I don’t know about you, but I’m all tariffed out.

The tariffs on Mexico and Canada that were supposed to be implemented this past Tuesday have been pushed out a month. But the 10% additional tariff on imports from China did happen, and so did the elimination of the de minimis exception.

That’s where we stand today, but all of this can change within seconds of publishing this post.

So, let’s focus on something else for a change. Here’s the rest of the supply chain and logistics news that caught my attention this week:

- Tariff Turmoil Elevates Customs Brokers to Star Role in Supply Chains (WSJ – sub. req’d)

- China initiates WTO dispute complaint regarding US tariff measures

- Why Trump Is Closing a Trade Exemption for China (WSJ – sub. req’d)

- ISM Report: Manufacturing Activity Enters Expansion Territory Following 26 Months of Contraction (Industry Week)

- About 100,000 eggs worth $40K stolen from trailer in Pennsylvania (NBC News)

- Descartes Showcases Global Trade Intelligence Technology Innovations

- Response raises $4M seed funding to help companies take control of indirect spend

- Preliminary Class 8 Net Orders Step Back in January

As Manufacturing Goes, So Does the Transportation Market

For the past 6+ months there’s been a lot of discussion/debate about whether we’re still in a freight recession or coming out of it. One positive data point indicating that freight demand is positioned for growth is the uptick in manufacturing activity.

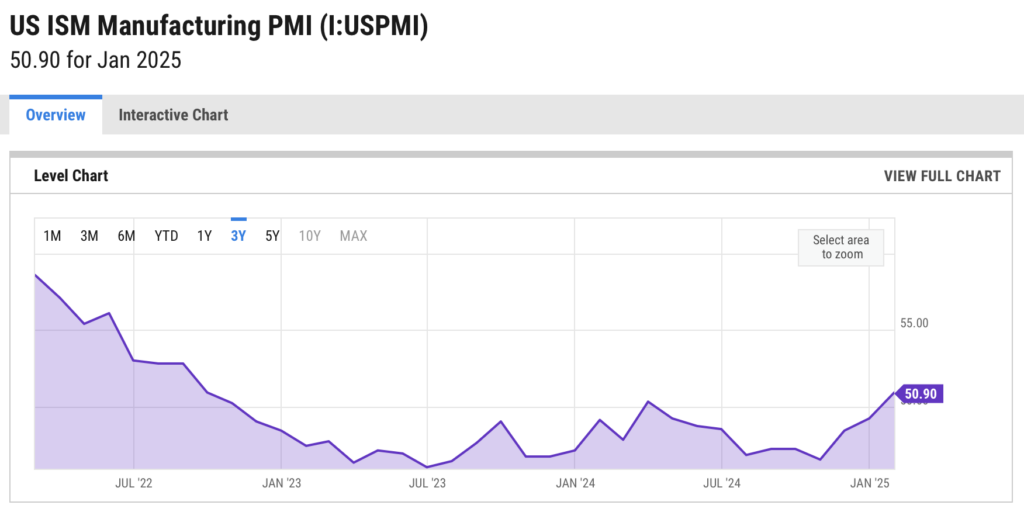

As reported by Anna Smith in Industry Week, “the January ISM (Institute for Supply Management) Manufacturing PMI registered 50.9%, indicating that the sector expanded for the first time in over two years.” Timothy Fiore, chair of the ISM’s manufacturing business survey committee, is quoted as follows in the article: “Of the five subindexes that directly factor into the Manufacturing PMI, four (new orders, production, employment and supplier deliveries) were in expansion territory, compared to three in December [2024].”

Manufacturing activity has a big impact on freight demand. Domestic manufacturing activity, however, had been in contraction mode for more than two years. A PMI over 50 indicates a growing manufacturing economy while a value under 50 indicates a shrinking manufacturing economy. As illustrated in the chart below, the U.S. ISM Manufacturing PMI had been below 50 since November 2022 (except for March 2024, when it was 50.3 but then declined again in April).

One data point is not a trend, but if the Manufacturing PMI stays above 50 for the next few months, that is a clear sign that freight demand is on the rebound too.

AI-enabled Global Trade Compliance

All this talk and activity about tariffs is putting the spotlight on global trade management, which is good news for technology providers like Descartes (a Talking Logistics sponsor) that offer solutions to help companies navigate the complexities of moving goods across borders.

Descartes announced this week that it will “showcase numerous technology innovations to its global trade intelligence software suite at Descartes’ Innovation Forum event, which takes place in Washington, DC from February 11-12, 2025. Innovations to Descartes’ solution suite help companies in diverse industries manage the cross-border trade of merchandise, commodities and services more securely and efficiently in the face of expanding compliance requirements, geopolitical volatility, and evolving tariffs and trade barriers.”

You can read the press release for all the enhancements, but here is one that caught my attention:

Artificial Intelligence (AI)-enabled screening and classification to scale compliance operations. AI-driven screening for restricted, sanctioned and denied parties quarantines low-quality false positives and identifies when additional due diligence is required. AI-driven import/export classification accelerates product lookup capabilities in combination with other features such as regulations cross-referencing and landed cost calculations. Both innovations help companies more efficiently access and manage high volume, repetitive tasks without overloading existing compliance resources or adding new staff.

I often get asked “How is AI technology impacting the logistics industry today?” which is why I wrote a post with that title back in October 2023. Here’s what I wrote at the time:

On the global trade front, trade compliance professionals will use AI to help with HS classification. The system can take the given attributes of an item and marry that with classification decisions applied in the past to assign an HS code automatically (although a trade expert, at least initially, would still review and approve the classification).

They will also use the technology to help with Denied Party Screening. The system can use natural language processing, for example, to highlight similar-sounding names, nicknames, aliases, misspellings, and so on to more quickly and accurately perform these screenings (again, with oversight from trade experts).

Yes, there is a lot of hype about AI. But there is also a lot of reality, and this is a great example of how AI can deliver tangible benefits in global trade management.

And with that, have a meaningful weekend!

Song of the Week: “Frightening Fishes” by Benjamin Gibbard & Tom Howe