In an alternate universe, one without COVID-19, I would be writing today about our Logistics Leaders for T1D Cure cycling team and the JDRF Ride to Cure we did last weekend in Saratoga Springs, NY.

But in this universe, there was no JDRF ride last weekend; it was reimagined due to the pandemic.

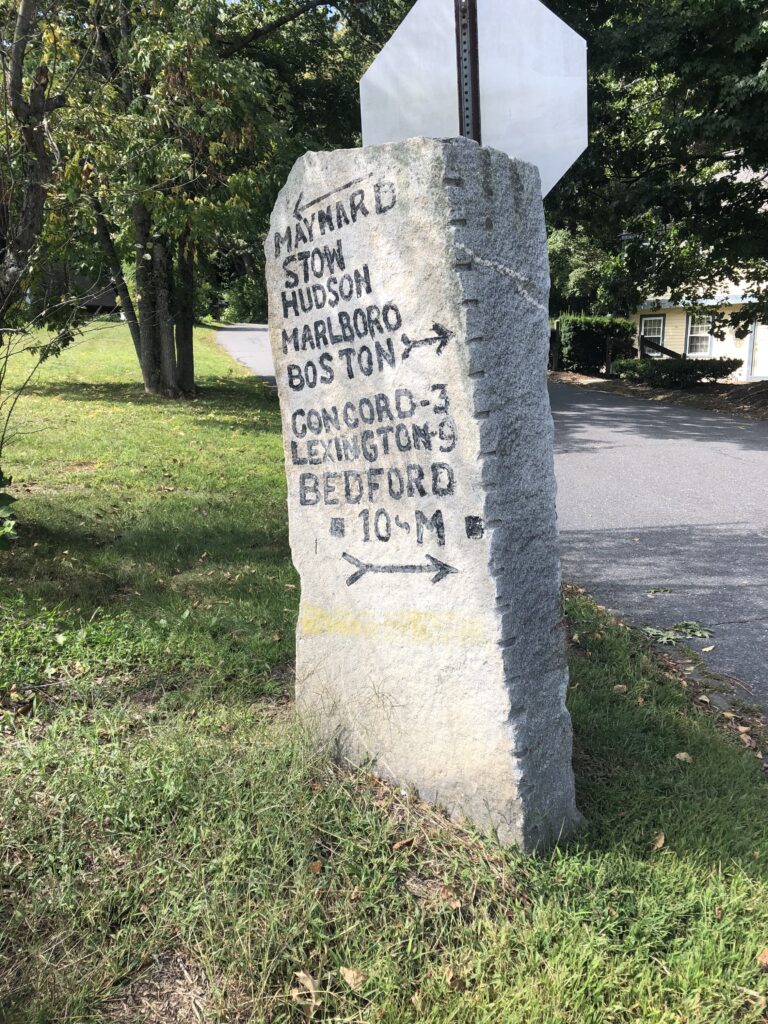

The reimagined version was me and my wife (a fellow LL4T1DCure team member) leaving our house at 6:30 am last Sunday and going for our own 103-mile bike ride. There were no rest stops along the way with food and drink; no porta potties for bathroom breaks; nobody cheering along the way. It was just the two of us, carrying enough food and drink to last us the day, and keeping our eyes open along the way for bathrooms (or woods).

It was a great ride.

The weather was perfect, we saw some deer, shared some laughs (and grunts of exhaustion) as we pedaled through many small towns, and we made it home safely.

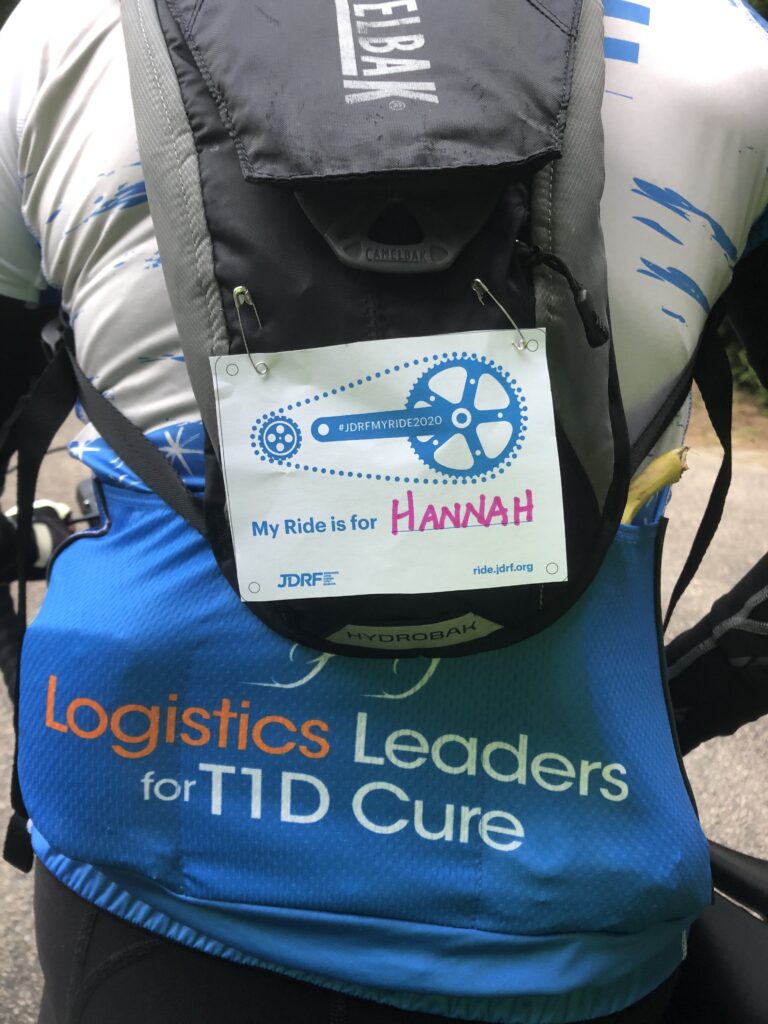

Why did we do this? For our daughter Hannah who was diagnosed at age 11 with type 1 diabetes (T1D), and for everyone else who has to deal with the daily challenges of this disease. Although COVID-19 has cancelled many things, it hasn’t cancelled T1D. If anything, the need to find a cure is more urgent than ever, since people with diabetes and other underlying health conditions are at a higher risk of developing serious complications from COVID-19.

Fundraising has been challenging this year, with many people experiencing financial and other hardships due to the pandemic. That is why we are more grateful than ever for all the donations we have received to date, and the continued support of our team sponsors BluJay Solutions and Descartes Systems Group.

(It’s not too late to donate; you can do so via this link. No amount is too small.)

I’ve penciled in another century ride for next month, and we will be revealing our team jersey soon, with a chance for you to win one (or earn one) via a donation. Stay tuned.

Thank you for your time and consideration. Now, on to the supply chain and logistics news that caught my attention this week:

- Amazon plans to put 1,000 warehouses in U.S. neighbourhoods (BNN Bloomberg)

- Amazon to Hire 100,000 in U.S. and Canada (WSJ – sub. req’d)

- W.T.O. Says American Tariffs on China Broke Global Trade Rules (NYT)

- Uber Agrees to Sell its European Freight Unit to Sennder (Bloomberg)

- FedEx to Transform Package Tracking with SenseAware ID, the Latest Innovation in FedEx Sensor Technology

- Accel-KKR adds the strategic acquisition of Shipper TMS to its platform investment PINC.

- UltraShipTMS’s New Integration Partnership with Samsara for Fleet Tracking

- Shipping and Logistics Industry Leader Visible Supply Chain Management Acquires Shipping Software Company PC Synergy

- August import volume swells above 2019 levels as retailers restock, prep for holidays (Supply Chain Dive)

- Air cargo market ‘going crazy’ as carriers prepare for a tight peak season (The Loadstar)

- Amazon and Walmart’s emerging delivery drone battle escalates with Zipline deal (MSN)

- Truckers now reporting 8-hour waits at California port of entry (KRQE)

Look Who Is Moving Next Door: Amazon

“Amazon.com Inc. plans to open 1,000 small delivery hubs in cities and suburbs all over the U.S., according to people familiar with the plans,” reports Bloomerg. Here are some excerpts from the article:

The facilities, which will eventually number about 1,500, will bring products closer to customers, making shopping online about as fast as a quick run to the store.

Amazon couldn’t fulfill its two-day delivery pledge earlier this year when shoppers in COVID-19 lockdown flooded the company with more orders than it could handle…So with the holidays approaching, Chief Executive Officer Jeff Bezos is doubling down by investing billions in proximity, putting warehouses and swarms of blue vans in neighborhoods long populated with car dealerships, fast-food joints, shopping malls and big-box stores.

“In just a few years, Amazon has built its own UPS,” says Marc Wulfraat, president of the logistics consulting firm MWPVL International Inc., who estimates Amazon will deliver 67 per cent of its own packages this year and increase that to 85%. “Amazon keeps spreading itself around the country, and as it does, its reliance on UPS will go away.”

The pandemic has accelerated the growth of e-commerce, which in turn has accelerated the investments the big three (Amazon, Walmart, and Target) are making to facilitate and expedite order fulfillment (which includes home delivery, ship-from-store, and buy online pickup in store). These moves are also adding competitive pressure on the other big three: USPS, FedEx, and UPS.

Earlier this week, I wrote about how “Please allow 4-6 weeks for delivery” was the standard back in the 90s. We may see the day in the not too distant future where “Please allow 4-6 hours for delivery” will be the new standard.

PINC Adds TMS Capabilities (via Accel-KKR Acquisition)

I’ll keep saying it: when it comes to transportation management systems (TMS), there is always something new to talk about.

The big news this week: PINC (a Talking Logistics sponsor) is adding TMS capabilities. According to the press release:

Accel-KKR, a leading technology-focused investment firm, today announced that it has closed on a carve-out acquisition of the Shipper TMS portion of the Supply Chain Optimization (SCO) software business portfolio owned by Wabtec Corporation. The Shipper TMS business provides cloud-based multi-modal shipment management applications to customers in the United States, Canada, and Mexico. Industrial shippers, carriers, logistics providers, and bulk terminal operators know the Shipper TMS business by two leading product brands, ShipperConnect and ShipXpress.

This is a strategic acquisition to Accel-KKR’s platform investment in PINC…The combined businesses will serve as a foundation for a Supply Chain Execution (SCE) platform focused on comprehensive transportation management software solutions for shippers. The platform will prioritize offerings that serve the origin and termination points in the supply chain with a specific focus on rail, truck, and terminal yard management. Combined with real-time visibility, electronic documentation, analytics, billing, rating and carrier management functionalities, the platform is well positioned to solve multiple transportation challenges in the supply chain industry.

This follows the partnership PINC announced recently with project44 for real-time freight visibility (see here for my comment).

As I state in a soon-to-be-published research report, you cannot view yard management in isolation. Unlike the saying “What happens in Vegas, stays in Vegas,” what happens in the yard does not stay in the yard. The inefficiencies that exist within a company’s yard — and in many cases, their network of yards — have a significant impact across the supply chain, especially in transportation and warehousing operations. Simply put, the coming together of yard management with transportation management has the potential to deliver greater enterprise benefits. Another example of “the whole is greater than the sum of its parts.”

And with that, have a happy weekend!

Song of the Week: “Check Your Phone” by Cheap Cuts feat. Pete Wentz