Editor’s Note: Our “Research in Focus” series highlights research conducted by select partners and provides our perspective on some of the most interesting findings and results.

Does paying higher rates to truckload carriers yield better on time performance?

That was one of the research questions explored by Nane Amiryan and Sharmistha Bhattacharjee, graduate students at MIT’s Center for Transportation & Logistics (MIT CTL), in a project sponsored by C.H. Robinson. The researchers used 27 months (2013–Q1 2015) of tender and shipment records for dry van truckload shipments from TMC, a division of C.H. Robinson (a Talking Logistics sponsor), to control for economic cycles. Only single stop loads between 250 miles and 3,000 miles within the continental United States were considered. The dataset included tender information from 40 shippers and 963 carriers, with more than 1.7 million shipment tenders to secure the movement of 807,662 shipments.

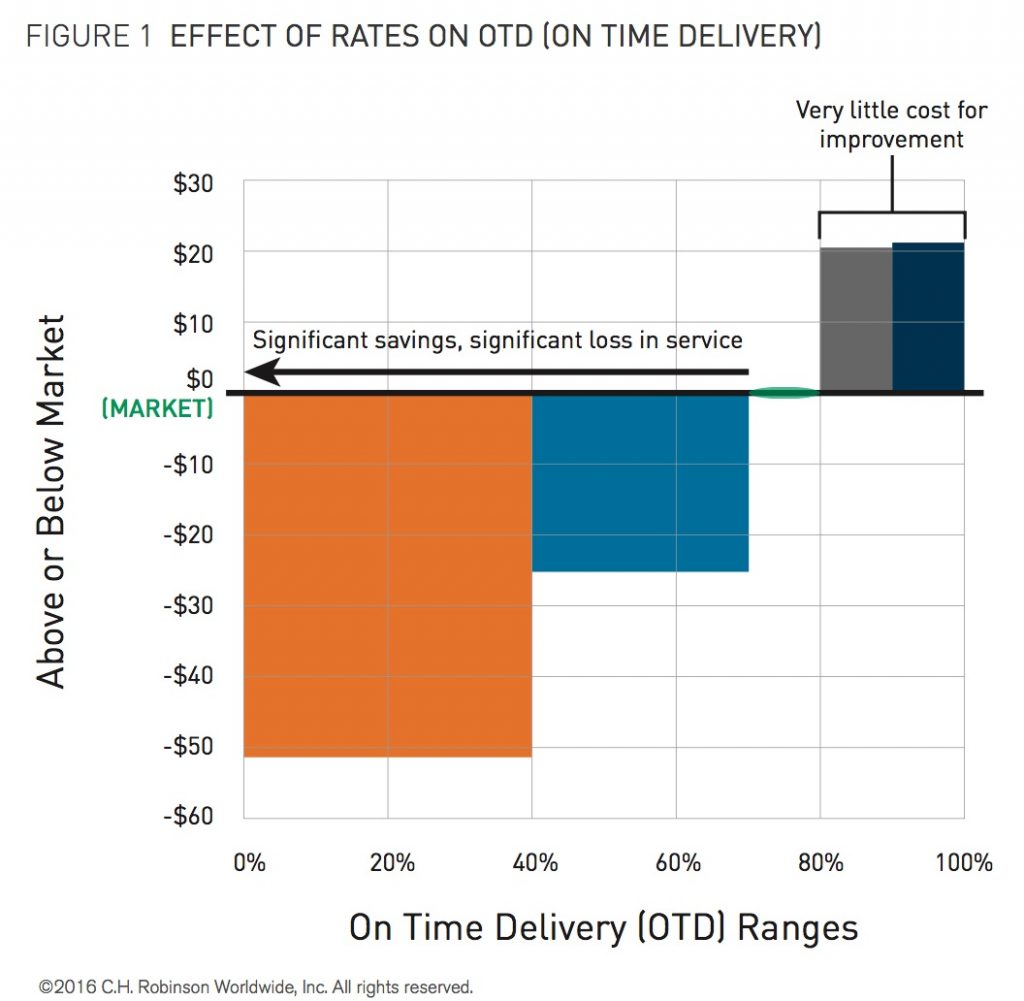

The chart below highlights their findings:

As summarized in the report titled “Do Higher Truckload Rates Bring Better Carrier Performance?”:

There was no relationship found between on time pickup (OTP) and freight rate. Rates had more impact on on time delivery (OTD) than OTP, but the correlation was weak.

However, when shippers paid below market average, there was a clear decrease in OTD performance. An average drop of $50 below the market rate resulted in OTD performance below 40 percent. A rate of $20 below the market rate led to 40 percent to 70 percent OTD.

As Figure 1 shows, carriers with OTD percentages below 70 percent charge less for their services. This shows that shippers who always choose the lowest-cost carrier are most likely to get what they pay for. Shippers who had OTD in the 70 percent and 80 percent range paid market rates.

Those with OTD between 80 percent and 90 percent paid just over a $20 premium. On average, there was almost no additional premium to reach the 90 percent to 100 percent OTD range.

For me, the results underscore the importance of benchmarking and understanding market rates — otherwise, you wouldn’t know if you’re significantly overpaying your carriers (which buys you nothing or very little relative to OTD) or significantly underpaying them (which negatively impacts OTD). Just like Goldilocks had to find the porridge that wasn’t too hot or too cold, or the bed that wasn’t too hard or too soft, shippers need to find the rates that are not too high or too low but “just right” relative to meeting their cost and service objectives. This requires taking an informed and collaborative approach to transportation procurement. For related commentary, see my post from earlier this year, Time to Squeeze Carriers for Better Rates?

Also, it’s important to note that poor on time delivery performance can result in significant cost penalties from customers, thus wiping out the money saved by using less expensive carriers. For example, consider the changes Walmart is making to its Must Arrive By Date (MABD) delivery expectations. As reported in Logistics Management:

Effective February 2017, Walmart is going to require its suppliers (shippers) to meet a two-day shipping window instead of its previous four-day window, as well as up its required compliance rate from 90 percent to 95 percent.

In a corporate blog posting, Walmart said that for non-compliant deliveries, its suppliers pay a fee of 3 percent of the cost of goods of all non-compliant deliveries, which has been in effect since 2010. The 3 percent “tax” also applies to suppliers when less than 95 percent of merchandise cases are received within the must arrive by date (MABD) delivery window.

The MIT researchers also explored another question: Does paying higher rates to truckload carriers yield better load tender acceptance? Download the report for the answer, plus other insights the researchers uncovered.