I called my father Papi.

My kids call me Papi too.

Well, not all the time.

Sometime ago, one of them (I don’t remember who), started calling me A-Dwee-An. This quickly morphed into just Dwee (which they spell DWI, to my dismay).

“Dwi,” they call out to me. “Papi!” I remind them.

It doesn’t matter, though. No matter what they call me, I’m their Papi, and I love them all.

Happy Father’s Day to all you dads out there.

Now, here’s the supply chain and logistics news that caught my attention this week:

- Biggest U.S. ports union suspends labor talks, with East Coast, Gulf Coast strike risk rising (CNBC)

- Monthly Import Cargo To Hit Highest Level Since 2022 (NRF)

- Trucking Payrolls Slide on Weaker Freight Demand (WSJ – sub. req’d)

- EU hits Chinese EVs with tariffs, drawing rebuke from Beijing (Reuters)

- Italian prosecutors probing supply chain of around a dozen fashion brands, says source (Reuters)

- Descartes Acquires BoxTop Technologies

- Infor Nexus Launches Map and Trace to Help Companies Demonstrate Responsible Supply Chains

- Ship Angel Raises $5M, Expands AI-Powered Operating System for BCO Shippers

- Thousands of drivers file arbitration claims against Amazon for unpaid wages and other losses (AP)

- California 2 years ahead of schedule on ZEV truck transition, CARB says (CCJ)

- Target’s Supply-Chain Chief Turned to Stores to Answer the Online Fulfillment Challenge (WSJ – sub. req’d)

- Canada border agents reach deal, avert strike (The Detroit News)

The War Against Automation at U.S. Ocean Ports

“If it’s a fight they want, it’s a war they’re going to get.”

That is the message The International Longshoremen’s Association (ILA) is sending to the United States Maritime Alliance (USMX), based on a sign several longshoremen are holding in a photo included in the press release issued by the ILA this week. The press release announced that the ILA was canceling its June 11th Master Contract talks with USMX “after discovering that APM Terminals and Maersk Line are utilizing an Auto Gate system, which autonomously processes trucks without ILA labor. This system, initially identified at the Port of Mobile, Alabama, is reportedly being used in other ports as well.”

So, while other nodes in the supply chain are racing ahead implementing a variety of automation technologies — such as autonomous mobile robots in the warehouse and robotic process automation for document processing — to improve productivity and throughput, port workers want to keep using clipboards and paper documents for gate entry.

Well, they probably don’t care too much about automating gate entry, but they view it as a gateway to automating other parts of port operations, those jobs that allow longshoremen to make between $150,000-$250,000 annually. If you give the USMX an inch with automation, the thinking goes, they’ll want to take a mile.

It’s the same story every contract negotiation cycle.

But as I wrote back in February 2015 in “Ready For The Next Port Crisis?”, “labor disputes are a distraction from the larger challenge facing the ports, especially in the United States: the need to increase port productivity as larger ships replace smaller vessels.”

Earlier this month, the World Bank and S&P Global Market Intelligence released the fourth edition of the Container Port Performance Index (CPPI), which is based “on the biggest dataset ever: more than 182,000 vessel calls, 238.2 million moves, and about 381 million twenty-foot equivalents (TEUs) for the full calendar year of 2023.”

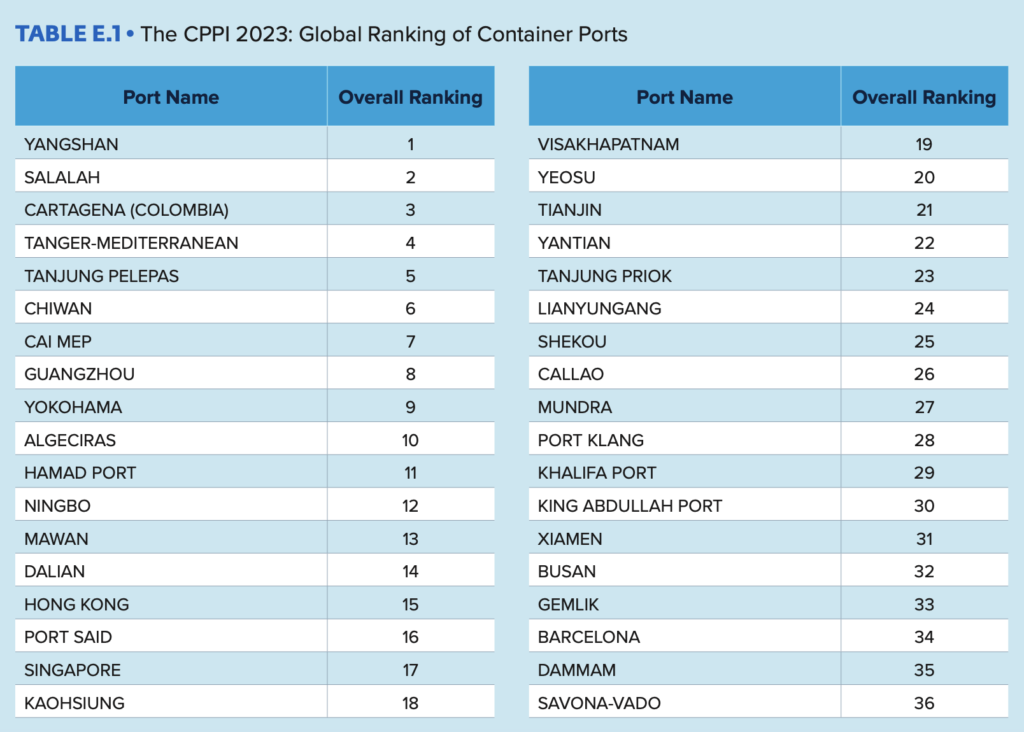

Not surprising, East and Southeast Asian ports accounted for 13 of the top 20 places. Here are the top 36 ports ranked “by efficiency, focusing on the duration of port stay for container vessels.”

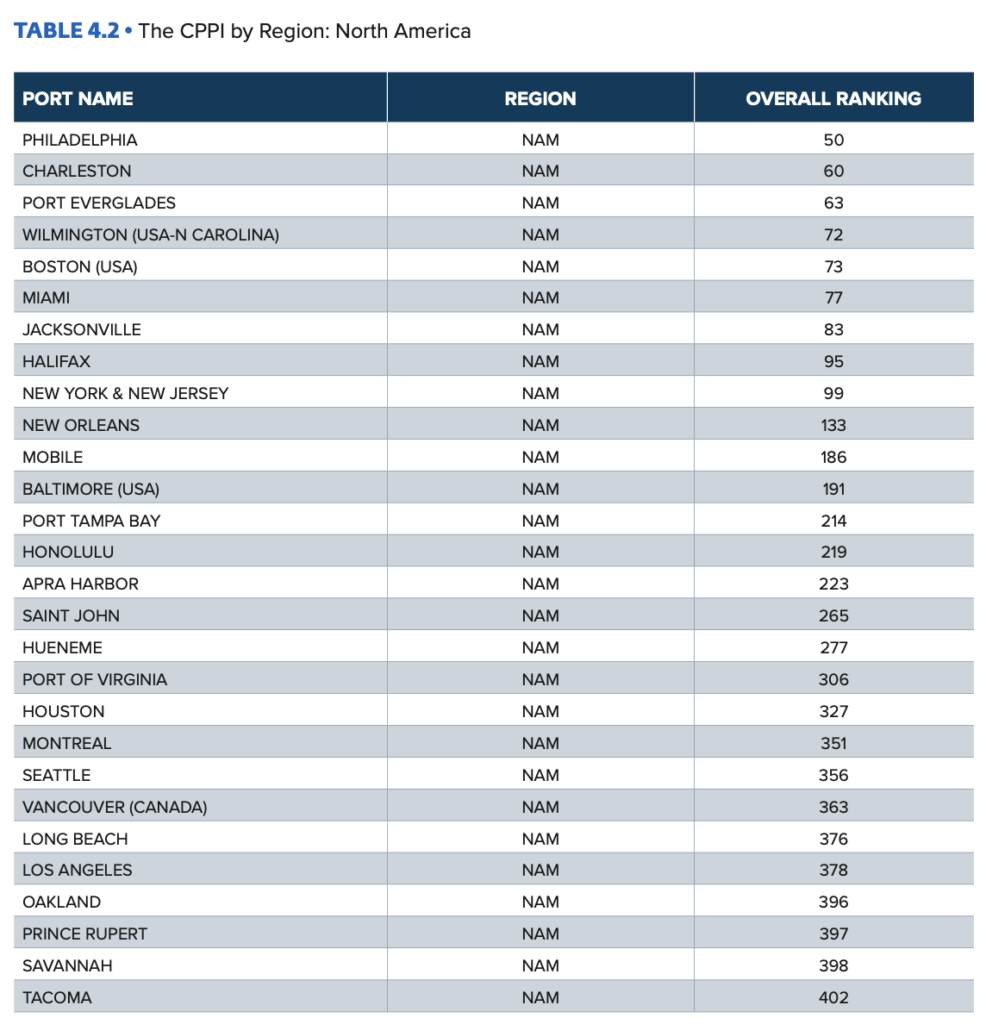

Below are the rankings for the ports in North America. The Port of New York and New Jersey, the largest on the East Coast, ranked 92nd. The ports of Los Angeles and Long Beach ranked 375th and 373rd, respectively.

Why does port efficiency matter? Here’s how the authors of the report put it in the Executive Summary:

Container ports are critical nodes in global supply chains and essential to the growth strategies of many emerging economies. In numerous cases, the development of high-quality container port infrastructure operating efficiently has been a prerequisite for successful export-led growth strategies. Countries that follow such a strategy will have higher levels of economic growth than those that do not. Efficient, high quality port infrastructure can facilitate investment in production and distribution systems, engender expansion of manufacturing and logistics, create employment opportunities, and raise income levels.

However, ports and terminals, especially container terminals, can cause shipment delays, disruptions in supply chain, additional expenses, and reduced competitiveness. The negative effect of poor performance in a port can extend beyond that port’s hinterland to others as container shipping services follow a fixed schedule with specific berth windows at each port of call on the route. Therefore, poor performance at one port could disrupt the entire schedule. This, in turn, increases the cost of imports and exports, reduces the competitiveness of the country and its hinterland, and hinders economic growth and poverty reduction.

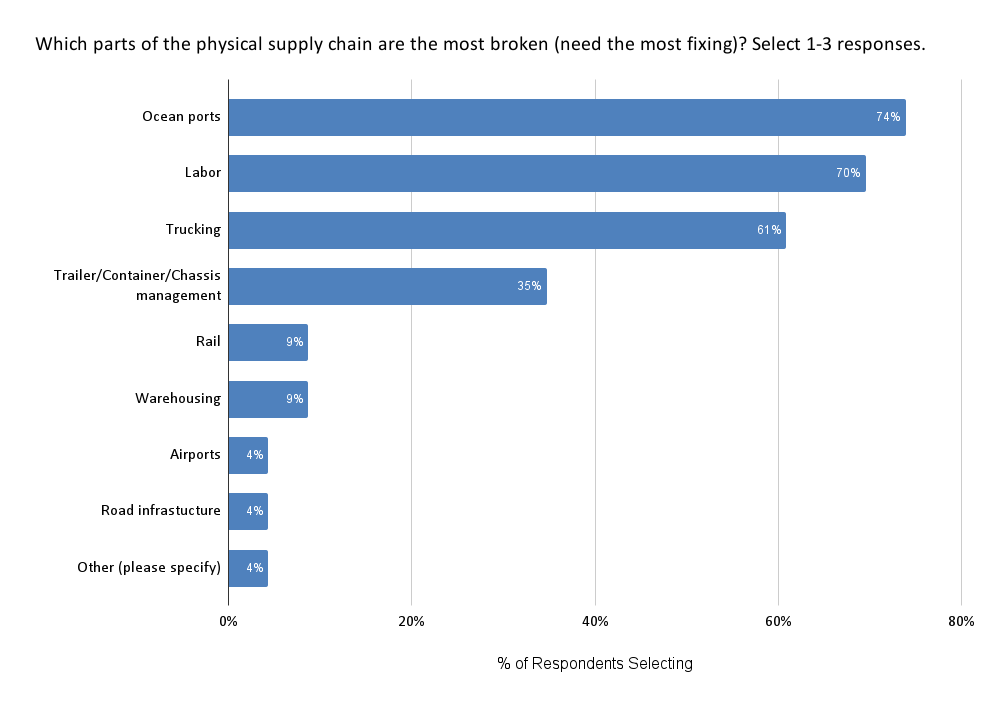

Back in October 2021, we asked members of our Indago supply chain research community — who are all supply chain and logistics professionals from manufacturing, retail, and distribution companies — “Which parts of the physical supply chain are the most broken (need the most fixing)?” It’s not surprising, considering the backups and delays occurring at the time, that “Ocean ports” received the most votes (74%), followed closely by “Labor” (70%).

The current master contract between the ILA and USMX expires on September 30th. Proactive shippers have already been making contingency plans in case of a strike, such as diverting shipments to the West Coast ports. But whether there is a strike or not, or whether this current fight turns into a war, the end result will be the same as always: America’s biggest and most important ports will remain laggards when it comes to productivity and efficiency, making them key constraints in global supply chains.

And with that, have a meaningful weekend!

Song of the Week: “Everything’s Over” by Darling Cruel