What do the Newspaper, Postal & Parcel, Public Works, and Utilities industries have in common?

They all have high-density routes — that is, routes with 100 or more stops, which makes route optimization even more complex.

They’re also the industries that for the past 40 years RouteSmart Technologies, a provider of vehicle route optimization software technology (and a Talking Logistics sponsor), has served.

I had the opportunity to speak at RouteSmart’s INTERSECT 2019 conference recently, which featured many presentations from clients and partners, including United States Postal Service, Smith Brothers Farms, SoCalGas, New Zealand Herald, Posti, Next Day Dumpsters, HERE Technologies, Esri, and Bestrane Group.

It was a great learning opportunity for me because I don’t typically focus on these industries. What I learned at the conference, and in the research I conducted beforehand, is that although these industries have their own unique challenges and opportunities, they also share common threads with just about every other industry today.

Industries in Transition

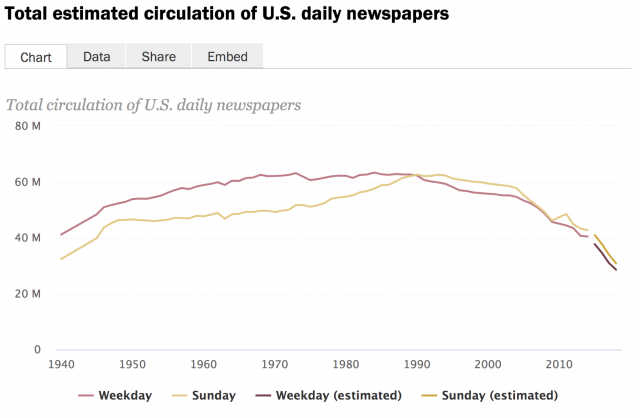

It’s no secret that newspaper circulation has been on the decline for many years. According to Journalism.org, weekday print circulation in the U.S. decreased 12% and Sunday print circulation decreased 13% in 2018.

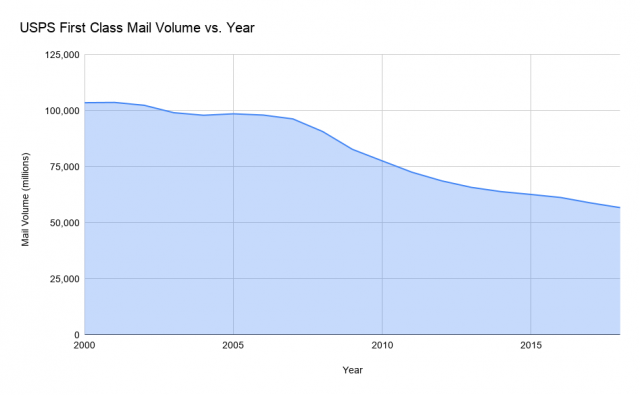

Similarly, First-Class Mail Volume in the U.S. declined 3.4% in 2018 to 56.7 billion pieces – back to 1978’s level.

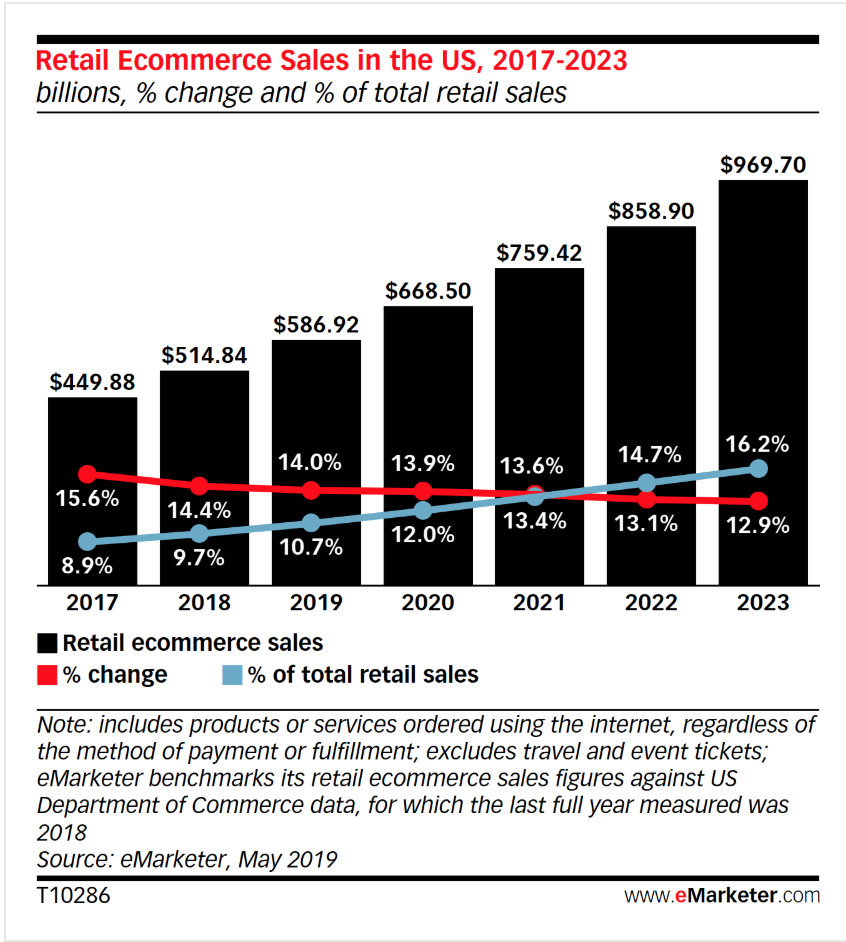

However, as these traditional business lines shrink, new opportunities emerge, especially those linked to e-commerce. According to eMarketer, e-commerce sales in the U.S. is projected to grow from about $587 billion in 2019 to $970 billion in 2023. This growth is fueling a rapid rise in parcel shipments, from 43 billion parcels in 2014 to 87 billion in 2018, according to the Pitney Bowes Parcel Shipping Index. Parcel shipping revenue has also increased by $100 billion over the past five years, reaching $317 billion globally in 2018.

Source: https://www.emarketer.com/content/us-ecommerce-2019

Source: https://www.pitneybowes.com/us/shipping-index.html

The public works and utilities industries are also facing transformations of their own, such as the growing use of automated side loaders in waste management (with autonomous, self-driving trucks in the works) and the growing adoption of drive-by advanced meter reading systems by utility companies.

Simply put, the pace of change and transformation in the newspaper, postal and parcel, public works, and utilities industries is accelerating. As a result, organizations in these industries must not only remain cost competitive, but also find ways to drive top-line growth and provide an enhanced customer experience. Since delivery and pick-up is at the heart of their operations, achieving excellence in route optimization is more critical than ever.

The Need to Drive Continuous Improvement Never Ends

All of the speakers at the conference presented great case studies in how route optimization is helping their companies respond to the challenges and opportunities facing their industries.

Take the case of a company that delivers newspapers and magazines to 790,000 homes and 3,000 retail outlets per week. When the company first implemented RouteSmart in 2011, it reduced the number of delivery routes from 3,000 to 2,000, reduced kilometers driven by 683,000, and reduced delivery hours by 17%. Over the years, the company made changes to its distribution network in response to market trends. In 2017-18, for example, the company used RouteSmart to integrate its home subscriber and retail delivery activity into combined delivery routes. This has further reduced the number of delivery routes from 2,000 to 800 and reduced kilometers driven by 653,276 and delivery hours by 30,436 per year. And today, in response to minimum wage increases and other factors, the company is leveraging RouteSmart to drive additional efficiencies in its delivery network, which has so far reduced kilometers driven by an additional 122,543 and reduced delivery hours by 10,090.

In another customer example, a company used RouteSmart to eliminate 27 routes and 5 trucks from its delivery fleet, resulting in $170,000 in expense reduction per year.

What was clear from all the case studies is that the need to drive continuous improvement is ongoing. Whether it’s to remain cost competitive or to create a competitive advantage — by enabling customers to order later in the day for next-day delivery, for example, or by providing customers with narrower and more accurate delivery time windows — there’s always another opportunity to go after.

RouteSmart: The Journey to Routing as a Service (RaaS)

On the technology front, the need to drive continuous improvement also applies to RouteSmart. When the company was founded almost 40 years ago, its applications were all on-premise, single-user solutions, which was typical at the time. Fast forward to today and the company is transitioning all of its industry-specific solutions to the cloud and leveraging API technology to access its routing engine, which is now a standalone web service used by RouteSmart’s applications and any third-party solution too (hence the “Routing as a Service” name).

For example, in the case of RouteSmart Online, a cloud-based solution for the newspaper industry, over 10 million newspaper deliveries across 50,000 carrier routes are optimized every night using RaaS.

I don’t have the space or time here to highlight all of the new capabilities presented at the conference, but here are a couple of solution features/capabilities that caught my attention:

Route Health Score

This is a computationally generated index that measures three weighted components — Balance, Efficiency, and Compactness — to indicate an overall assessment of route quality.

- Balance: a high Balance health score indicates the routed workload is distributed equitably between routes based on targeted time. Effectual use of assets (vehicle and personnel).

- Efficiency: a high Efficiency health score is representative of route territories that allow the minimization of non‐productive travel (aka “windshield time” or “deadheading”).

- Compactness: a high Compactness score shows that routes have minimal boundary overlap and are geographically clustered.

Users can leverage the RouteSmart Route Health Score index as a guide to evaluate existing routes as well as RouteSmart generated routing scenarios.

Turn Defaults By Street Class (TDBSC)

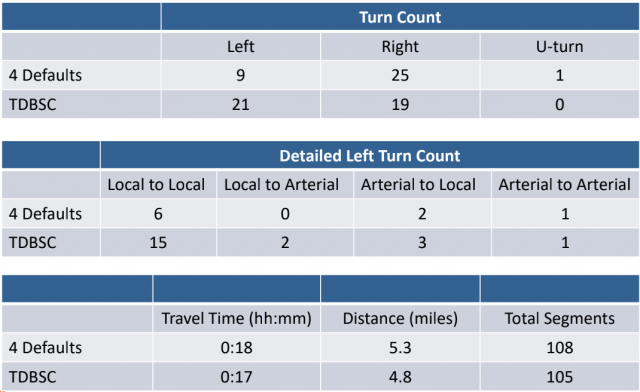

A couple of years ago, there was a lot of buzz about how UPS trucks almost never make left turns because they are generally considered unsafe and wasteful on right-hand driving roads. But are all left turns created equal? The short answer is no, not all left turns are created equal, as Larry Levy, RouteSmart’s Executive VP and Chief Operating Officer, demonstrated in his opening presentation.

Traditional solvers offer four defaults: Delay Time for Straight, Delay Time for Turning Right, Delay Time for Turning Left, and Delay Time for U-Turn. But turning left from an arterial road onto a residential street is different than turning left from a residential street onto an arterial road (the latter is riskier and takes more time). RouteSmart’s solver accounts for these differences by road type (Highways, Arterials, Locals), which results in more efficient (and still safe) routes overall.

In one example with 24 stops, the route developed using the TDBSC solver was a minute faster and 0.5 miles shorter than the traditional approach.

The key takeaway: do not fear left turns if you’re able to optimize your routes with more detail.

Final Thoughts

While some transportation management system (TMS) vendors have opted to expand their functional footprint to compete, RouteSmart has taken a different approach: it has remained focused on serving the unique requirements of the newspaper, postal and parcel, public works, and utility industries. That is, industries characterized by high-density routes. This focus has led RouteSmart to differentiate itself from the competition and build market share in these industries. For example, after a highly-competitive evaluation process, a leader in the postal and parcel industry recently selected RouteSmart as its technology partner in a 5-year deal.

Like its customers, however, RouteSmart is in transition. How does the company continue to drive growth within its core industries, especially as those industries face declining lines of business? What new opportunities or partnerships can Routing as a Service unlock? Are there adjacent solutions, such as mobile applications, the company should add to its portfolio? How does RouteSmart tap into the growth opportunities provided by e-commerce?

All important questions that time will answer.

In the meantime, RouteSmart is entering its 40th year with growing momentum and opportunities. And I have a deeper appreciation of what it takes to get my newspaper delivered to my doorstep on time every morning. And when I see the delivery driver make a left turn from my residential street to another, I know he’s probably right, and unafraid.