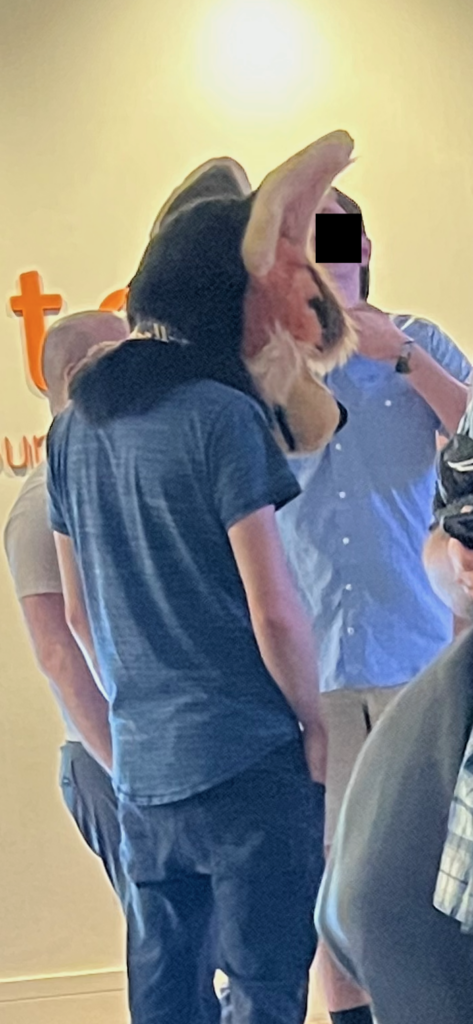

I had no idea what was going on when we arrived at the Marriott Marquis in Atlanta and saw tons of people in the lobby dressed as furry animals.

It turns out that it was the beginning of “Furry Weekend Atlanta.”

To be honest, I still have no idea what was going on, and who these people are who dress as furry animals in the middle of a workday.

I can tell you that none of them work in logistics — or at least nobody showed up to the networking session with freight forwarding executives I facilitated dressed as a furry fox or wolf. If that had happened, then I would have truly seen it all!

Moving on, here is the supply chain and logistics news that caught my attention this week:

- Trump unveils United Kingdom trade deal, first since ‘reciprocal’ tariff pause (CNBC)

- The Bubble Blasters and Other Chinese Goods That Are Paralyzed by Trade Chaos (WSJ – sub. req’d)

- US weighs plan to slash China tariffs to as low as 50% — down from 145% — as soon as next week: sources (NY Post)

- EU to launch dispute against U.S. tariffs as it sets out 95 billion euros in countermeasures (CNBC)

- Wall Street Is Watching This Shipping Data to Gauge Tariff Impact (WSJ – sub. req’d)

- Introducing Vulcan: Amazon’s first robot with a sense of touch

- Princeton TMX Launches New Rail Products to Simplify and Accelerate Rail Freight Transportation

- Blue Yonder Unveils Advanced AI-Driven Cognitive Solutions With Latest Product Release

- DHL Supply Chain strengthens its offering to small and midsize companies with acquisition of e-commerce and retail logistics specialist IDS Fulfillment

- Cargo thieves are attacking the U.S. supply chain at alarming rates (CNBC)

This Week in Tariffs

Tariff news is like a Netflix show, but instead of a new episode dropping every week, a new one drops every day, or every hour, or after every Truth Social post by the president.

What made the headlines this week?

First, the US and UK agreed on a trade deal. The devil is in the details, and there are many that still have to be hammered out, but as reported by CNBC, here are three main features of the deal so far:

- Keep in place a 10% blanket U.S. tariff on U.K. imports.

- Adjust tariffs on U.K. autos so that the first 100,000 vehicles imported from U.K. car manufacturers each year are subject to a 10% rate, and any additional vehicles face 25% rates.

- Create a ”$5 billion opportunity for new exports” for U.S. farmers, ranchers and producers, including more than $700 million in ethanol exports and $250 million in American beef and other agricultural products.

With regards to China, Lisa Fickenscher and James Franey report in the New York Post that “US officials are discussing a proposal to lower President Trump’s punishing levy on China goods to between 50% and 54% as they begin what promise to be lengthy talks [in Switzerland next week] to hammer out a trade agreement, sources close to the negotiations said. Meanwhile, trade taxes on neighboring south Asian countries would be cut to 25%, the source added.”

Meanwhile, across the pond, “The European Union’s executive arm on Thursday [May 8] said it would launch a dispute with the World Trade Organization over the U.S.′ ‘reciprocal’ tariff policy and duties on cars and car parts,” as reported by Jenni Reid at CNBC. “The European Commission further said it had launched a public consultation on countermeasures targeting U.S. imports worth 95 billion euros ($107.4 billion), to be implemented if a trade deal is not reached with Washington.”

I hesitate adding any analysis or commentary because, really, what’s the point. Whatever I write today could become moot by tomorrow.

Rail’s Turn to Get Love from TMS Vendors?

For the longest time, there were two transportation modes that were ignored (or “not well supported,” if you prefer) by transportation management systems: parcel and rail.

Of course, the rise of e-commerce forced TMS vendors to add or improve their parcel shipping capabilities, either organically or via acquisition.

Is it now rail’s turn to get some love and attention from solution providers?

I believe so, and this week’s announcement by Princeton TMX (a Talking Logistics sponsor) is a good example. The company announced the launch of two new capabilities: Rail Patterns and Rail ASN (Advanced Shipment Notifications), “that streamline rail operations for North American shippers.” Here are some excerpts from the press release:

Rail freight is inherently complex. Shippers must provide precise routing information, including origin and destination station codes, carrier paths, and special handling requirements. Missing or incorrect data leads to delays, rejections, and unnecessary dependency on internal tribal knowledge from rail experts.

Rail Patterns from Princeton TMX solves this challenge by automatically populating critical shipment details based on pre-configured logic and shipment behavior. All the shipper needs to enter is the commodity, origin, and destination; Patterns handle the rest.

In traditional rail operations, shippers often wait for the railroad to send status updates on inbound freight, usually too late to optimize production planning or labor requirements. Rail ASN flips that script.

With Rail ASN, suppliers can now send Advanced Shipment Notifications directly into Princeton TMX via EDI or API. These notifications include shipment details, quantities, routing, and expected arrival times, well before updates are received from the railroad.

Part of the reason many TMS solutions have traditionally lacked rail capabilities is that most vendors focused on industries where rail was either a small portion of their transportation spend or none at all. This left companies that depend heavily on rail — such as in the steel, lumber, building products, chemicals, forest products, and food industries — with limited TMS options, including developing their own solutions.

Fast forward to today, and companies across a broader set of industries are adding rail and intermodal into their mode mix. This is being driven by a number of factors, including sustainability initiatives and the redesign of supply chain networks.

Now we just have to wait for TMS vendors to add drone and delivery robot capabilities to their solutions.

And with that, have a meaningful weekend!

Song of the Week: “Common People” by Pulp