Last month, I attended and spoke at the Command Alkon ELEVATE 2017 conference, where I learned many things about the Heavy Building Materials (HBM) industry.

For example, I learned that there’s a difference between cement and concrete, even though many people use the terms interchangeably. Cement is one of the raw materials that goes into making concrete, which is the finished product.

I also learned that there are a lot of similarities between the Heavy Building Materials supply chain and the Domino’s Pizza supply chain. Executives from Command Alkon (a Talking Logistics sponsor) illustrated the parallels in a keynote presentation: in both cases, customer orders are coming in all the time; you have to carefully coordinate the inbound flow of various materials/ingredients (cement, aggregate, water and other materials in the case of concrete; dough, cheese, sauce, vegetables, and meat toppings in the case of pizza); and you have to deliver the finished product quickly and in a finite amount of time (delivered and poured within 90 minutes for concrete otherwise it starts to go out of spec, and 30 minutes or less for Domino’s Pizza to ensure the pizza arrives hot and fresh).

But that’s where the similarities end.

When it comes to electronic ordering, real-time order visibility, and the use of mobile apps and technology, Domino’s Pizza is much further up the supply chain maturity curve (see video demonstrating Domino’s Tracker app). And that was the main point of the keynote presentation: to illustrate to all the stakeholders in the HBM ecosystem (producers, suppliers, contractors, and haulers) the possibilities and opportunities that exist to elevate the way they communicate, collaborate, and orchestrate (plan and execute) their processes.

The elevation journey actually began the day before the conference officially started. Command Alkon organized a Leadership Roundtable with a select group of industry executives from all segments of the HBM ecosystem to discuss “The Data We Have vs. The Information We Need.” Although the topic was centered on data — the type of data trading partners are currently sharing; its timeliness, accuracy, and completeness; and how it’s shared — the conversation was really about how to enable more efficient and effective collaboration across the HBM ecosystem.

I moderated the session, which included brief presentations by executives from each industry segment sharing their perspective of the data challenges that exist and their vision for how everyone can better collaborate and communicate in the future. This was followed by a breakout session where the attendees discussed the challenges and opportunities in small groups and then reported back their key takeaways.

So, what are some of the data challenges the industry faces?

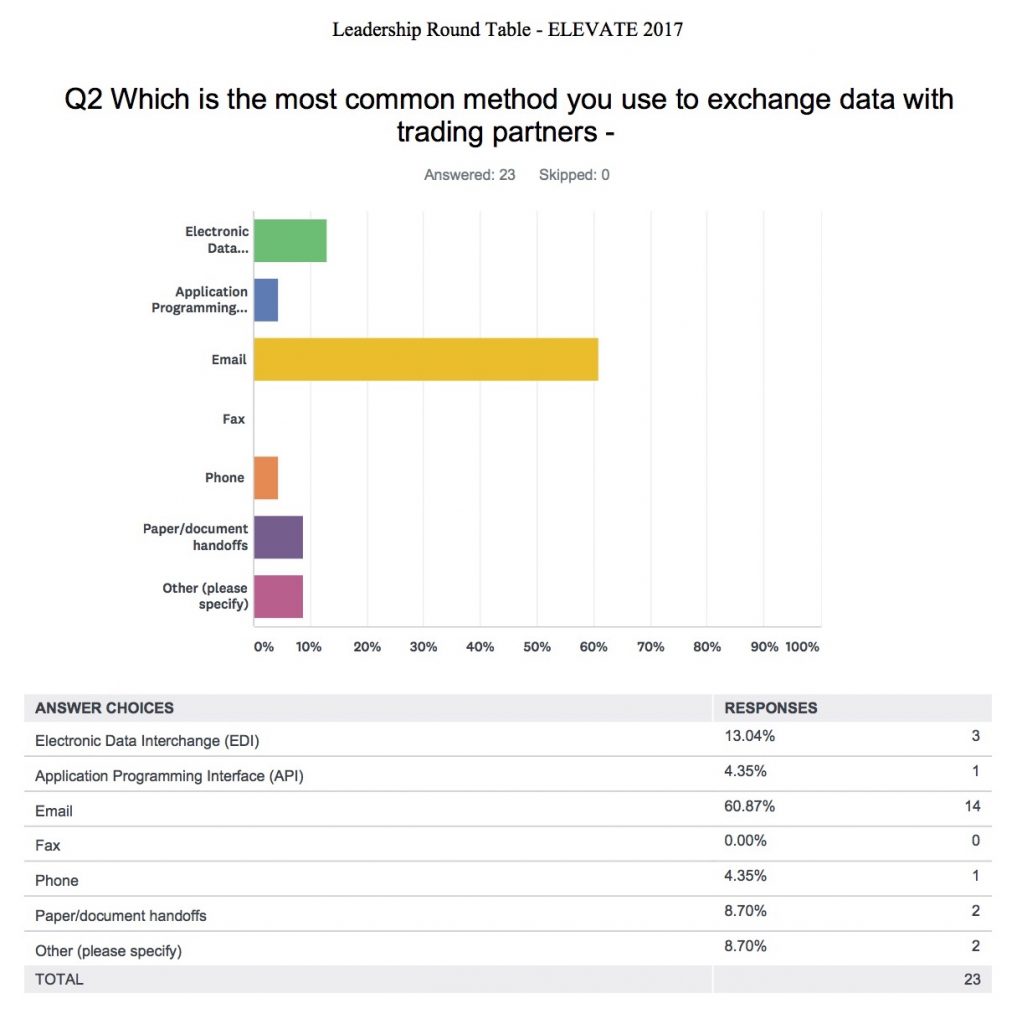

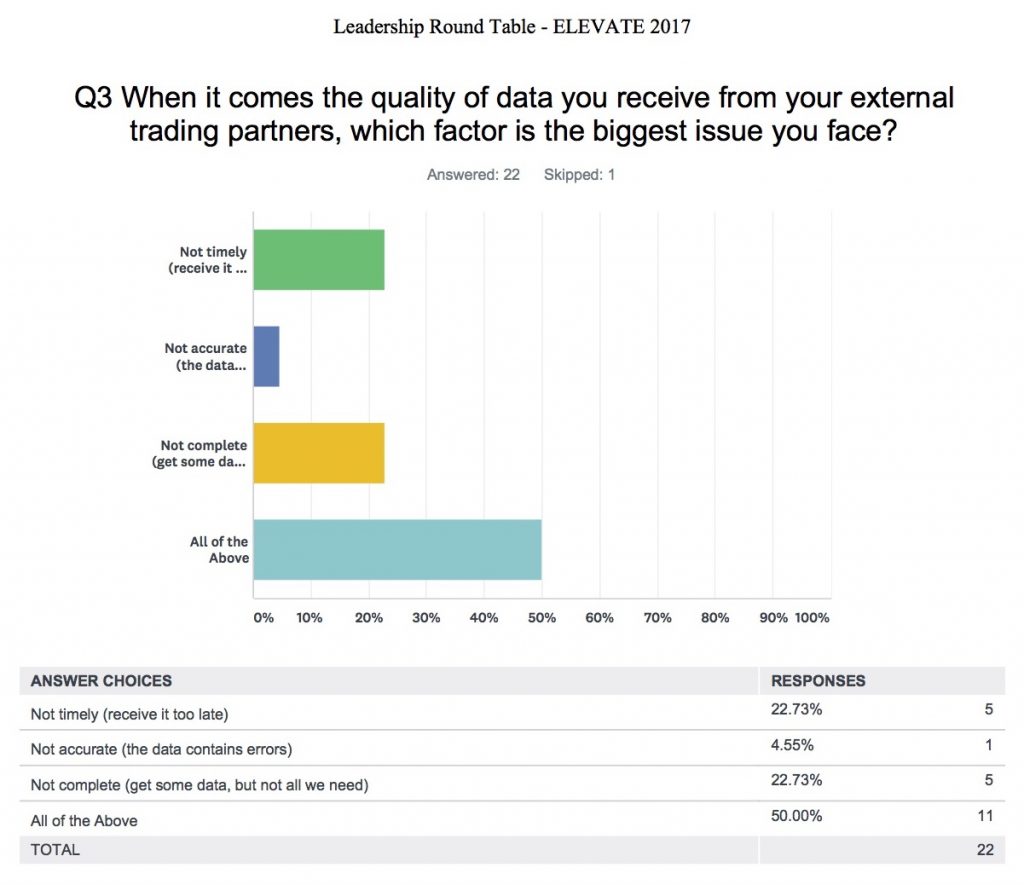

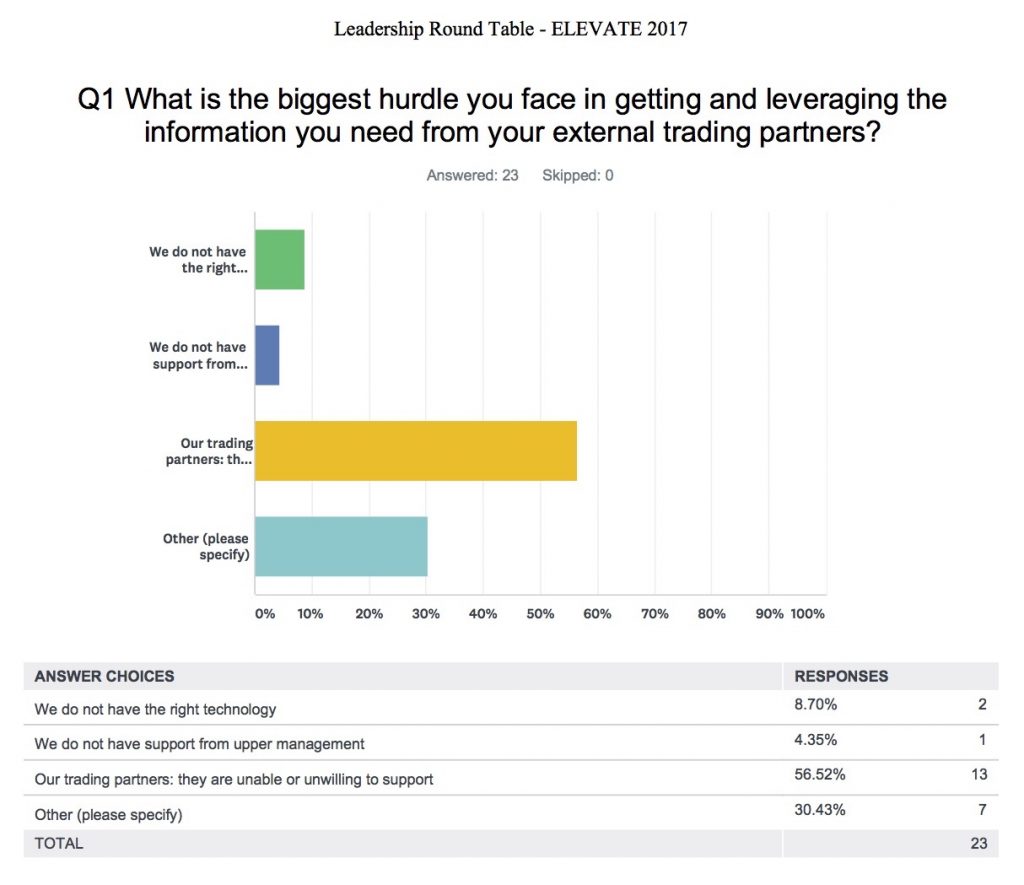

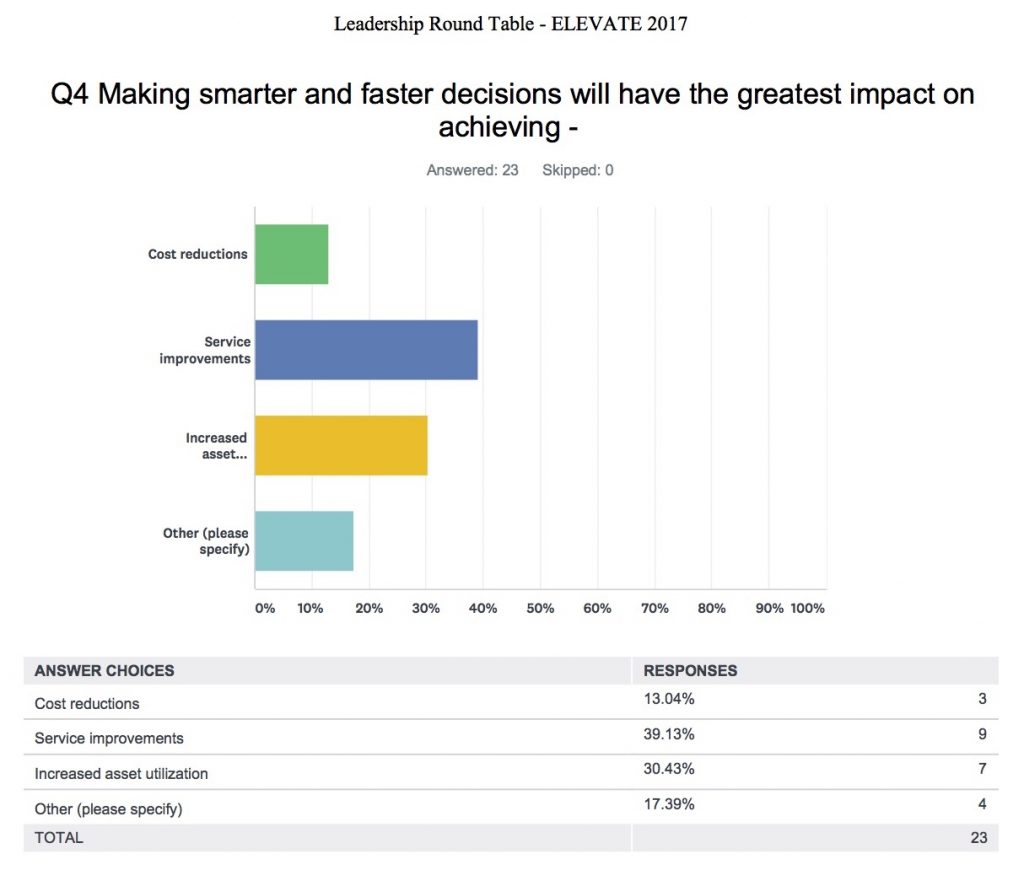

Prior to the conference, we asked the roundtable attendees a series of poll questions related to the topic and here are some of the results. While the sample size is not large, the respondents represent a good cross-section of industry participants, with several leading companies represented.

Email is the by far the most common method used to exchange data with trading partners:

In terms of data quality, there’s significant room for improvement across all dimensions: timeliness, accuracy, and completeness.

And when it comes to getting and leveraging the information they need from their trading partners, the biggest hurdle isn’t technology, but getting the buy-in and support from their trading partners.

You can interpret the results of that last question one of two ways: the respondents are either pointing the finger at their trading partners as the main source of the data problems or they are recognizing that addressing this issue is not their problem alone; it’s an ecosystem challenge that requires the support and effort of all trading partners to resolve.

Having more timely, accurate, and complete data — and converting it into actionable intelligence — will not only lead to cost reductions and increased asset utilization, but also improvements in customer service and satisfaction, the top metric cited by the respondents.

In retrospect, the time allotted for the breakout session was too short — the participants didn’t want to stop sharing their thoughts and ideas with one another! To me this was a clear sign that everyone in the HBM ecosystem is interested and motivated to not only continue the dialogue, but also to take joint steps forward to pursue the opportunities identified.

What were some of these opportunities? Too many to list here, but here are some of the opportunities that generated the most discussion:

- Electronic ordering and load tendering, with real-time visibility to status.

- Supplier Managed Inventory — that is, provide suppliers with real-time visibility to material consumption rates and inventory levels and have them manage replenishment automatically.

- Eliminate paper tickets — that is, leverage electronic order data, GPS tracking, geo-fences, and mobile devices to track and confirm deliveries and trigger payments.

- Streamline, automate, and compress Order-to-Cash and Procure-to-Pay processes.

Overall, the Leadership Roundtable was a highly productive and informative session. As I commented to the attendees, borrowing a phrase from Amazon CEO Jeff Bezos, everyone will look back on this day as “Day One” of the journey to elevate the Heavy Building Materials supply chain to higher levels of communication, collaboration, and performance.

Back to the main conference, I gave a keynote presentation titled “Keep Your Breadcrumbs Behind My GeoFence: Why Fleet & Freight Visibility Matters.”

I chose this topic because the real-time fleet and freight visibility space has been heating up this year, with two major acquisitions completed in recent months. Why the increased attention and demand? Because shippers want this visibility, and more importantly, they want to do something with it — that is, they want to identify and implement better ways to plan and execute their transportation and logistics operations, which is what ultimately delivers value.

You can watch my presentation in full below, but in a nutshell, I highlighted several ways that real-time fleet and freight visibility delivers value, including:

- Visibility enables proactive action: to reschedule, resequence, or reroute pickups or deliveries, and to proactively notify customers of delays, which gives them time to readjust plans and reallocate resources.

- Visibility Enables “Manage by Exception”: enables companies to focus time and resources on what’s not occurring to plan to proactively resolve or minimize its impact.

- Visibility Enables Faster Procure-to-Pay and Order-to-Cash processes: for example, as mentioned earlier, you can leverage Electronic Proof of Delivery (ePOD) and geofencing to initiate invoicing and payment process.

While this year’s fleet visibility acquisitions have received a lot of attention, Command Alkon was actually ahead of the curve. It acquired FiveCubits, a software-as-a-service provider of fleet management and mobile computing solutions tailored for the HBM industry, back in 2014. The company’s TrackIT suite provides a variety of capabilities, including real-time visibility and mapping of individual trucks; the ability to set up geofences; time and attendance functionality, including electronic time cards; and engine diagnostics and electronic driver logs capabilities.

In short, while most of the other fleet visibility solution providers have focused on traditional tractor-trailer trucks, Command Alkon has established a dominant position in the ready-mix concrete and dump truck segment of the market.

To wrap up, this was my first time attending the Command Alkon conference. If you’re not in the heavy building materials industry, you’ve probably have never heard of the company, but with over 40 years serving the HBM market around the world, Command Alkon is in a unique position to help the industry move up the supply chain maturity curve. In addition to fleet visibility, the company has a other supply-chain related applications, including demand and inventory management and dispatch optimization. The missing piece, and where I believe the biggest opportunity resides, is providing a network platform for suppliers, producers, contractors, and haulers to communicate and collaborate with each other in a more efficient and scalable manner.

Simply put, Command Alkon has the opportunity to become a supply chain operating network for the heavy building materials industry, which would not only provide the company with new avenues for growth, but would also help the entire HBM ecosystem reach higher levels of supply chain performance.