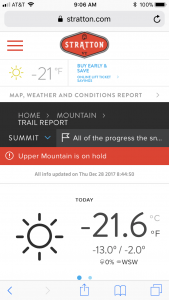

Can a Cuban ski in -21.6F and survive?

I wasn’t willing to find out. But I did ski the day before when it was a balmy -10F and I survived (barely) eight runs down the mountain.

The cold still has a tight grip on the East coast, with more than a foot of snow falling yesterday and today we’re blessed with wind chills as low as -20F.

Happy New Year, everyone!

While I thaw out a bit, here are the supply chain and logistics news that caught my attention this week:

- Tight Trucking Market Has Retailers, Manufacturers Paying Steep Prices (WSJ – sub. req’d)

- Amazon shipped over 5 billion items with Prime in 2017 (TechCrunch)

- UPS and FedEx Handle Record Holiday Surge With Minimal Delays (Bloomberg)

- Retailers Offer Myriad Returns Options to Retain Customers (WSJ – sub. req’d)

- Peloton holds 1,000-mile platooning demo in Florida (CCJ)

- Aurora self-driving startup partners with VW, Hyundai (Reuters)

Like a screwdriver turning a screw, bit by bit, trucking capacity continues to tighten.

“By the end of last week, just one truck was available for every 12 loads needing to be shipped, according to online freight marketplace DAT Solutions LLC,” reported the Wall Street Journal this week. “That is the most unbalanced market since October 2005, after Hurricane Katrina, and is up from a roughly 4-to-1 ratio at the end of 2016…The cost to hire the most common type of big rig shot to $2.11 per mile, including a fuel surcharge, in the week ended Dec. 30, a 3½-year high, DAT said.”

One of my supply chain and logistics predictions for 2018 was that companies will focus on integrating the long tail of supply chains. As trucking capacity continues to tighten, tapping into the long tail of carrier capacity will become especially important. For related commentary, see Trucking Capacity: Tapping into the Long Tail.

In Amazon news, the company announced that “more new, paid members joined Prime worldwide in 2017 than any other year [and] that over 5 billion items worldwide shipped with Prime in 2017, including via one-day and two-day shipping,” as reported by TechCrunch.

Simply put, Prime is Amazon’s most potent competitive weapon, and it keeps getting sharper and sharper. For related commentary, see Defining Your Own Logistics Competitive Weapon.

Considering that many online orders are returned, especially during the holidays, several hundred million of those Prime items were probably sent back. As I wrote earlier this week, dealing with product returns is the hangover headache of e-commerce and most retailers lack the systems, processes, and expertise to manage returned goods in an intelligent and efficient manner.

Here are how Amazon and Walmart are dealing with returns, as reported by the Wall Street Journal:

Online retailer Amazon.com Inc. said it has expanded options for in-person returns this year, with a network of 2,000 “locker” locations, including 400 at Whole Foods stores, where customers can drop off items to be returned. Amazon also partnered with Kohl’s Corp. stores in Chicago and Los Angeles, which are accepting returns of Amazon goods bought online.

Wal-Mart Stores Inc. is touting its Mobile Express Returns kiosks, located in its stores, where it says customers can complete the return process in less than five minutes and receive a refund within a day or so.

Will 2018 be the year that companies get smarter about product returns and liquidation? That’s another of my supply chain and logistics predictions for this year. We’ll certainly find out in the weeks and months ahead.

And with that, have a happy weekend!

Song of the Week: “Wolf Like Me” by TV On The Radio