Shippers today find themselves in a difficult and costly situation: their routing guides are often broken and they’re having to go to the spot market to cover their loads, which is costing more than they had budgeted. The great transportation spot market inversion has occurred. What does that mean for shippers? How should they respond? And what actions should they take longer term to prepare for whatever market conditions lie ahead?

Those are some of the questions I discussed with Andrew Lockwood, Senior Manager of Analytics and Solution Design at Kenco Group, in a recent episode of Talking Logistics.

What is a “Spot Market Inversion”?

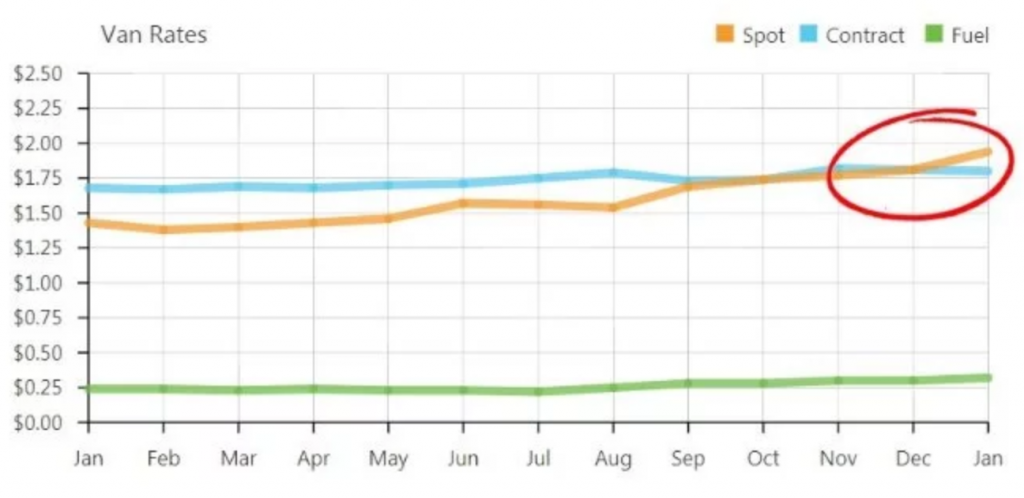

My first question to Andrew was what exactly is a spot market inversion? His response was, “Starting in late 2017 data showed that the prices brokers were paying to carriers on the spot market and the prices shippers were paying to carriers directly were getting very close together. Then in January, for the first time since I’ve been in the transportation business, those rates actually inverted. Shippers actually had better buying power going to carriers directly in negotiating longer-term rates than they did going through brokers. That doesn’t mean there is no longer a need for brokerage. It depends on the shipper’s profile and goals, as well as on the other value brokers offer.”

Andrew noted that the rate inversion flipped back again in February due to supply and demand issues that were uncommon for what is normally a slow period for shipping. On the supply side, the driver shortage, increased driver pay, and high utilization rates are putting upward pressure on prices. On the demand side, the strong economy and increased shipments of e-commerce orders are straining trucking capacity.

How Should Shippers Respond?

With all of the uncertainty around constrained capacity, increasing demand, and the flip-flopping of rate inversions, how should shippers respond?

Andrew believes there are two shipper profiles that will dictate responses. “If you have a lot of one-way lanes or one-off type shipments where the origin and destination points aren’t consistent, then going through a broker or transportation management provider will likely get you the least cost situation in the long run. But most companies have fairly consistent volumes and patterns where you can create match-backs (matching a head-haul with a backhaul) or a freight triangle. This allows shippers to take advantage of the benefits of a dedicated fleet.”

Andrew added that now is a good time to focus on building strong relationships with the right carriers. “Which carriers treat you well? Which carriers consistently provide high quality service and good rates?” He compared it to refinancing your mortgage. He says you want to lock in the best rates when the rates are low and he thinks now is the time to do that with carrier rates because the trend looks like rates will continue to increase for at least the next couple of years.

The other side of the relationship deals with how well you are treating carriers. If carriers are experiencing long dwell times at your docks, or you are slow to pay them, that makes you less favorable to them. With continued high utilization and capacity constraints, shippers need to look internally at how they can position themselves strategically as preferred shippers for carriers to secure capacity and the best rates.

The Long Run View of a Dedicated Fleet

Oftentimes shippers are reluctant to lock themselves in to a dedicated fleet contract, fearing they will be paying for capacity they may not fully utilize. Andrew says that analysis shows this is rarely the case and that shippers almost always benefit in the long run. To find out why and to learn how to set up dedicated fleet strategies and relationships to maximize value, watch my conversation with Andrew, where he also addresses the following questions and topics:

- How should carriers and brokers respond to current market shifts and what will be their long term best strategy for success?

- Will the spot market invert again and how should shippers and carriers position themselves accordingly?