim at the European Union for what he claims is an unequal trade relationship,” reported Jenni Reid at CNBC. “Echoing previous comments, Trump said in his Davos address: ‘They make it very difficult to bring products into Europe, and yet they expect to be selling and they do sell their products in the United States. So we have, you know, hundreds of billions of dollars of deficits with the EU, and nobody’s happy with it. And we’re going to do something about it.’”

So, there you have it, there is virtually no place to hide to escape the tariffs the Trump administration threatens to impose on imports from all major U.S. trading partners.

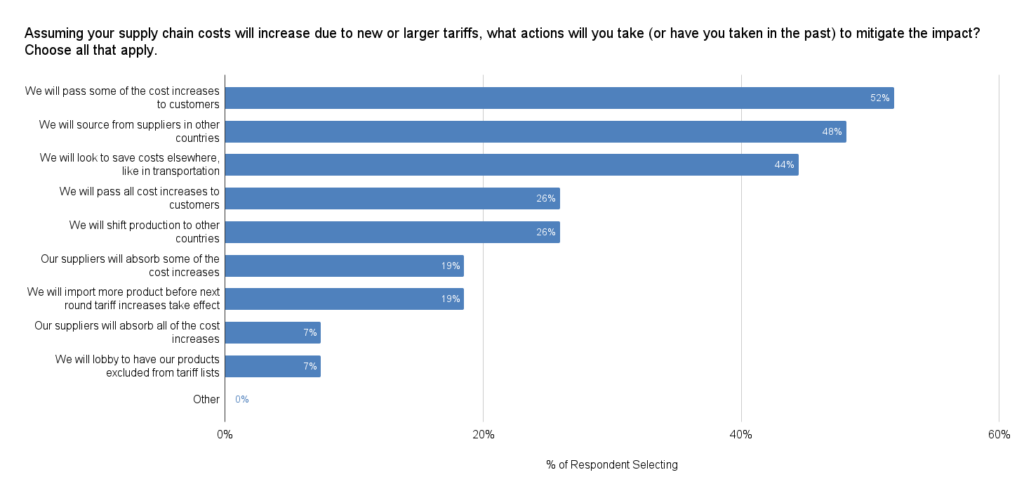

This past November, we asked members of our Indago supply chain research community — who are all supply chain and logistics executives from manufacturing, retail, and distribution companies — “Assuming your supply chain costs will increase due new or larger tariffs, what actions will you take (or have you taken in the past) to mitigate the impact?” More than half the respondents (52%) said they would pass some of the cost increases to customers.

Here is what one supply chain executive said at the time:

“An all-encompassing tariff placed on all imports would be catastrophic for our business. There are no workarounds, we would just have to absorb or pass on the costs to customers to make up for them. Given our previous history with Section 301 tariffs when they first went into effect, we would with high certainty push the impact of the tariffs on to our customers and increase our prices. Our margins are too thin to absorb the tariff without potentially putting our company out of business.”

Almost half the respondents said they would source from suppliers in other countries, the assumption at the time being that China would be the primary target for the tariffs. But with Canada, Mexico, and the EU also on the hit list, this option is less appealing/effective now.

As we’ve learned during Trump 1.0, things can change very quickly with just a single tweet from the president. So, if you’re involved in global trade, expect ongoing confusion, uncertainty, and changes in the days and weeks ahead.

“Nothing is permanent except change,” said the Greek philosopher Heraclitus, a quote that should hang in the offices of every global trade manager today.

And with that, have a meaningful weekend!

Song of the Week: “Disco” by Surf Curse