I’m running short on time, so let’s go straight to the supply chain and logistics news that caught my attention this week:

- Amazon patented a highway network that controls self-driving cars and trucks (Recode)

- Trucking Freight Brokers to Merge Under Private-Equity Deal (WSJ – sub. req’d)

- China’s Cosco in Talks to Buy Orient Overseas (WSJ – sub. req’d)

- Japan to subsidize pickup lockers to reduce parcel deliveries (Nikkei Asian Review)

- Japan firms shifting to trains to move freight amid dearth of new truckers (The Japan Times)

- JDA Introduces Store Optimizer to Deliver an Exceptional Customer Experience

- Paragon Software Systems Routing and Scheduling Software Now Available in Japanese

- CargoSphere Announces eSUDS for Ocean Carriers to Digitally Speed Confidential Rates to Customers

- New York Port Will Use Truck Appointments to Battle Congestion (WSJ – sub. req’d)

- The UPS Store Introduces On-Demand Delivery Service For Online Print Products

- November 2016 North American Freight Numbers

Another week, another Amazon patent to talk about (see my commentary on the company’s patents for “airborne fulfillment center” and “underground delivery network”). Here the abstract from Amazon’s latest patent titled “Lane Assignments for Autonomous Vehicles”:

Disclosed are various embodiments for coordination of autonomous vehicles in a roadway. A roadway management system can generate lane configurations for a roadway or a portion of the roadway. The roadway management system can determine the direction of travel for lanes in a roadway and direct autonomous automobiles to enter the roadway in a particular lane.

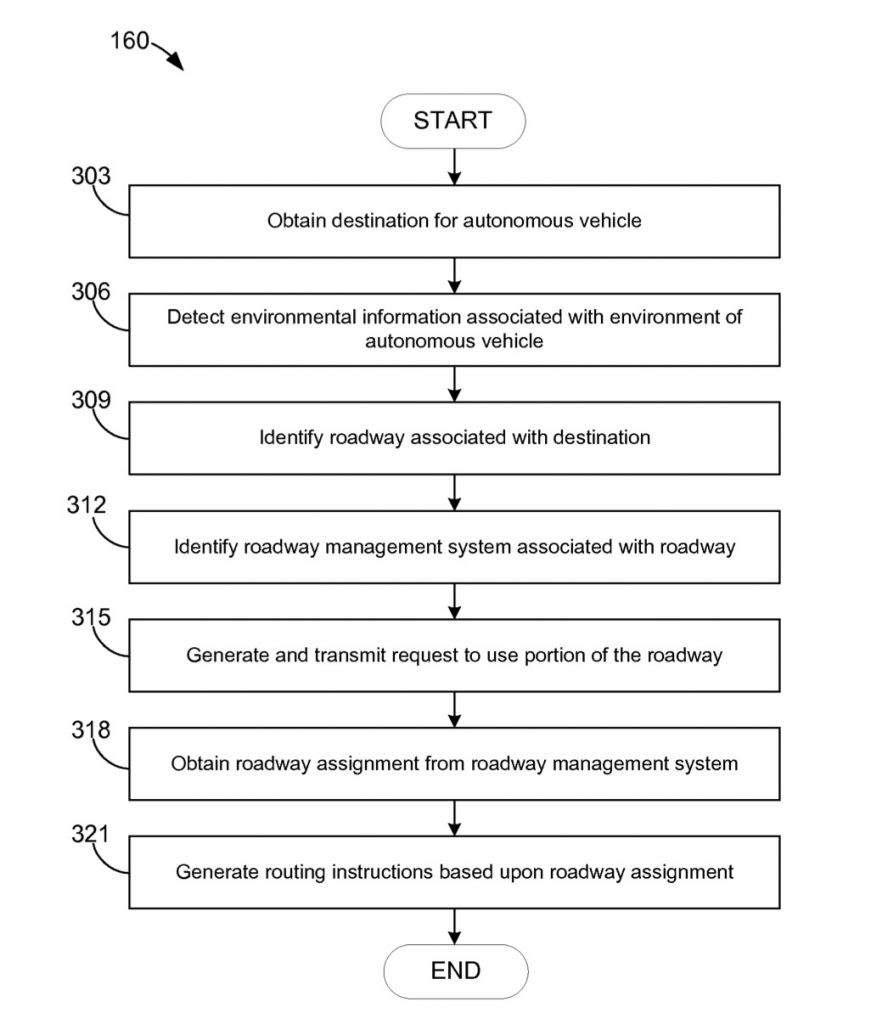

And here’s a flowchart that provides an example:

Of all the recent patents, I see this one as the most practical because it falls under the banner of intelligent transportation systems (ITS), a research field with a lot of interest and activity at the moment (for example, see the Department of Transportation’s Intelligent Transportation Systems Joint Program Office). I see the concept of a roadway management system as being similar to an air traffic control system, but more automated and intelligent, with lanes, travel directions, and vehicle lane assignments all dynamically optimized. The big hurdle, as is often the case, is not coming up with the technology (a lot of the pieces already exist), but cutting through the bureaucratic red tape and getting the funding to upgrade our highway and transportation infrastructure. On second thought, maybe we’ll see warehouses suspended by blimps before this happens.

On the logistics M&A front, the Wall Street Journal reports that “Ridgemont Equity Partners is acquiring trucking brokerage Worldwide Express and combining it with its Unishippers Global Logistics business…According to a source familiar with the matter, Ridgemont is paying between $680 million and $720 million to acquire Worldwide Express.”

The WSJ also reports that “Chinese conglomerate Cosco Group is in talks to acquire smaller rival Orient Overseas Container Line Co. [reportedly for more than $4 billion], people familiar with the matter said, as shipping companies explore new combinations to battle an industry slump.”

What’s the common thread here? A belief that “Survival of the biggest” will replace “Survival of the fittest” in some sectors of the logistics industry.

In ecommerce news, the Japanese government “will start subsidizing the installation of pickup lockers at train stations and convenience stores, with an eye toward reducing repeat delivery runs,” according to an article in Nikkei Asian Review. Here are some excerpts from the article:

About 500 million yen ($4.38 million) has been allocated under the draft fiscal 2017 budget for the scheme, which launches in April…Only [lockers] that accept deliveries from any logistics company will qualify for the subsidy. The goal is to set up about 500 new locations in the first year.

About 20% [of packages] must be delivered again [due to people not being home] — a task said to require an annual 90,000 workers, or 10% of those in the field. Logistics companies worry that the growing personnel shortage, coupled with an increase in online shopping, will make their delivery networks difficult to maintain. Parties including the ministries overseeing the economy, transportation and the environment are together supporting efforts to cut down on redeliveries.

Here in the U.S., FedEx (see Ship&Get Self-Service Locker), UPS (see The Access Point Network), USPS (see Gopost), and Amazon (see Amazon Locker) have all invested in their own delivery locker networks. I have never used one, have you? My sense is that the use of lockers will be more widespread in Europe and Asia than here in the US. Outside of urban commuters, I believe that getting people to use lockers here will require a cultural/mind shift — especially since most consumers already pay $0 for delivery.

Finally, on the technology front, JDA Software introduced JDA® Store Optimizer, which according to the press release:

Has built-in intelligence which factors in space and floor plans, labor and products to create the optimal assignment of tasks for individual associates. It enables store personnel to focus on the optimal task via immediate information and alerts on mobile devices such as their phones, tablets and watches. It leverages both existing inventory location technologies and new technologies via the Internet of Things.

Sounds like a great way to make retail associates more productive, unless they’re also getting Facebook and Snapchat notifications on their phones and watches. I wonder which notifications and alerts they’ll respond to first?

And with that, have a happy weekend!

Song of the Week: “LA Devotee” by Panic! At the Disco