The freight transportation market in 2019 turned out to be very different than the 2018 market. As we begin 2020: Where are we in the truckload market cycle? What will be some of the key factors impacting supply and demand this year? What actions should shippers take to successfully navigate the road ahead?

As I did at the beginning of last year, I posed these questions to Steve Raetz, Director of Research and Market Intelligence at C.H. Robinson, during a recent episode of Talking Logistics.

The truckload market cycle

In a recent Talking Logistics guest commentary, Steve discussed the truckload market cycle. I asked Steve to briefly recap that as a way to begin our interview.

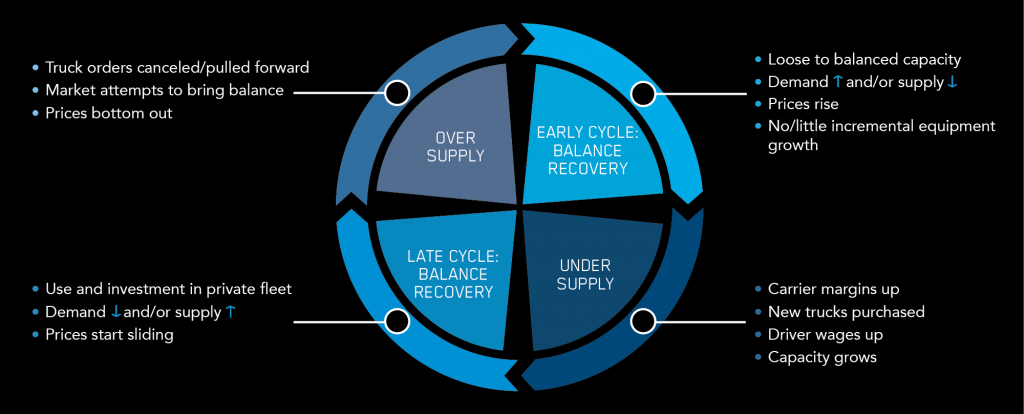

Steve describes how the market goes through a recurring cycle of over-supply and under-supply separated by segments of rebalancing (see figure above). “The market always goes through these stages,” says Steve. “But the amplitude and duration of each stage varies based on all the attributes of the market at the time. The market ebbs and flows as demand enters and leaves the market with economic conditions, and supply changes as carriers invest in assets or divest them in relationship to those demand signals.”

“Where are we today?” asks Steve. “Most analysts believe we are getting to the near end of the oversupply stage. The spot market, which is often a leading indicator for the broader market, is showing signs of bottoming out on pricing and some signs of regional supply tension that is an indicator of recovery. I believe in the next 6-9 months we’ll move into the early cycle of balance recovery.”

Factors impacting supply and demand

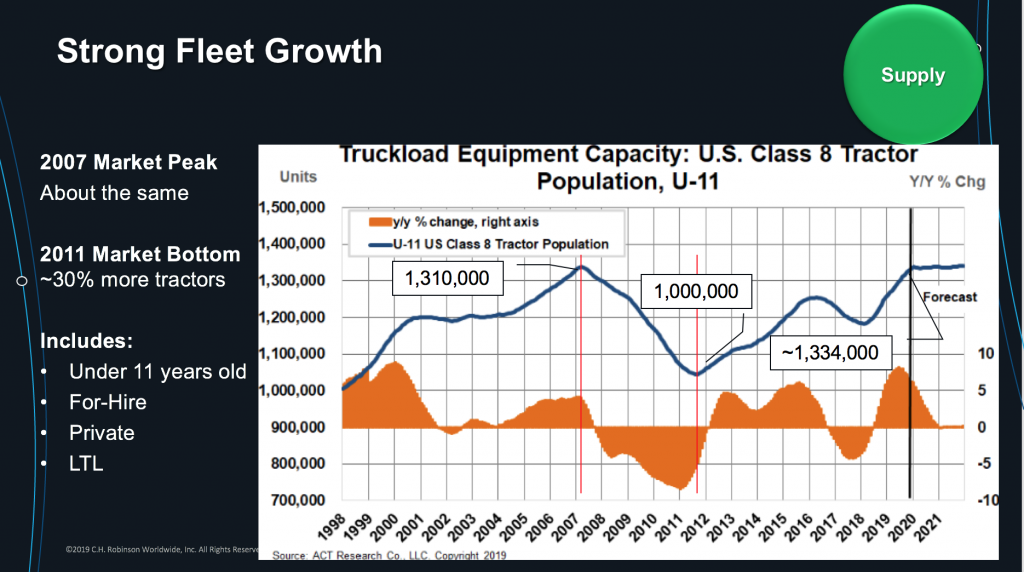

I next asked Steve to discuss where supply and demand are today, beginning with supply, which has to do with carrier investments. Steve shared the graph from ACT Research which shows the relationship between market conditions and fleet size.

Steve points out that the population of Class 8 tractors less than 11 years old peaked at about 1.3 million units in 2007 right before the great recession hit, then when through a contraction phase down to about 1.0 million units in mid 2011. The population then started to grow back up again, despite a dip in 2016-17 due to the economy, and it is now back up to over 1.3 million units. “What happened in 2018 (starting in Q4 2017) is that while demand was way up because of economic conditions, the carrier community didn’t start adding capacity until late Q1 2018,” explains Steve. “Then 2019 hits and what simply happened is that we put more capacity into the market than demand, so we became slightly over supplied. Therefore, the forecast moving forward is to not grow the fleet this year.”

Steve also comments on the significant increase in carrier bankruptcies in 2019, including a major carrier, Celadon. “Although reports through the third quarter of 2019 show that 795 carriers with approximately 24,000 trucks filed for bankruptcy, a significant percentage of those trucks and drivers were snapped up by other carriers. So I don’t think this has had a material impact on capacity.”

On the demand side, Steve notes that 2019 was actually a good year with committed capacity up about 1.5 percent from a phenomenal 2018. The slight decline overall was primarily in the spot market. For 2020, analysts are generally predicting growth to be from flat to 1.5% overall as the economy continues to be strong. “The variables we have to watch are the trade war with China, the impact of USMCA, and continued high consumer confidence. If you remove some of those uncertainties, foreign trade and carrier investment should increase, but there are many variables that can impact it.”

The impact of AB5 and IMO 2020

Steve also talked about the impact of California’s Assembly Bill 5 (AB5), which reclassifies many independent drivers as employees, and the International Maritime Organizations rules on the use of low-sulphur fuels (IMO 2020). Steve says that the impact of AB5 is minimal at the moment since the regulation is being challenged in courts, but if upheld, it would raise operating costs for carriers.

Steve notes that early indications of the implementation of IMO 2020 have not caused much impact on diesel prices because there has been an ample supply of both the new low-sulphur fuel and diesel fuel for trucking. Although the new fuel is more expensive for ship operators, the ample supply of diesel fuel has meant the feared increase in those prices has not occurred.

What should shippers do?

To wrap up our discussion, I asked Steve what actions shippers should take today to prepare themselves for success in 2020 and beyond. I encourage you to watch the full episode for all of his insights and advice. Then keep the conversation going by posting your own expectations for 2020.