Editor’s Note: The following is an excerpt of a research report published last week, “Focus on Customer Experience: Research on Supply Chain Priorities and Investments.” The research, conducted by Adelante SCM and the Council of Supply Chain Management Professionals (CSCMP), and presented by BluJay Solutions (a Talking Logistics sponsor), was conducted to explore the links between supply chain management innovation, customer experience, technology adoption, and company performance. You can read and download the full report at https://www.supplychainresearch.info/2019/.

Will customer experience overtake price and product as the No. 1 brand differentiator? Which supply chain capabilities will be most important in delivering an enhanced customer experience (CX)? What factors are driving — and which ones are inhibiting — supply chain innovation efforts? How are companies exchanging data with trading partners, and what is the quality of that data?

To find answers to these and other pressing supply chain questions, Adelante SCM and BluJay Solutions, in partnership with the Council of Supply Chain Management Professionals (CSCMP), conducted an online survey of supply chain and logistics professionals in March 2019. We received 438 valid responses from around the world, a significant increase from last year’s survey, which had 137 respondents.

We asked manufacturers, retailers, logistics service providers (LSPs), and other companies in the Americas, EMEA, and APAC to rate their company’s supply chain performance relative to industry peers (ranging from Significantly Below Average to Significantly Above Average). Respondents also characterized their company’s culture with regard to technology adoption (ranging from Laggards to Innovators). This enabled us to compare the responses between Above Average and Innovator companies with those from Below Average and Laggard companies.

Siloed Systems/Processes Remain Big Barriers to Supply Chain Innovation

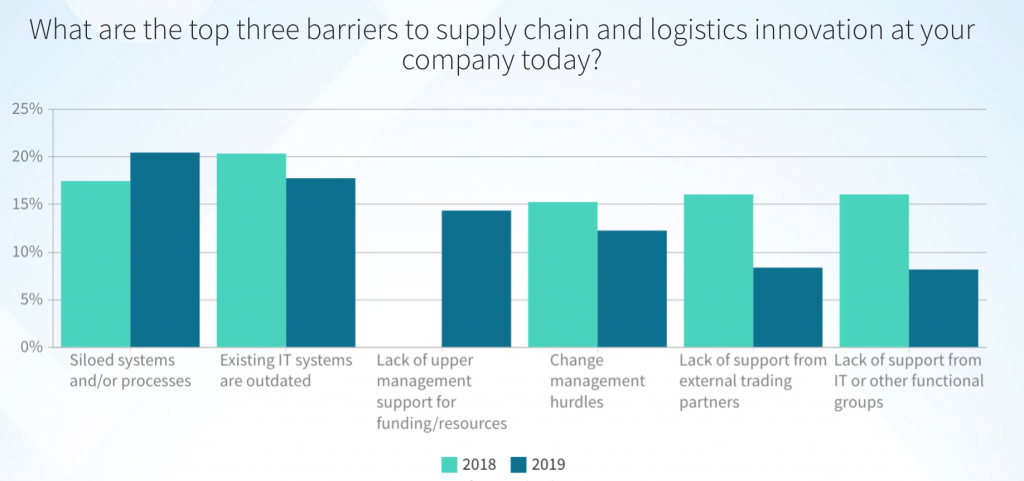

What are the top three barriers to supply chain and logistics innovation at your company today?

Siloed systems and/or processes received both the highest percentage of top-factor votes (21%) and the most total votes as a barrier to innovation — that is, the most votes for first, second, or third place combined.

Existing IT systems are outdated (18%) and Lack of upper management support for funding/resources (14%) rounded out the top three.

The top two barriers were the same in 2018 but in reverse. Siloed systems and/or processes increased by 17% this year compared with 2018, while Existing IT systems are outdated decreased by 13%. This suggests that companies are making some progress in modernizing their IT systems, but breaking down the silos between their systems and processes is a growing challenge.

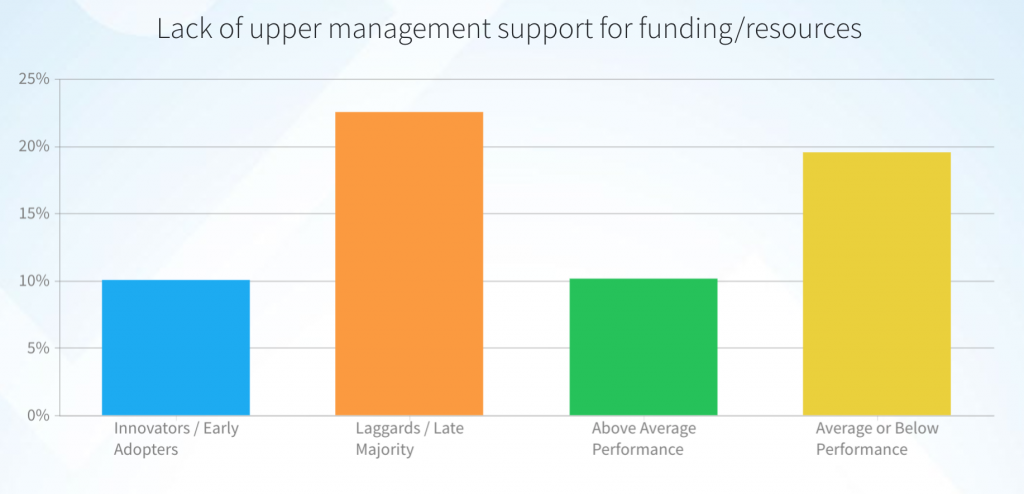

We did not include Lack of upper management support for funding/resources as a response option in the 2018 survey, so we cannot make year-over-year comparisons. However, the fact that it received the third-most top-factor votes overall is notable. Also, for Laggard/Late Majority companies, it is the biggest barrier to innovation, receiving 23% of top-factor votes (compared to 10% for Innovator/Early Adopter companies).

Similarly, Lack of upper management support for funding/resources received the second-most top-factor votes from Average or Below Performance companies (20%), ranking higher than Existing IT systems are outdated (17%). In comparison, Lack of upper management support for funding/resources ranked fifth for Above Average Performance companies, with 10% of top-factor votes.

These results suggest that Innovators/Early Adopters and Above Average Performance companies are better at developing and communicating the business case for supply chain innovation investments than their counterparts. It could also mean that upper management teams at Innovators/Early Adopters and Above Average Performance companies are doing a better job of creating innovation-driven cultures.