Author’s Note: At Transporeon Summit 2024 last week, I delivered a brief presentation on the state of the European transportation market. Below is an excerpt of what I presented, which includes data from Transporeon Market Insights.

When the team at Transporeon invited me to speak again this year, they asked if I could give an update on the European transportation market, similar to the quarterly market updates I used to write. I said, “Sure, that would be great, I’d be happy to do it.”

But then they added, “You’ll have about 8 minutes on the stage for your presentation.”

8 minutes to tell you everything you need to know about the European transportation market. And as I look at my watch, I now only have 7 minutes.

No doubt, this is a tough assignment, but it would have been much more difficult 10 years ago because back then real-time data and insights about the transportation market wasn’t easily available. Today, you have solutions that give you visibility to rates, capacity, and other transportation metrics to help you become more data-driven in your decision making.

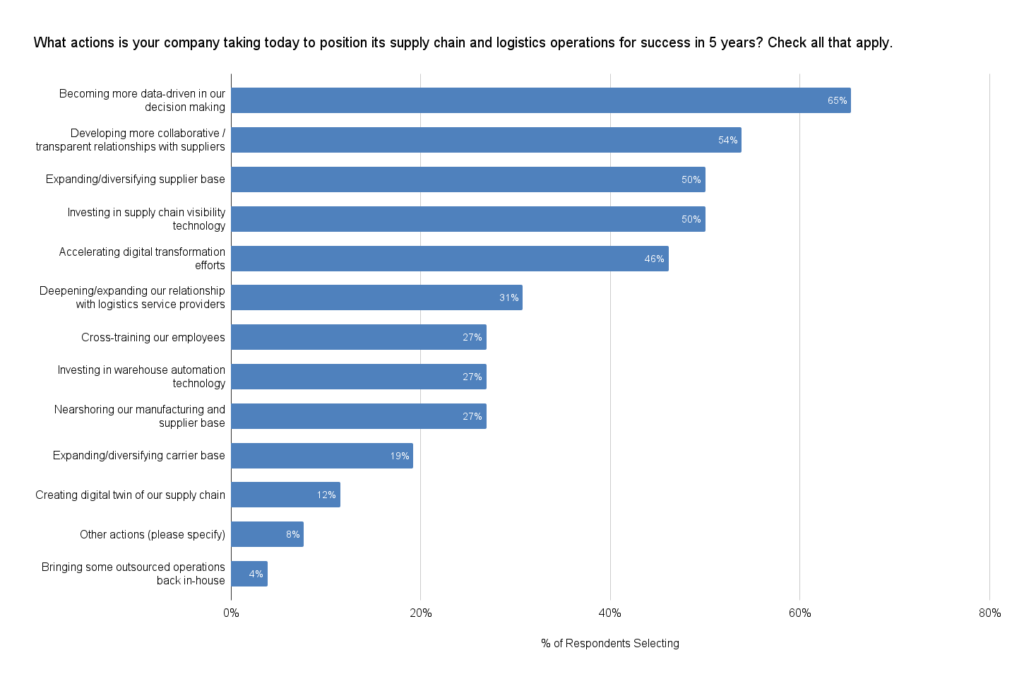

Why is this important? Well, in a April 2023 survey we conducted with members of our Indago supply chain research community — who are all supply chain and logistics executives from manufacturing, retail, and distribution companies — “Becoming more data-driven in our decision making” was the top action companies are taking today to position their supply chains for success in 5 years.

When you consider all the factors and variables impacting transportation today — including the ongoing Russia-Ukraine war, the Mobility Package, sustainability regulations, and GDP growth (or lack thereof) — it’s clear that having real-time data and insights about trends in the market is more important than ever.

Okay, with the few minutes I have, I want to highlight a few important trends.

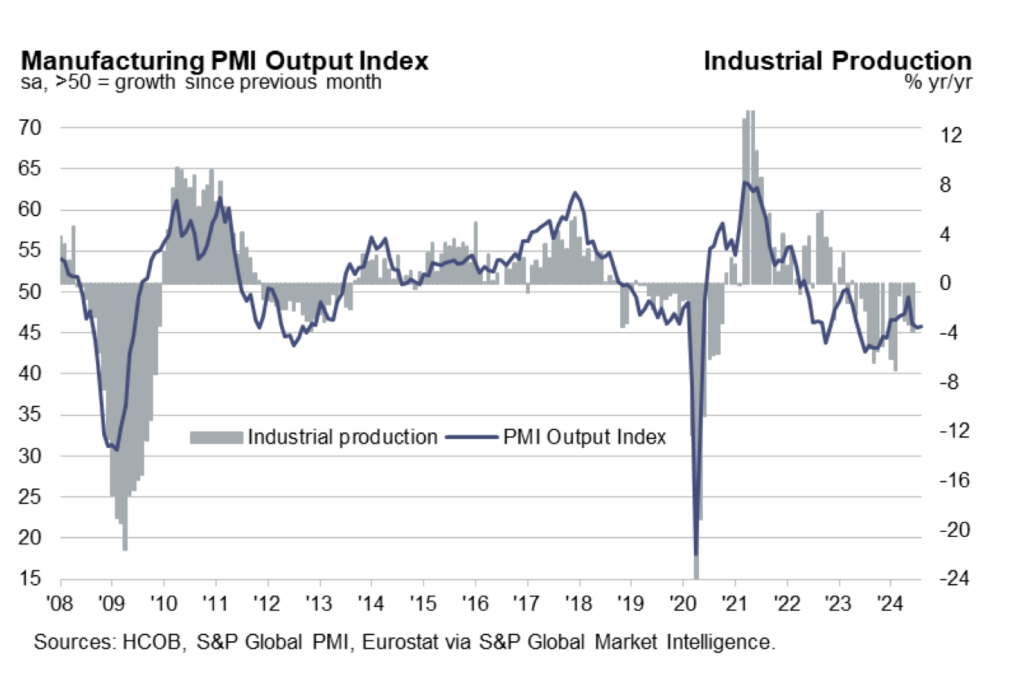

First, let’s look at the demand side of the market. As in the U.S., manufacturing is a significant driver of transportation demand. If you look at the Manufacturing PMI Output Index, a reading above 50 indicates a growing manufacturing economy while a value under 50 indicates a shrinking manufacturing economy. As the chart below shows, the Manufacturing PMI Output Index has been below 50 for more than two years, with Germany and France being the biggest drags on factory performance this past August.

Of course, some countries and industries are performing better than others, but when you have big economies like Germany and France — and big industries like Automotive — all struggling from a manufacturing perspective, that is going to have a big impact on the transportation market.

So, in order for transportation demand to increase significantly, manufacturing activity will have to increase too, but that is not happening at the moment and it’s unclear when (or how quickly) the turnaround will be.

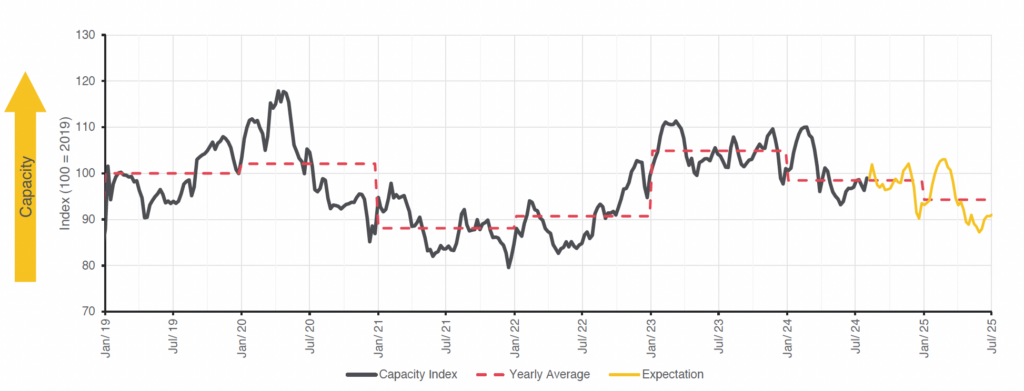

On the supply side, the main issue is that there is still too much capacity in the market. However, capacity is starting to tighten. As the chart below shows, the average Capacity Index level in 2024 is below the average in both 2023 and 2019. This has been driven by several factors, including carriers reducing their fleet sizes and carrier bankruptcies. This capacity tightening is expected to continue in 2025.

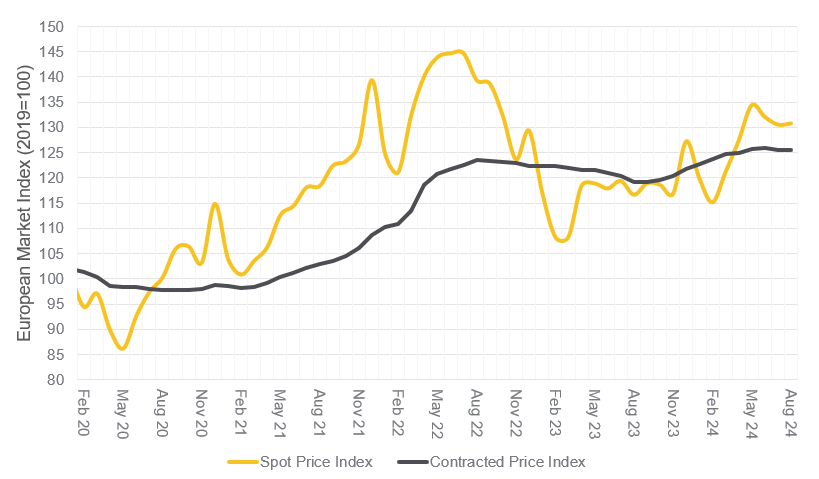

How is all this affecting rates? As you can see in this chart, spot rates have been above contracted rates for the past six months. Contracted rates began rising in Q3 2023, due in part to the incorporation of toll increases and other regulatory changes, but they have started to level off in recent weeks. Meanwhile, spot rates have been increasing for most of 2024 due to capacity tightening. With spot rates above contracted rates, we’re also seeing an increase in contracted load rejection rates.

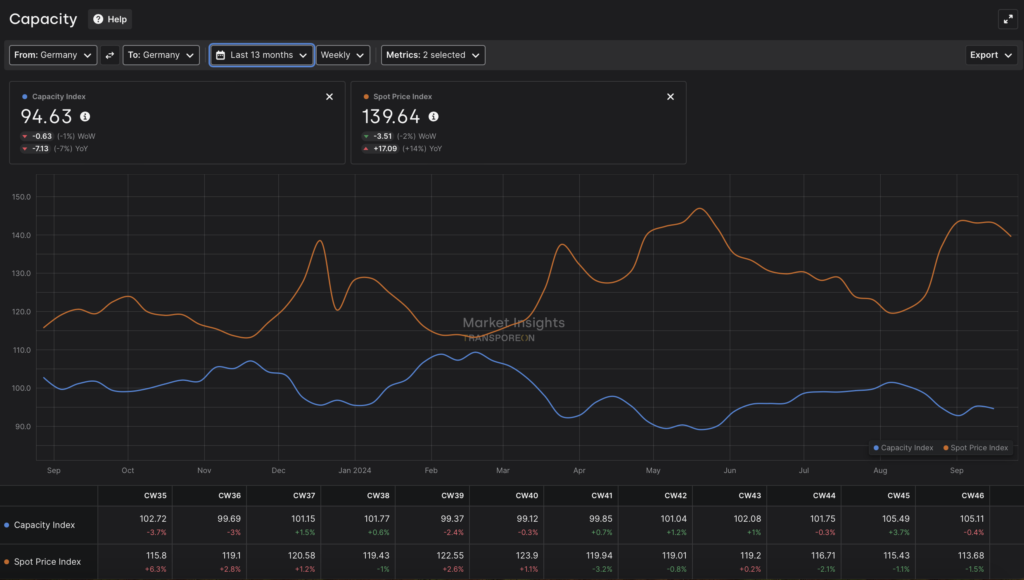

To give you an example, here is data from Transporeon Market Insights looking at the German market over the past 13 months. The line on top is the Spot Price Index and it has increased 14% year over year, while the Capacity Index (the line on the bottom) has decreased 7% year over year.

Again, this is not the case for every country, which is why taking a country-specific perspective is important when analyzing your operations. But overall, at an aggregate level, the European transportation market is experiencing flat demand, a gradual tightening of capacity, and increasing spot prices.

I’ll end by highlighting some other trends that are impacting the transportation market. First, it’s the introduction of battery-powered electric trucks. On the one hand, electric trucks are more environmentally friendly than diesel powered trucks, but on the other hand, they are more costly, have a more limited range, take much longer to refuel, and have a lower payload (due to weight of batteries).

A diesel powered truck, for example, can refuel in 15 minutes and travel about 1,200 miles before needing to refuel. A battery-powered electric truck, however, can take several hours to fully charge and travel less than 500 miles before needing to charge again. Coupled with the fact that electric trucks cost more than double the cost of diesel trucks, this reduction in range and efficiency negatively impacts both carriers and shippers.

Another trend impacting transportation is the reconfiguration of shipper supply chain networks, as companies seek new sources of supply and shift manufacturing locations. This started happening in response to the Covid pandemic, and the Russia-Ukraine war has also served as a catalyst. This reconfiguration has led to changes in product flows and transportation networks, which now have to be re-optimized.

Finally, of course, you have the ever-present driver shortage problem. According to a 2023 IRU study that surveyed over 1,000 European carriers, more than half of European trucking companies are unable to expand their business because they can’t find skilled workers due to the shortage of truck drivers. The average age of a European truck driver is 47 and one third of truck drivers are over 55 and are expected to retire in the next ten years. Meanwhile, less than 5% of truck drivers are below 25 years of age. In short, there is no clear solution to this problem, other than leveraging existing drivers and capacity more efficiently and perhaps using driverless trucks in the future where applicable.

So, there you have it, a snapshot of the European transportation market in 8 minutes or less.