There is a lot of focus today on competing on customer experience and the role of supply chain and logistics in enabling it. But one of the first companies, particularly in the e-commerce era, to embed customer experience in its culture and leverage it as a competitive differentiator was Zappos (which Amazon acquired in 2009 for $1.2 billion). Its founder and CEO, Tony Hsieh, wrote about Zappos’s “very different kind of corporate culture” in his 2010 book Delivering Happiness: A Path to Profits, Passion, and Purpose.

In a video interview about the book, here is how Mr. Hsieh described Zappos’s goal and approach:

“Our goal is to actually develop a personal, emotional connection with each and every customer through every interaction. The way we do it is really by making company culture our number one priority. Rather than take a lot of money and spend it on paid marketing and advertising, we instead invest it into customer service and customer experience and let our customers do the marketing for us…We really want to build the Zappos brand to be about the very best customer service and customer experience.”

Tony Hsieh died this past weekend due to injuries sustained in a house fire. He was 46 years old. Another sad loss this year.

Who Comes First: Customers Or Employees?

Should companies put customers or employees at the center of their universe?

I asked that question in a July 2019 post, contrasting the views of Jeff Bezos, Richard Branson, and James Sinegal. Based on the quote above (“making company culture our number one priority”), it seems that even though Zappos is now part of Amazon, Mr. Hsieh would probably have agreed more with Richard Branson and his view that “clients do not come first; employees come first. If you take care of your employees, they will take care of the clients.”

Pandemic Hasn’t Diminished Importance of Customer Experience

While providing an enhanced customer experience has been particularly difficult during the pandemic, due to stockouts and delayed deliveries, companies remain firm in their belief that customer experience will become the number one brand differentiator moving forward.

This was revealed once again in the recently-published research report “Creating Resilience Amid Disruption: 2020 Supply Chain Market Research,” which was conducted by Adelante SCM and the Council of Supply Chain Management Professionals (CSCMP) and presented by BluJay Solutions (a Talking Logistics sponsor).

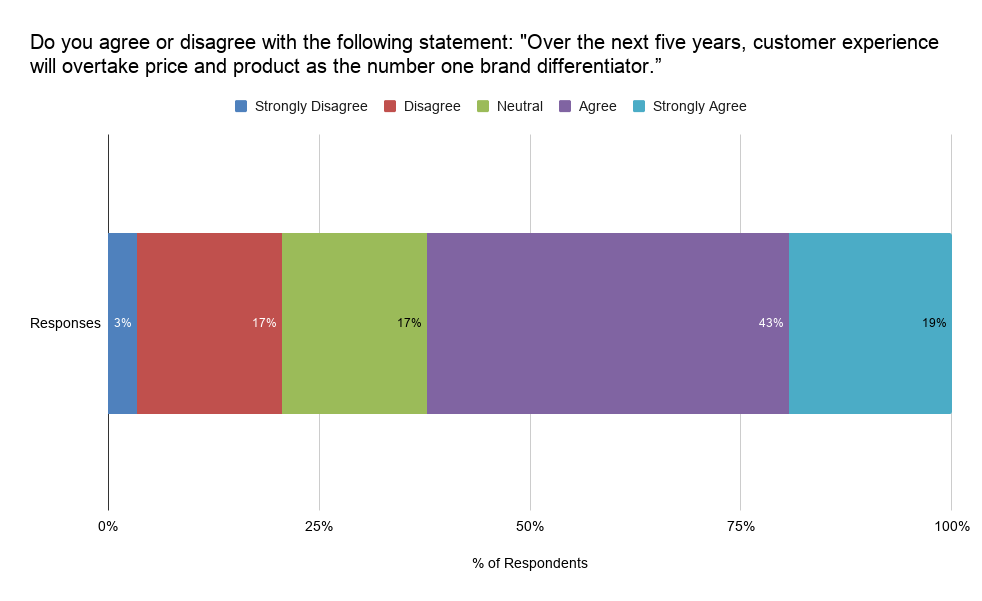

Overall, 62% of the survey respondents Agree or Strongly Agree that customer experience will overtake price and product as the number one brand differentiator over the next five years. This is a slight increase from 2019 when 61% responded the same.

Similar to 2019, Agree received the highest percentage of votes across all respondent categories — including for both Innovator/Early Adopter companies and Laggards/Late Majority companies, as well as Above Average Performance companies and Average or Below Performance companies.

However, the number of respondents who Strongly Agree increased by almost 12%, and the number who Strongly Disagree decreased by 40%, compared to 2019.

Simply put, despite the disruptions caused by the pandemic, companies believe more strongly than ever that customer experience will become the primary competitive differentiator moving forward.

Logistics: Too Vital to Outsource?

The following paragraph from Mr. Hsieh’s obituary in the Wall Street Journal by James R. Hagerty caught my attention:

Zappos initially outsourced the warehouse operations. That proved disastrously unreliable, and Mr. Hsieh scrambled to set up a company-owned warehouse in Kentucky. For an e-commerce company, he concluded, warehousing and related logistics were too vital to be entrusted to outsiders [emphasis mine].

In a March 2013 post titled Keeping Control: What 3PLs Must Convince Their Customers, I hypothesized that as manufacturers and retailers start to view logistics as a core strategic function, their desire to take more control will increase, and so their desire to outsource will diminish.

The negative experience Amazon had with UPS during the 2013 holiday season certainly served as a catalyst for Amazon to invest more quickly and heavily in developing its own delivery capabilities.

And as I highlighted in a post last year, Domino’s Pizza, Panera, and others are keeping delivery in-house because (as the companies explained) delivery is tightly linked to customer experience and brand reputation.

Yes, e-commerce is a growth engine for third-party logistics providers. But it comes with a warning: unlike baseball where you get three strikes, if you swing and miss just once (especially during a critical sales period like the holidays), you will be out.